Basic Guide to Double Three Running Patterns

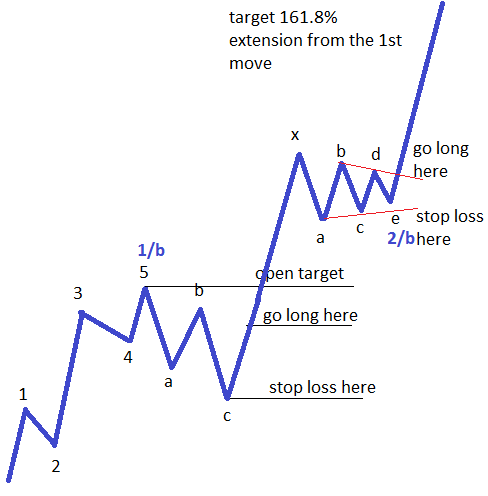

One of the most common running patterns, if not the most common one, is the double three running. Such a pattern appears most of the time as the second wave in an impulsive move, and the third wave to follow in such a case is always the extended one. Not only should the price to follow be a minimum of 161.8% when compared with the length of the first wave, but it should also have few or no retracements. It means that it is very likely that for the third wave, the whole five-wave structure of a lower degree will this time have a running correction as well. The name of this correction tells us much about what to expect, in the sense that the word “double” is telling us a complex correction is about to form. This complex correction, because of its running nature, should have a large x-wave, so look for it to stretch beyond 61.8% when compared with the previous corrective wave. Most of the time the x-wave will actually retrace the whole previous correction and some more, and will be either a double or a triple zigzag, or a combination of some sort. In any case, the x-wave will trick many people into thinking the third wave has already started, which is a crucial mistake.

| Broker | Bonus | More |

|---|

Trading a Double Three Running Pattern

Enter when the 61.8% Retracement is Exceeded

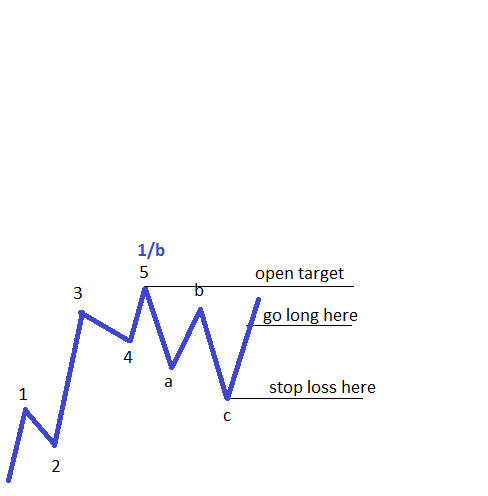

The way to trade the double three running pattern depends very much on the move prior to it. That move must be a five-wave structure, and therefore it can only be the first wave of an impulsive move of a larger degree, or the a-wave of a zigzag of a larger degree. It doesn’t really matter though what the previous count is, as long as it is an impulsive wave. Therefore, the first thing to watch before deciding whether a correction is a double three running is to make sure the move prior to it is an impulsive wave. If the answer is affirmative, then that impulsive wave must be corrected. This is the role of the first correction, or the first part of the overall double three running pattern. Keep in mind that at this moment in time we have no idea whether the market is forming a running correction or not – all we know is the fact that a five-wave structure has been followed by a correction. The next thing to do is to see whether the move that follows the correction is retracing more than 61.8% out of it. If so, it is an early sign of a possible running correction of larger degree, and a first trade should be taken by the time the retracement goes more than 80%. The take profit for the trade should be left open, as we need to first find out the exact end of the double three running pattern before calculating the possible extension. As for the stop loss, this one must be at the end of the first corrective phase of the double three running.

Add a New Trade When the b-d Trendline is Broken

So powerful are these running corrections that most of the time the price exceeds the 161.8% level and goes even into 261.8% or more. The 161.8% is the minimum distance to be travelled in order for the third wave to be an extended wave. In the event that the double three running was actually the b-wave of a zigzag, the c-wave to follow should end around the 161.8% level, even though an extension is not necessary in this case.

Other educational materials

- Different Fibonacci Levels Important When Trading with Elliott

- Trading Different Types of Extended Waves

- Placing Pending Orders When Trading with Elliott

- How to Trade 2nd and 4th Waves

- The All-Important B Wave Retracement

- What Are Corrective Waves?

Recommended further readings

- Primary commodity prices, manufactured goods prices, and the terms of trade of developing countries: what the long run shows. Grilli, E.R. and Yang, M.C., 1988. The World Bank Economic Review, 2(1), pp.1-47.