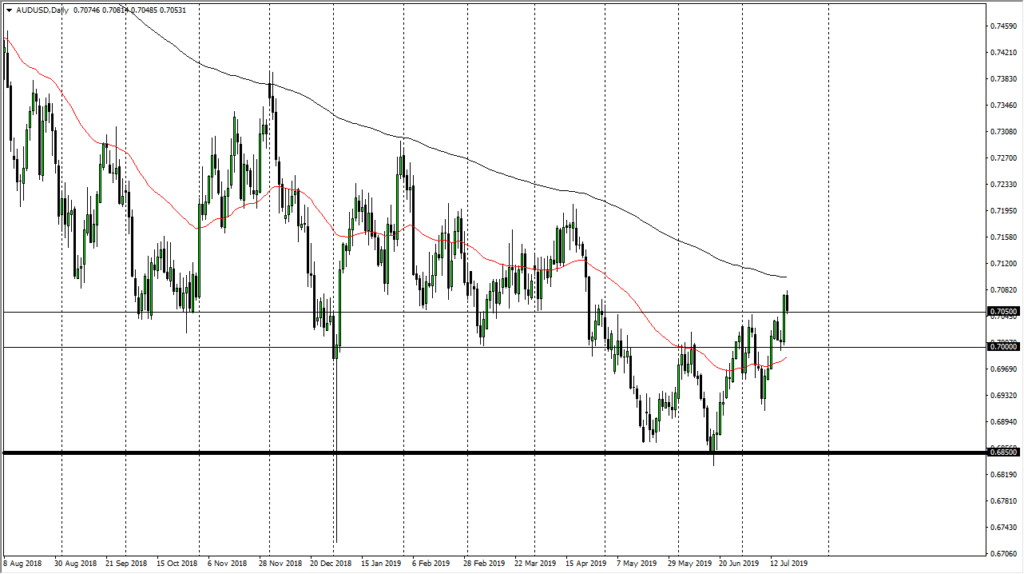

Australian dollar breaks serious resistance

The Australian dollar has broken above the crucial 0.7050 level during trading on Thursday and pulled back a bit on Friday. However, this looks like a simple retest of previous resistance to see if it is going to be support. By doing so, it looks as if the market is trying to build up the necessary momentum to go higher and continue what could be the change in trends that we have been waiting on.

The importance of the move on Thursday

AUD/USD

The importance of the move on Thursday cannot be overstated. There had been 50 pips worth of resistance at the market was fighting with for quite some time, and the fact that we sliced through it on Thursday and closed at the top of the candle stick for the session is a very bullish sign. With that in mind, it makes quite a bit of sense that we will pay attention to the top of the candle stick for a potential break out again. When we look at this chart, then 50 pips had been particularly troublesome, and now it looks as if it is in the pattern of retesting that previous resistance for support, and very possibly finding that crucial support.

Federal Reserve

Keep in mind that the Federal Reserve is going to be cutting interest rates. That is a well-known “certainty.” With that being the case, the US dollar will probably continue to be on the back foot, and if we can get good economic figures coming out of places like China, the Australian dollar will continue to go higher. Remember, Australia is a bit of a proxy for China, so it’s not likely to be immune to the US/China trade talk noise as well. However, I do believe at this point it’s likely that we are going to see some consolatory action as it has seen as of late. With that, and if we get any serious progress, this pair will take off to the upside.

The influence of gold

Looking at the gold market, it has been extraordinarily bullish. It quite often has a significant influence on the Australian dollar as Australia is a major exporter of that commodity, so it makes sense that as gold breaks out, the Australian dollar should as well. After all, gold is rallying based upon loose monetary policy around the world, not necessarily a fear trade. With the Reserve Bank of Australia suggesting that they were pausing their easy monetary policy, at least for the moment, this is also a reason to think that the Aussie could gain.

The trade going forward

The trade going forward is to simply buy the Australian dollar on short-term dips. While I do recognize that the 200 day EMA is sitting just above, quite frankly I think it’s only a matter of time before we break through there. Moving averages are great and all, but the reality is that we are making “higher highs”, and “higher lows.” In the end, that’s truly all that matters. As long as we stay above the 0.70 level, this is a potential trend change.