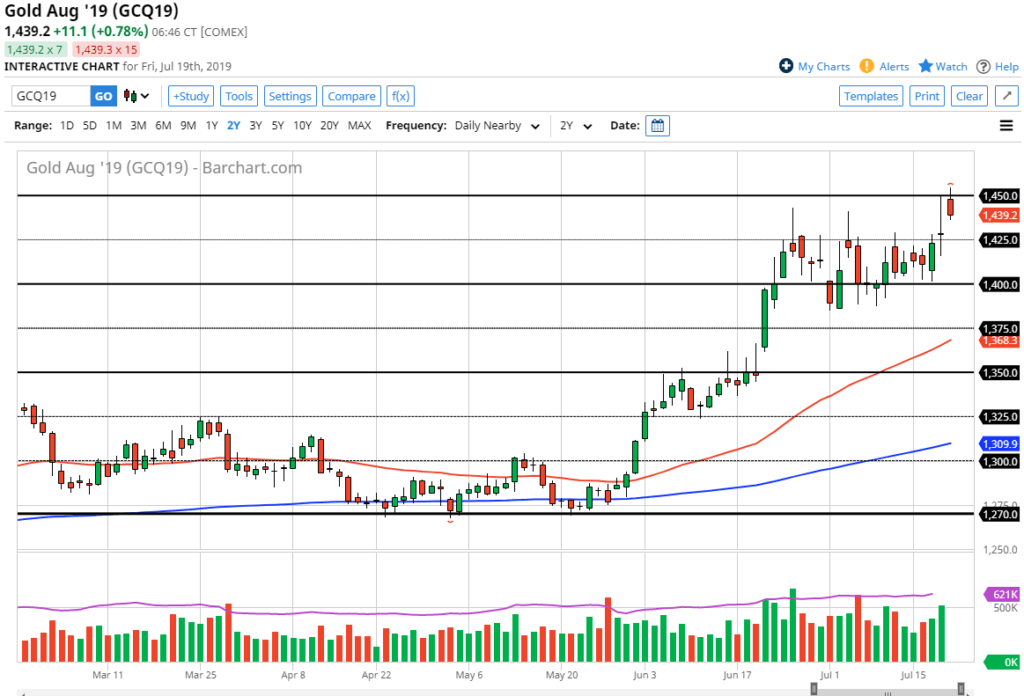

Gold markets gap higher and pull back on Friday

The Gold markets gapped higher to kick off the trading session on Friday, slicing through the $1450 level originally. This is a very bullish move, because quite frankly the $1450 level has been significant resistance in the past, and it is of course a large, round, psychologically significant figure. The fact that we broke through there of course is positive, but then again so is the pull back.

The gap needs to be filled

Gold

The gap needs to be filled under normal circumstances. At this point, we are trading on a Friday session going into the weekend, and therefore it makes a lot of sense that traders will be wanting to take profits before the markets closed. With that being the case, it makes perfect sense that they would be taking profit right at the obvious resistance level. In that sense, the gap will get filled because of profit taking more than anything else. Clearly, nothing has changed from a fundamental standpoint.

The $1425 region should be supportive based upon the gap, and the previous resistance that is there. It’s very likely that were going to pullback and find buyers, people who either were short and are in a lot of trouble, or people who have missed the most recent move.

Sometimes, we wait

Sometimes we need to wait for markets to come back to a support level, and that may be what most of Friday will be about. This sets up an interesting trade early Monday in Asia, as the closer we are to this level, the more likely we are to find buyers. Beyond that, it now looks likely that the $1425 level is supported all the way down to at least the $1400 level. If you squint, you can make out a bit of an ascending triangle, although I’m the first person to admit that it’s not perfect. In other words, there are a lot of reasons to think that the buyers are definitely still in control.

With all that being said, we need to wait for the proper pricing to get involved in buying. Simply “paying up” is a great way to lose money in the long term. Why buy gold at $1439, when you can buy at $1429? The professional trader will be waiting for the gold market to offer value.

The play going forward

The play going forward in the gold market will be relatively simple. We are simply looking to buy gold, and not sell it as it is obviously bullish. With the Federal Reserve looking to cut interest rates it makes quite a bit of sense that the gold markets will rally over the longer-term. The other central banks around the world are doing the same thing, and this is another reason that gold will strengthen as the demand for ‘hard money’ will increase. All things being equal, the Federal Reserve gets what it wants over the long-term, and this time will be no different. It may be noisy, but it will be the same as other times.