Australian dollar fails to hang onto gains against Canadian dollar

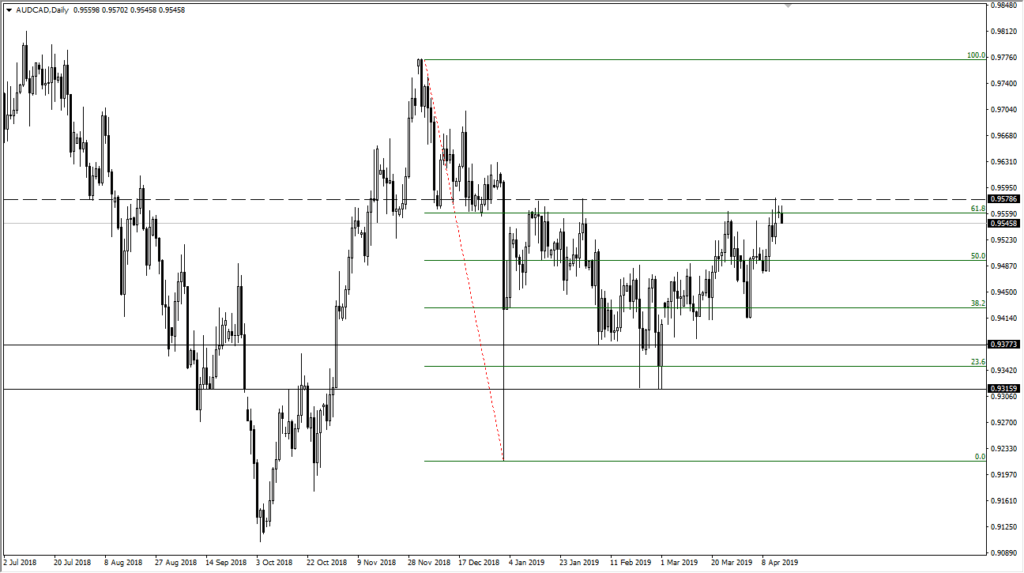

The AUD/CAD pair initially tried to rally during the trading session on Monday, perhaps in reaction to the Australian elections, as the Aussie was bought overall. However, you can see that we have most clearly failed and turned around of form a bit of a shooting star at an area that was previous support.

Major resistance

The 0.93 region is the beginning of significant resistance, and it is certainly showing itself to be so on Monday. By rolling back over, it’s very likely that we are going to fall towards the 0.92 level which is massive support. However, if we were to break above this major resistance that’s a very good sign for the Australian dollar. The fact that we failed there though tells me that we still have a lot of work to do as far as the bullish side is concerned, and that makes quite a bit of sense considering when you look at the attitude of both of these currencies and what they are attached to.

AUD/CAD daily chart

What drives these currencies, at least typically?

So when trading this pair, or any other cross like this, you need to be aware of what can drive the currencies from external pressures. In this case, you have the Australian dollar which is highly levered to China which of course is all about the US/China trade situation right now. In other words, as we are concerned about how the two countries are working with each other, it makes sense that Australia will suffer. Remember, Australia is a major provider of commodities for the Chinese industrial machine, so as long as that is an issue, I think that the Australian dollar will struggle a bit.

The Canadian dollar is highly levered to oil which although has ran into a little bit of resistance as of late, has been much stronger than the sentiment involving China and the US. That makes sense that we continue to fall here, because it’s much easier to put your money into the idea of crude oil as opposed to copper or iron going to China. After all, there are plenty of Middle East tensions out there to keep crude oil prices somewhat levitated, so course that should help the Canadian dollar with most currencies, perhaps with the lone exception of the US dollar.

Levels I’m watching

Right now, I am looking at the 0.9325 level as resistance, and then the 0.9375 level. To the downside, the 0.9225 level as a target, if we can break down below the bottom of the daily candle. That would bring in more selling, and then perhaps looking towards those supported levels underneath. If we break down below the bottom, then it’s likely that we could go down to the 0.91 handle which is the next major support level.

Keep in mind that this market is highly levered to commodity markets in general, so make sure to compare and contrast copper versus crude oil, gold versus crude oil, and the like.