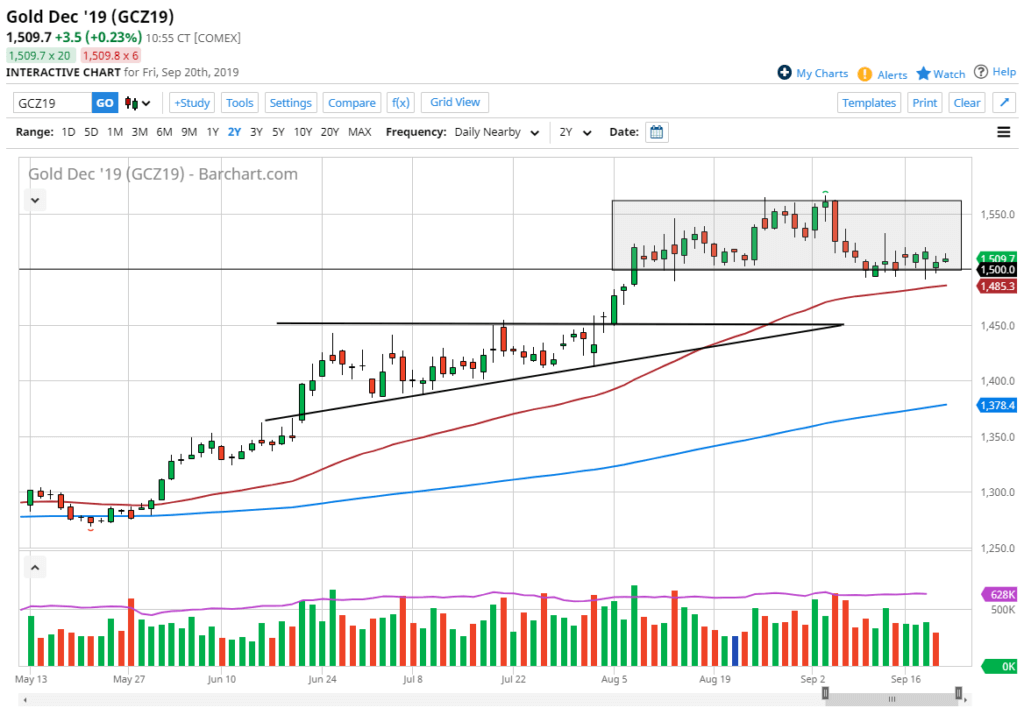

Gold Continues to Look Bullish

- Gold markets continue to hang onto $1500

- The precious metal supported by loose monetary policy globally

- 50-day EMA just below

- Ascending triangle also supportive below

Gold markets did very little during the trading session on Friday, but it should also be noted that it was “quadruple witching Friday”, meaning four different variations of options were expiring. This means that people were buying and selling to hedge large positions, so these few days generally tend to be quite choppy. Beyond that, the gold markets are hanging around a crucial level.

The importance of $1500

Gold daily chart

The importance of $1500 cannot be overstated. This is an area that has been rather supportive, extending down to the $1490 level as it is more or less a “support zone”. There is also the 50-day EMA underneath, rallying and tilting to the upside. The 50-day EMA is a very crucial technical analysis indicator for longer-term traders as well, and therefore this study will probably bring a certain amount of buying pressure by itself.

Beyond that, the $1500 level is the bottom of the overall consolidation area that we have been in since the initial push higher. We have simply been digesting very strong gains, and the fact that we have not pulled back significantly suggests we are going to continue to see buyers, given enough time. As soon as people are comfortable with these levels, the market will go much higher. Simply put, the longer the market sits at this level, the more likely participants will start to feel very comfortable with this price, meaning they will step into the market and start buying again.

Ascending triangle

The ascending triangle below had resistance at the $1450 level, which is also going to be very supportive. It’s not until the market breaks down at that level that sellers will start to be concerned about a significant pullback. All things being equal, the market has been bullish due to central bank liquidity measures.

The play going forward

The play going forward is to simply find value in the gold market and start to buy it again. Shorting gold is almost impossible, because the biggest players in the world, central banks, are starting to buy as well. Beyond that, there are a lot of geopolitical concerns out there that could cause major problems. Those particular concerns have caused money to flow into gold for safety. Furthermore, there are many concerns about the so-called “trade war” between the United States and China, which has people looking to gold as a way to preserve wealth.

Short-term pullbacks should continue to offer a nice buying opportunity, and the targets could be $1600, $1800, and then finally $2000. It isn’t that we will get there right away, but those are the most common targets on longer-term charts that will certainly be tested.