British pound continues to run into trouble

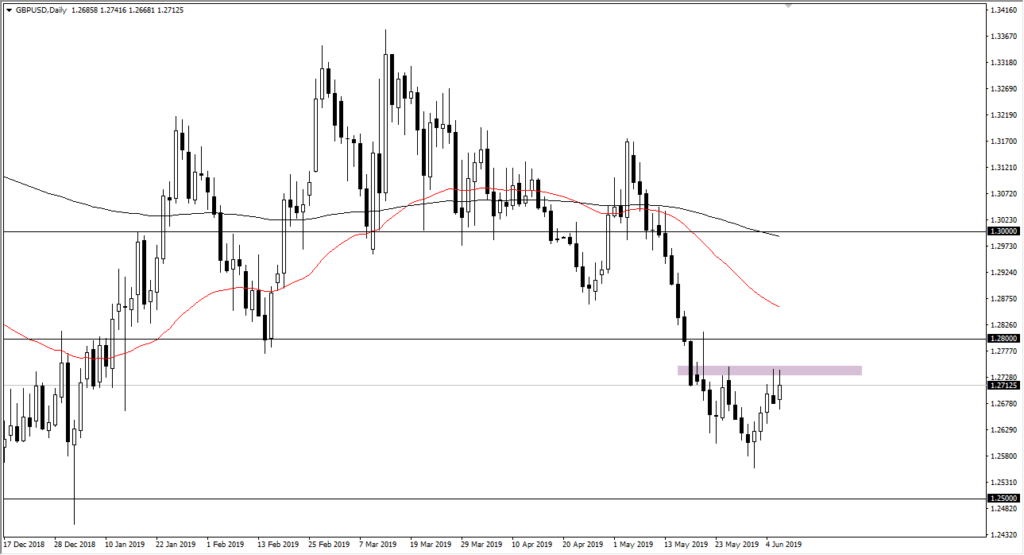

Although the pressure to the upside was felt initially during the trading session on Thursday, the British pound has given back quite a bit of the gains, as the 1.2750 level continues to cause a lot of issues. I have this marked by a lavender box on the chart, and you can see that clearly every time we close this area short sellers come in and push the pair lower.

Obvious resistance

GBP/USD Chart

This is obvious resistance, and therefore you should pay quite a bit of attention to it. Quite frankly, sometimes when you are trading currencies or other financial markets, some of the most important pieces of information you can find is where market won’t go as opposed to where you think it will. At this point, if we can rally from that level, then we have significant resistance above the 1.28 handle. Quite frankly, I’d be a bit surprised to see a breakout above the 1.28 handle although we would show massive strength in doing so.

Brexit

Unfortunately, the Brexit continues to drag on. Overall, this is a market that is extraordinarily sensitive to the headlines, which continue to be very murky to say the least. Rallies at this point continue to get faded, because quite frankly there is in a whole lot in the way of uncertainty when it comes to the divorce from the European Union. It’s difficult to imagine a scenario where the British pound has a lot of strength for the longer-term, at least not until we get some type of resolution to the EU situation.

Duel shooting stars?

The market did rally a bit during the last couple of sessions but continue to give back those rallies as we don’t have enough momentum to finally break higher. Even if we did, I suspect there’s even more selling pressure all the way to the 1.28 handle. The fact that we have formed a couple of candlesticks that look like shooting stars tells me that we will continue to struggle.

The main take away

The main take away is that the British pound simply can’t keep gains for any significant length of time. Yes, we are in a downtrend and most certainly had been a bit oversold. I think at this point what we are looking at is an attempt to start shorting the market down to the 1.25 handle underneath, which of course will attract a lot of attention as it is a large, round, psychologically significant figure.

With the Nonfarm Payroll Numbers coming out on Friday, it’s very likely that we are going to see a lot of volatility in the greenback, and we don’t really know which direction it’s going to move right away. That being said though, I still believe that the Brexit is first and foremost on the minds of the British pound traders, so look for opportunities to short this market. Will we break below the 1.25 handle? That’s a question for another time, but I certainly think we are going to try to get down there.