Canadian dollar is showing signs of life against Japanese yen

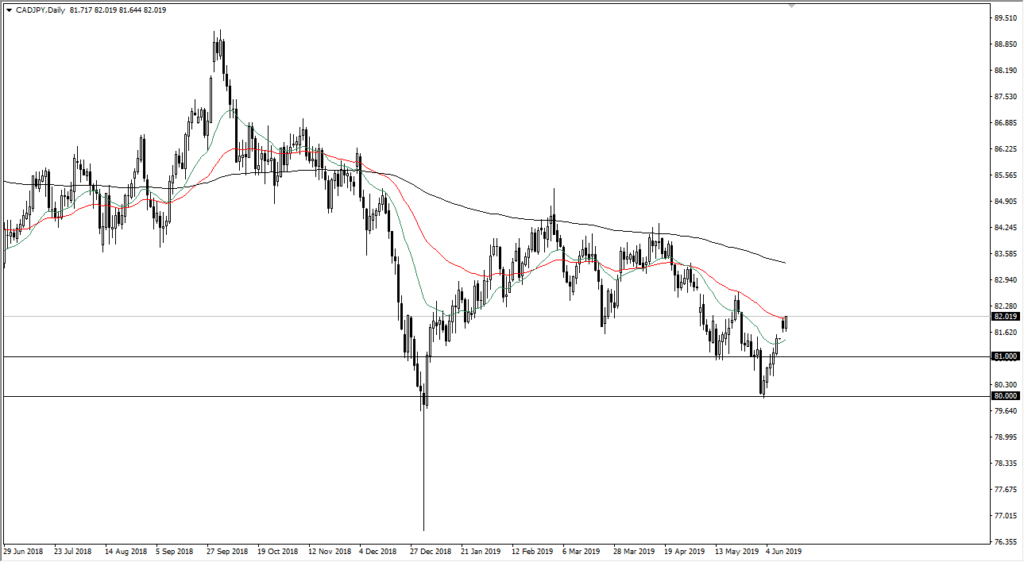

The Canadian dollar opened up the week gapping higher against the Japanese yen on Monday, and on Tuesday is continuing that move. By breaking above the top of the candle stick for Monday, and of course the 50 day EMA, it now looks as if there is still plenty of momentum to lift this market and send it higher. Beyond that, the 20 day EMA is now starting to turn higher, looking very likely to try to cross above the 50 day EMA and the next few sessions.

Crude oil

The crude oil is starting to perk up again, and that of course will help the Canadian dollar. That’s especially true in this market though, as the Japanese import 100% of their oil, and of course the Canadian dollar is a proxy for crude itself. This doesn’t mean that crude oil is going to suddenly become massively bullish, but it is oversold and therefore a bit of a rally makes quite a bit of sense. By the virtue of monetary flow, this pair will almost certainly have to go higher.

Targets

CAD/JPY

There are various targets that we can look at. There was a gap that has been filled recently, near the ¥83 level, and therefore we could go to retest that area. If we can break above that level, then we could go much higher. That is the initial target that I see, so therefore it makes sense that there will be a bit of a magnet for price there. I expect a big fight, but if we can get above there it’s very likely that we will go looking to test the black 200 day EMA.

If we were to turn around and fall from here, then it’s likely that we will pull back towards the bottom of the gap that opened up on Monday. A break down below there sends the market down to the ¥81 level which is massive support that extends down to the ¥80 level. In general, this looks a lot like an attempt to reverse the overall downtrend, so I favor the upside obviously, especially considering that crude oil has a way to go before it runs into major resistance.

Sentiment

The sentiment effect will be a major situation, but currently it looks as if we are willing to go higher in stock markets as well as other risk assets as well, it makes sense that we continue to go higher. The recent ferocity of the bounce suggests that there is a lot more money in this market to the upside than there was in a couple of previous attempts to go higher, but that doesn’t mean we will get the occasional pullback. It’s not until we break down below the ¥80 level that I believe we can break down significantly. In general, this is very likely to be the bottom of this pair for some time. However, if we get some type of economic panic or general malaise in the markets, then this pair could fall apart.