Understand Different Types of Expanding Triangles

We have seen that contracting triangles are of three types, and the same thing is true for expanding triangles. The only difference is that these expanding triangles appear less often than the contracting ones. However, when it comes to some of the types of expanding triangles we’re going to cover in this article, they’re not that rare, and they do form, especially on the Forex market. The thing is that the Forex market, being so liquid, is sometimes tied up in so many ranges that triangles of all types are forming. By now you’re probably wondering why there are so many articles in our Forex Trading Academy dedicated to the triangular formation. Well, the answer is, it’s exactly because they are so common! Elliott found more than 10 different types of triangle, and based on their characteristics, they appear in different places in the overall Elliott Waves count.

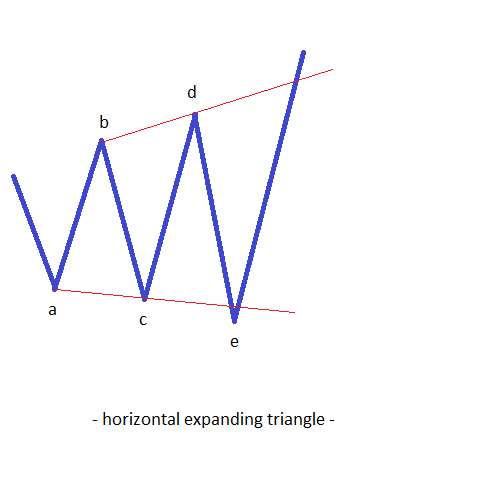

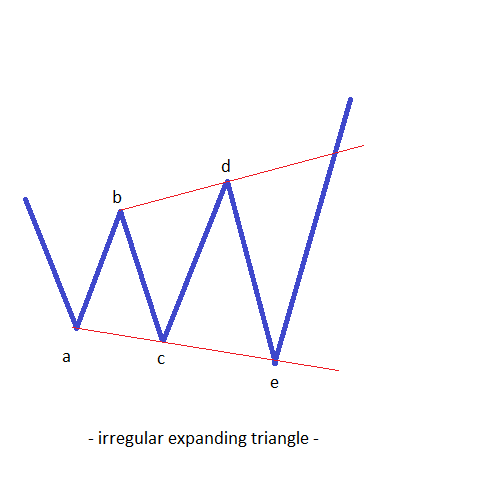

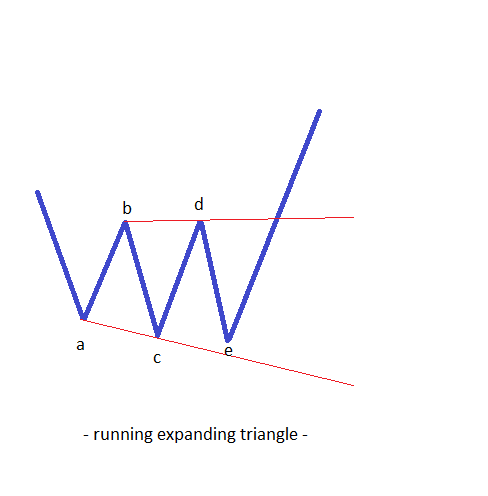

Returning to expanding triangles, as a brief review, they are three-wave structures, in the sense that all five segments of the triangle are corrective ones, and they appear most likely as part of complex corrections. (For the definition of a complex correction, please refer to the article dedicated to it.) As with any other triangle, expanding or not, the key remains with the b–d trendline, as by the time this line is broken, the whole pattern is considered to be complete. This b–d trendline is usually easy to identify as it needs to be a clean one. It means that no parts of the c-wave or the e-wave should break this trendline before the triangle’s completion.

| Broker | Bonus | More |

|---|

Three Types of Expanding Triangles

Following the contracting triangles lead, in order to identify the types of expanding triangles a market can form, the thing is to start from the very basic definition and then to apply the changes. So, if a contracting triangle, a classical type, has each of the segments of the triangle smaller than the previous one, then in the case of an expanding triangle, logic dictates that each of the segments should be bigger than the previous one. And this leads to the first type of expanding triangle Elliott found!

Horizontal Expanding Triangle

Irregular Expanding Triangle

Running Expanding Triangle

When compared with the running contracting triangle, this one appears more often. The running concept is the same, though: The triangle will end above or below the end of the previous wave(depending on whether the triangle is a bullish or a bearish one). This running feature is often misunderstood by traders, but this doesn’t make it appear any less often. Knowing that it can form is a huge competitive advantage for any trader. In order to define a running expanding triangle, we should again start from the contracting type, and do things in exactly the opposite way. Following those steps, a running expanding triangle is one that has

With these triangles explained here, we have covered all the possibilities Elliot found for triangular formations. They are really important when counting waves, as they form quite often. Actually, most of the complex corrections the market makes (and complex corrections form more often than simple ones) have at least one triangle in their componence. Such a triangle can be either a contracting or an expanding one, and we have listed here all of the possible types that may form. Regardless of the type of triangle, though, one thing should matter above all: by the time the b–d trendline is broken, we should look for trading in the opposite direction, placing a stop loss at the end of the e-wave.

Other educational materials

- The All-Important B Wave Retracement

- What Are Corrective Waves?

- Trade Forex with Simple Corrections

- Complex Corrections in Elliott Waves Theory

- Types of Flat Patterns

- Types of Zigzag Patterns

Recommended further readings

- International trade and foreign investment: substitutes or complements. Kojima, K. (1975). Hitotsubashi journal of economics, 16(1), 1-12.

- “The pattern of international trade among advanced countries.” Kojima, Kiyoshi. Hitotsubashi Journal of Economics 5, no. 1 (1964): 16-36.