Aussie continues to show strength against Singapore dollar

The AUD/SGD pair is one that measures risk quite nicely. After all, the Australian dollar is highly levered to commodities and of course the Chinese economy. With that being the case, it’s very important to watch this pair as the Singapore dollar is considered to be the “Swiss franc of Asia.” That being the case, the further this market rises, the better it is a reflection of a “risk on” type of move. With that in mind, we take a look at this pair.

Trend line break

AUD/SGD

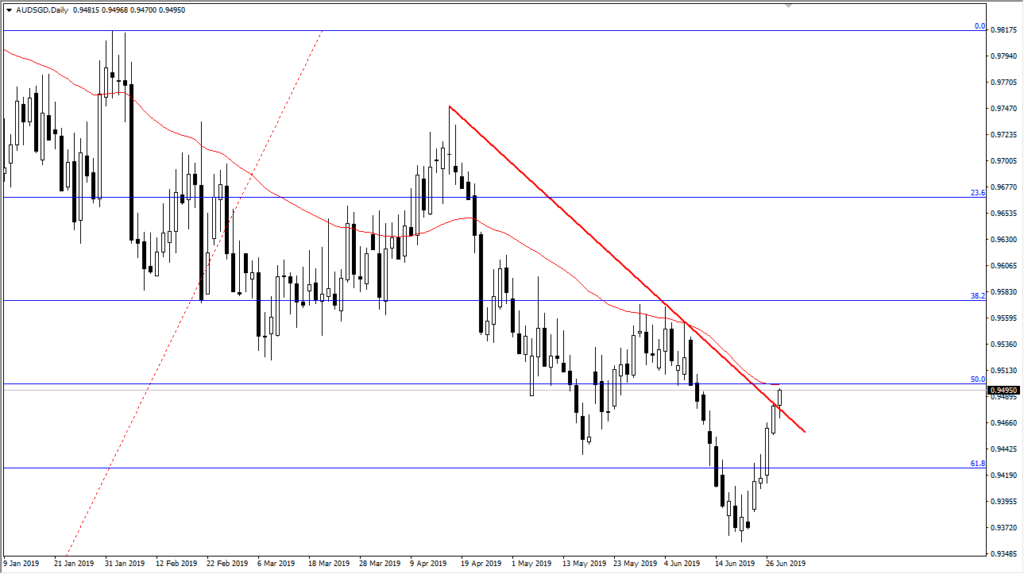

There is a bit of a trend line break on the daily chart, as we have fallen from that trend line, turned around and broke out above it during the day on Friday. Perhaps this is the market trying to get ahead of the G 20 conversation between the Americans and the Chinese, as there are signs that they are at least trying to work together. With that being the case, short-term pullbacks could be buying opportunities, but we do have a large, round, psychologically significant figure just above that will cause some issues.

The 0.95 level will be resistive, but once we break above there we will not only be clear of a round figure but is very likely that we will then break above the 50 day EMA. With that, it would be yet another bullish sign in this market.

G 20

Without a doubt, the G 20 is going to be crucial, or at least the conversation between the Americans and the Chinese. I think at this point we are waiting to see any signs of positivity that we can take advantage of, and therefore Australia will be a major beneficiary. Beyond that, we are starting to see the Aussie break above the 0.70 level on the daily chart against the United States dollar, and that is a very bullish sign as well.

That being said, the market is definitely leaning in one direction. If we get some type of extraordinarily negative sign or statement out of the Americans or Chinese, that would more than likely crush the Aussie dollar, and therefore send this market much lower. If we break down below the lows of the Friday session that will confirm this as a “false breakout.”

The play going forward

The best play going forward for this pair is going to be to wait to see if we gap higher or lower at the open on Monday. It’s very likely were going to do one or the other, and that should tell you which direction this market is going to go for quite some time. A break down should send this market down to the 0.94 level. However, if we break to the upside, this market more than likely will go looking towards the 0.96 level. All things being equal, this next candlestick is going to be crucial as to where this market goes for a longer-term move. Ultimately, we are at a major potential crossroads.