US dollar continues to recover against EM currencies

The US dollar, which has taken a bit of a beating against emerging market currencies as of late, has recovered over the last couple of days. It looks as if the greenback is going to retain some strength based upon the last couple of sessions, as we approach the question as to whether or not global growth continues.

Keep in mind that money will flow into emerging markets when there is global growth, because quite frankly the returns are higher in the emerging economies than in industrialized and mature economies like the United States or Europe. In times that are good, you will see people much more willing to invest in these emerging markets but when times get a bit uncertain, the losses can be multiplied in these less mature economic conditions.

In this article I’ll take a look at a couple of charts that represent two very different parts of the emerging market world. As a proxy, I will use the Mexican peso as it represents Latin America, and of course has a bit of an attachment the petroleum as well as many of the oil rigs in the Gulf of Mexico are actually Mexican, and not American.

The other pair will be the South African Rand, which of course represents most of Africa and is heavily depended on commodities such as gold and diamonds, as well as other minerals that are mined out of that country.

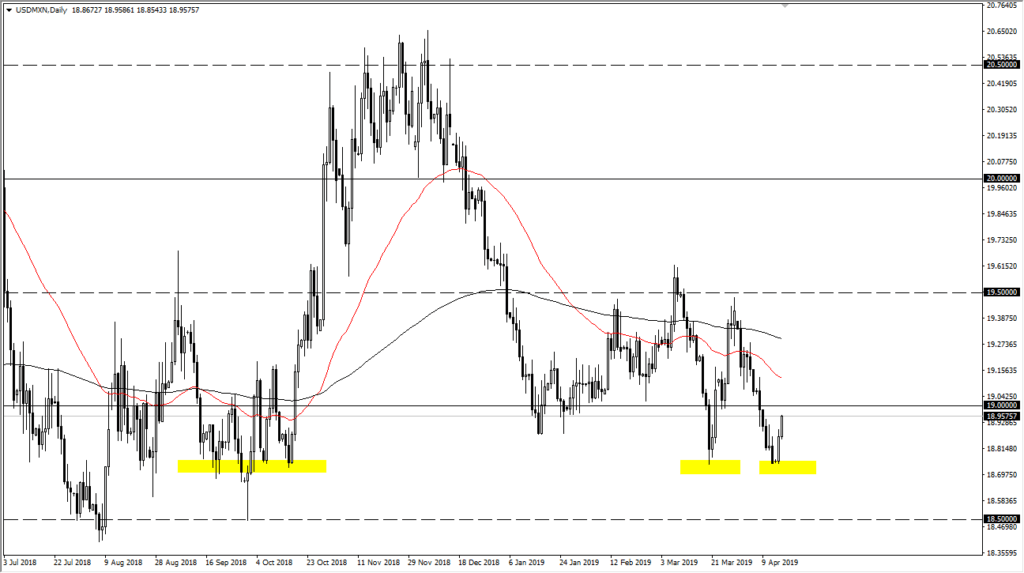

The Mexican peso

The US dollar has been falling against the Mexican peso for weeks, but over the last couple of days has seen a bit of a resurgence near the 18.70 pesos level, an area we have bounced from a couple of times. It’s very likely that this market will continue to be supported in this area, and as ever write this article we are pressing against the 19 pesos level, an area that of course will attract some attention as it is a large, round, psychologically significant figure. This market could rally all the way to the 19.50 pesos level without changing much in the way of its attitude. In other words, it appears that the Mexican peso has gotten a bit ahead of itself, and perhaps even the crude oil market and the risk appetite of traders in general. Underneath the 18.50 pesos level should be massive support as well, so it’s very likely that growth of this currency against the greenback is somewhat limited.

USD/MXN daily chart

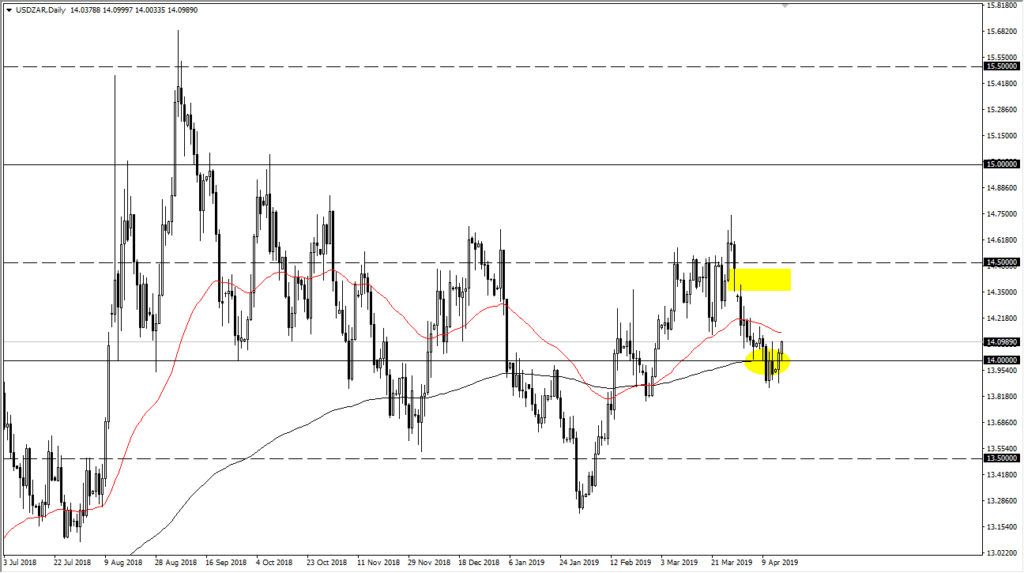

South African Rand

The US dollar has rallied against the South African Rand as well, as we bounced around the 14 Rand level. This is an area that has been important more than once, and what’s truly interesting about this chart is that we are currently at the 200 day EMA, and there is a gap above that has not been filled as represented by the rectangle. In other words, it’s very likely that the US dollar will strengthen against the Rand in the short term.

USD/ZAR daily

The main take away

Remember, money flows to where it’s treated best or has the best opportunity to grow. This tells us that the emerging market may get ready to pull back, and money continues to flow into America. This means that the greenback should strengthen, but perhaps even more actionable is that this could be a representation of all of the money the continues to flow into the US stock markets. Money is flowing to the mature markets right now, so even if you don’t invest in the US, this tells you where you shouldn’t be investing: emerging in frontier markets.