Silver Looking to Continue Higher

- Fibonacci retracement levels

- Moving Averages and focus

Silver markets rallied a bit during the trading session on Thursday as a bit more volume has come back into play. Keep in mind that positioning is still going on for the year, so ultimately, it’s a scenario where we could get a bit of gyrating back and forth in the short term, but should see this market continued longer-term. Remember, silver is in a longer-term uptrend, and it looks as if we are ready to continue.

Technical analysis

Silver chart

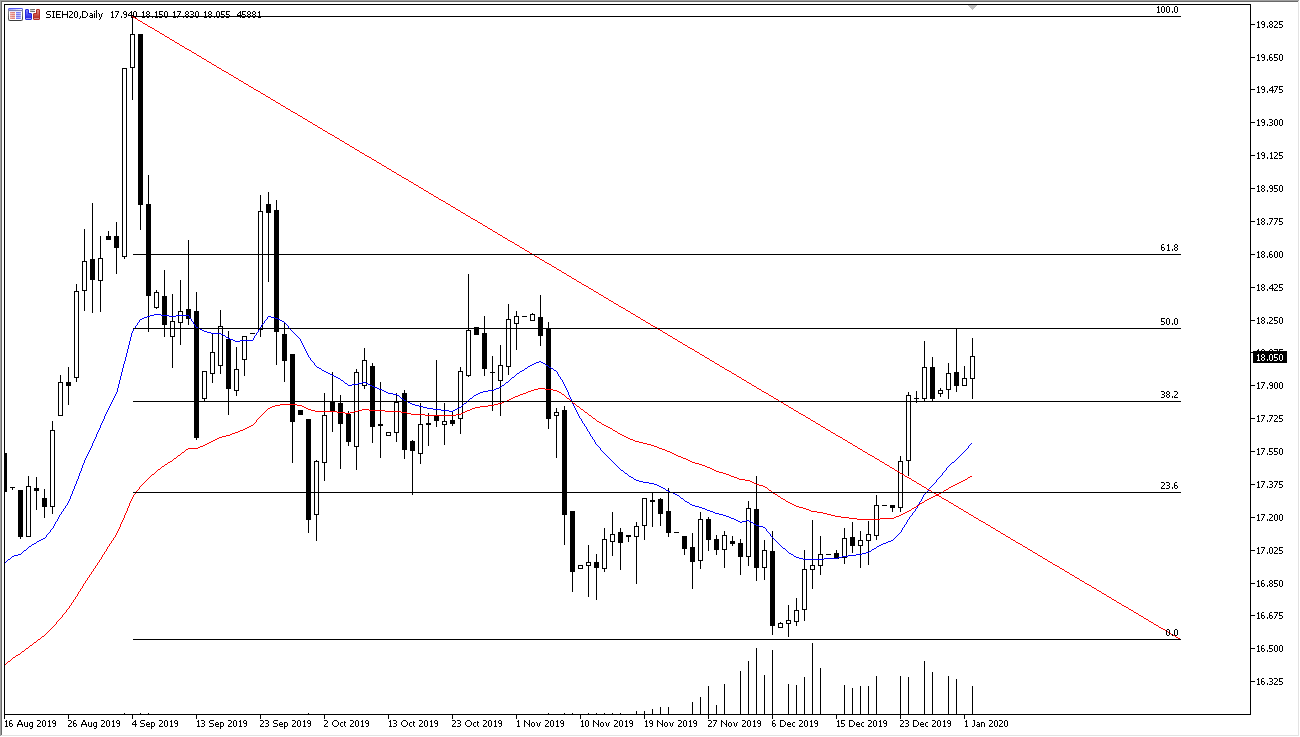

Looking at the forward contract, you can see that silver has gone back and forth during the trading session on Thursday, but it looks as if we are simply going back and forth in the same small range. This looks like a market that is trying to build up enough momentum to make a move, it must be stated that longer-term this market has been rallying. The most recent Fibonacci retracement shows the 50% to 90 retracement level holding so far, but if we can break above the $18.25 level, then it’s likely that we could go much higher. Then, the market could go to the 61.8% Fibonacci retracement level at the $18.60 level, and then eventually meet the highs again.

Keep an eye on the 20-day EMA which is colored in blue, as it is reaching towards the price action, and it has recently crossed above the 50-day EMA. This is typically a good sign that the longer-term move will continue higher. Beyond that, you can also make an argument for a little bit of a bullish flag, or at the very least a consolidation rectangle which typically leads to continuation. Even if we were to pull back, it’s very likely that the market will go looking towards the 20-day EMA for support, and of course the 50-day EMA which is a longer-term moving average that a lot of players will pay attention to.

Silver to go higher

The main take away is that silver looks like it’s going to go higher and it makes quite some sense considering that the economic concerns around the world continue. Silver is a safety play at times.

Longer-term, it looks very likely that the market is going to continue to see a move to the upside but the occasional pullback will be part of the issues facing traders due to headlines coming out of the US/China trade situation and the signing of the “Phase 1 deal”. Other concerns relate to the Federal Reserve cutting interest rates, and of course softening economic data around the world. In other words, longer term it looks like silver will go higher, but it is going to be extraordinarily choppy on the way out.