Australian dollar runs into resistance against Canadian dollar

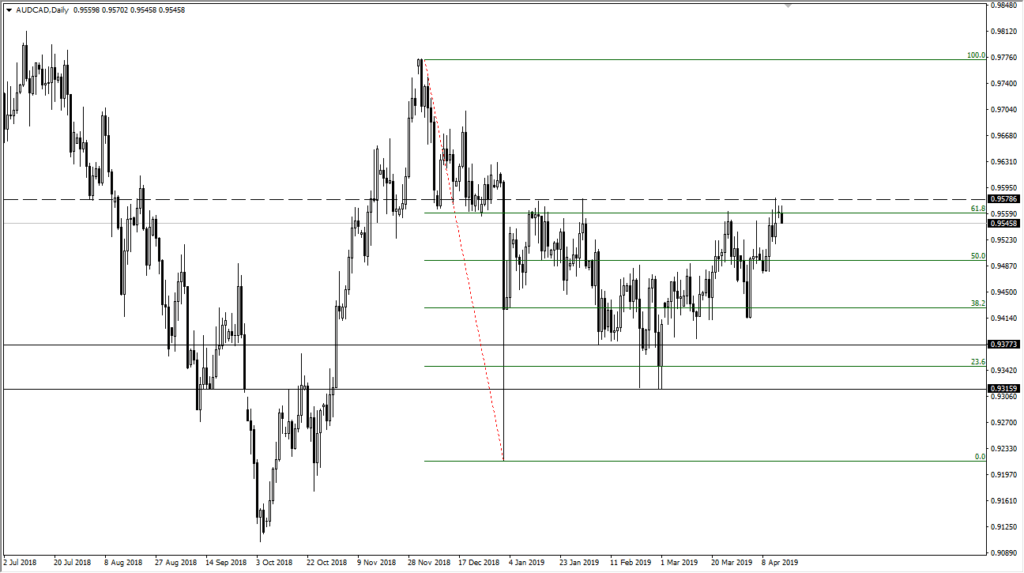

The Australian dollar initially gapped higher to kick off the week on Monday but seems as if we are running into major resistance at an area that has of course been important previously. Because of this, it looks as if we are setting up for some type of continuation trade of the previous breakdown. Looking at the chart, there are a couple of obvious areas to pay attention to.

61.8% Fibonacci retracement level

The 61.8% Fibonacci retracement level is right in this neighborhood, and as you can see cause quite a bit of resistance previously. It is at roughly 0.9550, and you can also see where we have clearly seen previous support in that region. In fact, the support that previously kept the market higher extend all the way to the 0.96 level. At this point, it should now offer quite a bit of resistance as we are on the other side of that level.

With that being the case, we should also pay attention to the exhaustive candle stick from Friday, which of course was a nasty looking shooting star. If we break down below the bottom of the Friday candlestick it’s very likely that we will probably go down to the 0.95 handle, and then possibly the 0.9375 level. In general, this is a market that simply looks like we have to make some type of decision in this area.

Another thing that’s worth paying attention to is that typically if we break past the 61.8% Fibonacci retracement level, then the market will quite often reach towards the 100% Fibonacci retracement level. Because of this, if we can break above the 0.96 level, then I think the market continues to go much higher, perhaps to the 0.9775 level. In general, that means that we are in somewhat of a binary situation.

AUD/CAD daily chart

Australian dollar and China

The Australian dollar of course is highly levered to China so keep in mind that the US/China trade relations and situational course will continue to move the Australian dollar. While I do believe that the US and China will come back into form again, we obviously have a lot of work to do when it comes to coming to a resolution. Once they do, that should be good for the Australian dollar.

On the other side of the equation we have the Canadian dollar so therefore it is worth paying attention to the crude oil market. Crude oil has been relatively strong lately, so that could help the Canadian dollar, but at the same time we have a rather weak Canadian economy, so it causes a lot of volatility in that currency as well.

The technical set up

The technical set up for this currency pair is obviously a negative one, but if we were to break through the 0.96 level it suddenly becomes very positive as it would be a complete breakdown of massive resistance. This pullback should be good for a handle or two, especially if we can get a bit of a boost in the crude oil market.

As the United States and China aren’t near a resolution to the trade deal quite yet, that extra boost to the Australian dollar is probably down the road, so all things being equal it makes quite a bit of sense that this pair would pull back from here.