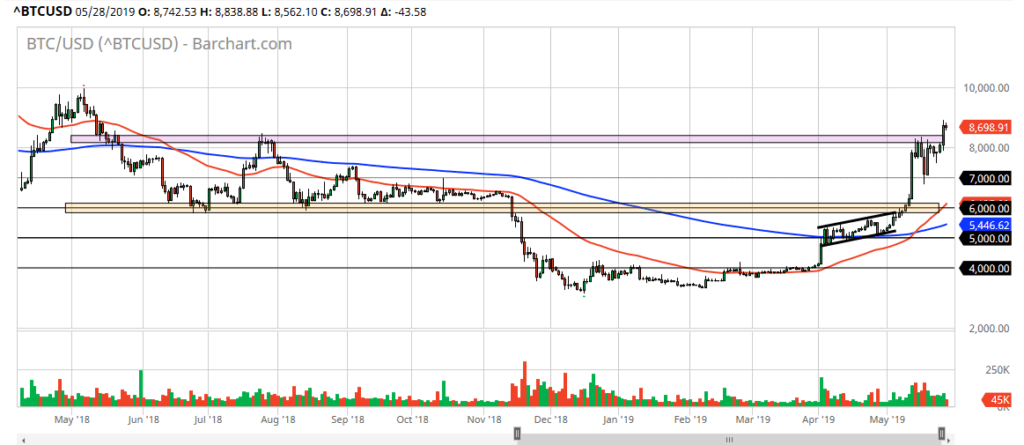

Bitcoin finally pulls back

The Friday session saw the bitcoin market pulled back finally, which quite frankly is a good sign. This is a market that has been extraordinarily bullish for quite some time, so it’s difficult to imagine a situation where I would be a seller of this market, even though we have seen a very negative candle for Friday. This is a market that is overbought, and therefore a pullback would be necessary and of course expected.

The last thing we need is parabolic markets

The last thing that we want to see is another parabolic market as we had previously dealt with in the Bitcoin market. Remember, that was what caused the massive bubble, and the last thing you want is to see is this market repeating that type of situation. After all, if we get another high profile bubble bursting, it will wipe out the idea of Bitcoin ever being an investment vehicle again.

I for the life of me can’t imagine a scenario where people can see 60 to 70% losses a second time and be willing to buy. It is because of this that the Bitcoin community needs to be cautious about becoming overly bullish. If this market goes parabolic, your number one job as a trader is to collect profits and get out. The fact that we have pulled back from the $8000 level makes me quite happy and quite bullish as there is plenty of support underneath.

Potential support

There is obvious potential support at the $7000 level, and it could hold and send this market back towards the $8000 level. Quite frankly, I’d rather see it go all the way down to the $6000, because it would offer value as well as what should be significant support. That was a rather drastic support in the past and of course the resistance that we had recently broken above. It has not been retested, so that’s something that you should keep in mind.

A support event bullish candle stick near the $6000 level has me interested in this market, and I believe that we could see a new flood of money come back into the marketplace in that general region. All of that being said, if we did break down below, it’s possible that we could see this market unwinds as it would be very destructive to the overall bullish pattern.

Bitcoin daily chart

The main take away

the main take away of course is that we are in a bullish market, and even though you can almost guarantee some type of pullback, that doesn’t mean you should be selling. The market is very bullish, so therefore there’s no need to fight what is obvious. Ultimately, this is a marketplace that should continue to be monitored and treated with temperance, because when you don’t do that you get what we had in January 2018. All things being equal though, this is a market that looks ready to go much higher over the longer-term. Slow and steady wins the race.