Ethereum Heading Towards $100

- Ethereum continues to show malaise

- Downtrend in crypto overall

- Heading towards $100 support level

Ethereum continues to show a significant amount of malaise as it simply can’t go anywhere. Looking at the chart, it has been drifting lower for some time. This coincides quite nicely with the overall cryptocurrency markets, which simply can’t get a boost these days.

With that being the case, it’s not a surprise to see this market drifting below the $150 level. Ethereum tends to be the “little brother” of other cryptocurrencies, such as Bitcoin. As long as Bitcoin struggles, Ethereum won’t do much better.

Crypto in downtrend

Crypto markets have been in a downtrend for several months. Bitcoin simply cannot find adoption and is far too volatile to be used as currency. That only leaves speculators and it has recently come out that the amount of Bitcoin holders out there is relatively small when it comes to the larger amounts. If that’s the case, then this is a market that will remain very dangerous.

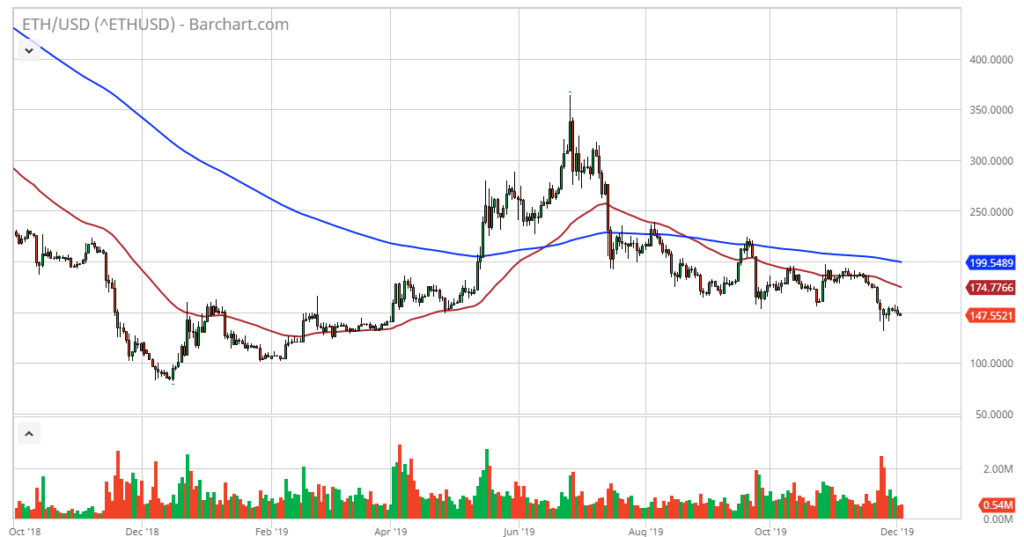

As such, the “little brother” won’t fare very well. Looking at Ethereum, one can see that the 50-day moving average, indicated in red on the chart, has offered dynamic resistance for some time.

The-200 day EMA, marked in blue on the chart, is also well above current pricing. This suggests that the $200 level will not only be interesting due to the fact that it is a large, round, psychologically significant figure, but also because the 200-day EMA is sitting there, which will be massive in its ability to cause resistance.

A slow and steady descent

Ethereum yearly chart

Ethereum looks likely to be heading towards the $100 support level, which is the scene of the most recent uptrend. It has been a slow and steady descent to that level, so that is much more likely to be sustainable as a downtrend, as it hasn’t been impulsive.

Previously, once the $100 level was tested, the Ethereum market bounced rather significantly. It is because of this that a technical analysis-driven trader will expect to see some support in that area. That’s not exactly a stretch considering it is such a large, round, psychologically significant figure.

It looks as if rallies will continue to be sold, as there is simply no reason to think that things are going to change in the short term. Central banks around the world continue to be very loose with their monetary policy, and even Bitcoin can’t pick itself up off the floor.

In that scenario, Ethereum stands no real chance to gain. A result, it remains a good option for a short trade, or perhaps something traders may wish to look towards at lower levels in the future.