Apple Shares Surge as NASDAQ Bounces Back in After-Hours Trading

After a mixed day for the US equity indexes, Apple led the fightback, posting strong guidance for the next quarter. This was well above what analysts had projected, allowing a sharp rise of almost 4% in after-hours trading. This also helped the NASDAQ recover after a difficult day of mixed earnings reports. The index still closed down 0.81% for the day.

McDonalds and GE Lead a Positive Start

McDonalds set a positive tone for the day even prior to the opening bell. This helped rally the Dow Jones which had been falling in to the shadows of the S&P 500, and NASDAQ this week. The latter have both been running at record highs throughout.

Markets were buoyed by McDonald’s quarterly earnings. These came in with a growth of 5.4% in global same-store sales. Substantially more than the 3.4% forecasted by analysts. This news was quickly followed by an unexpectedly positive report from General Electric. This strong earnings report, coupled with more of the same guidance for the next quarter sent positivity through traders. GE shares rose an impressive 4.6%.

NASDAQ Weighted Down

All of the early positivity noted across the market, was not reflected on the NASDAQ. This was largely due to the impact of underwhelming results from Alphabet, the parent company of Google. Their earning miss sent prices into a spin, with the company losing 7.5% in its worst day since October 2012.

The company, which has seen almost $70 billion wiped off its market cap, is placing much of the blame on YouTube. Alphabet CFO Ruth Porat commented, “The rate of YouTube click growth rate decelerated versus a strong Q1 last year, reflecting changes that we made in early 2018”. She is thought to be referring to algorithm changes which the platform implemented in response to the spread of fake news. These have seemingly caused a lower engagement.

The near $1 billion revenue miss, coming in at $36.34 billion was the result of poor ad sales growth at Google, the company said. Although this miss was felt throughout the market, it is not reflective of a declining trend, as experts still see many huge avenues for growth in the coming quarters.

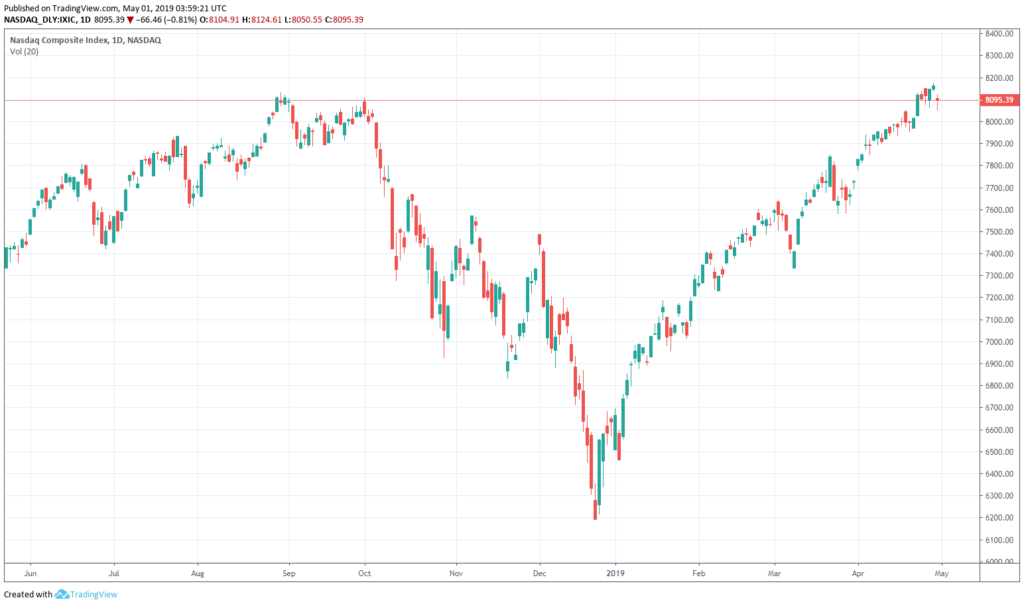

NASDAQ Daily Chart – May 1st

Apple to the Rescue

When the day looked to be coming to a dismal end, Apple duly stepped in to save the NASDAQ with some positive guidance for the next quarter. This followed earnings that fell in line with expectation for the first quarter.

The share price saw a boost of around 4% on the positive guidance news. This reflected a stabilizing iPhone demand moving forward, and what appears to be a continuing shift away from Apples smart phone focus.

CEO Tim Cook has been projecting strong confidence in the range of Apple services for the future. These include iCloud, and Apple Music. In total, Apple services revenue has increased 16% since the same period last year. Apple TV+ and Apple Arcade, both due for summer release were two additional services which contributed to the strong, day-saving guidance.