EUR USD Continues to Stagnate

In what has been the norm as of late, the Euro has stagnated against the US dollar. This is because we have two central banks it simply cannot tighten at this point. After all, it was just recently that Jerome Powell suggested that they were going to “be patient” when it comes to interest rate hikes, after the market had priced in “automatic” rate hikes.

On the other side of the Atlantic, you have the European Central Bank who looks very likely to put the rate hiking cycle on hold, because quite frankly the economic numbers in that region don’t suggest that we are in a place where interest rates need to be higher than they already are. This is especially true now that Germany has barely avoided a recession.

Stuck in a range, take advantage of it

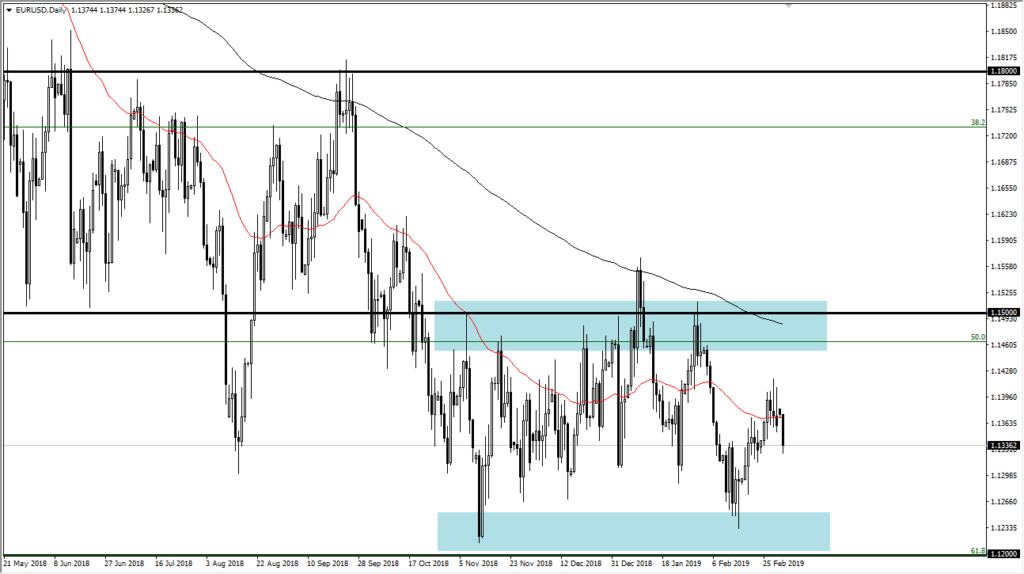

when you’re stuck in a range like this, it actually becomes one of the better pairs to trade. Obviously, you’re not going to be getting massive moves, but you do have a somewhat reliable area from which to trade back and forth. I believe that the 1.12 level underneath is the floor, while the 1.15 level is the ceiling. It’s more of his own though, as I show on the chart with the large rectangles.

As we are in the middle of this area and had formed a couple of shooting stars late last week, it makes sense that we may roll over a bit and go looking towards the support. However, the support is so strong that I would be very surprised if we broke through it, not only as it is a large round number, but it is also the 61.8% Fibonacci retracement level.

That being said, at the 1.15 level we have the 200 day EMA, an area that will attract a lot of attention. With that being the case, we simply go back and forth that right now we are closer to the middle than anything else so patience will be needed.

That being said, you need some type of bias

One of the ways that these markets can be traded is simply going back and forth but recognizing that we will eventually break out of this range. Judging from the longer-term charts and the massive amount of support underneath, it seems very unlikely that we are going to be able to break down significantly. Beyond that, the Federal Reserve has changed its tune, so quite frankly all we need is somebody in Europe suggesting that there is some growth, or perhaps they haven’t given up on the idea of tightening. Once that happens, this market will start going higher.

Based upon the longer-term charts, I do think that we are in the middle of a basing pattern, so I do have an upward bias. That doesn’t mean that I won’t short this pair, just that I will use smaller positions as we get closer to the 1.15 level to start selling. In fact, a common tactic is to use half your normal size and what could be considered the “soft side.” This way, if you do see the market break out to the upside in your stop loss gets hit, it’s not as much of a loss. Beyond that, it’s just simple back and forth until we get the expected move.

What is somewhat ironic is many Forex traders out there will complain about these types of markets, but quite frankly they can be extraordinarily lucrative. Small victories over time add up, and for that matter it makes the analysis of this pair very simple. You know where you want to be buying, and you know where you want to be selling. Don’t let this type of opportunity pass you by.