Silver Market Looks Towards Highs Again

- Silver markets started off Wednesday session positive again

- Investors await FOMC

- Market still in an uptrend

The silver markets have started off the trading session on Wednesday to the upside, showing signs of continuation of the overall trend. That being said, the market is awaiting the FOMC rate decision and statement later in the day, but it certainly looks as if the market is ready to continue to the upside overall. Silver has been in a nice uptrend for quite some time, and that should continue to be the case going forward.

Technical analysis

Silver chart

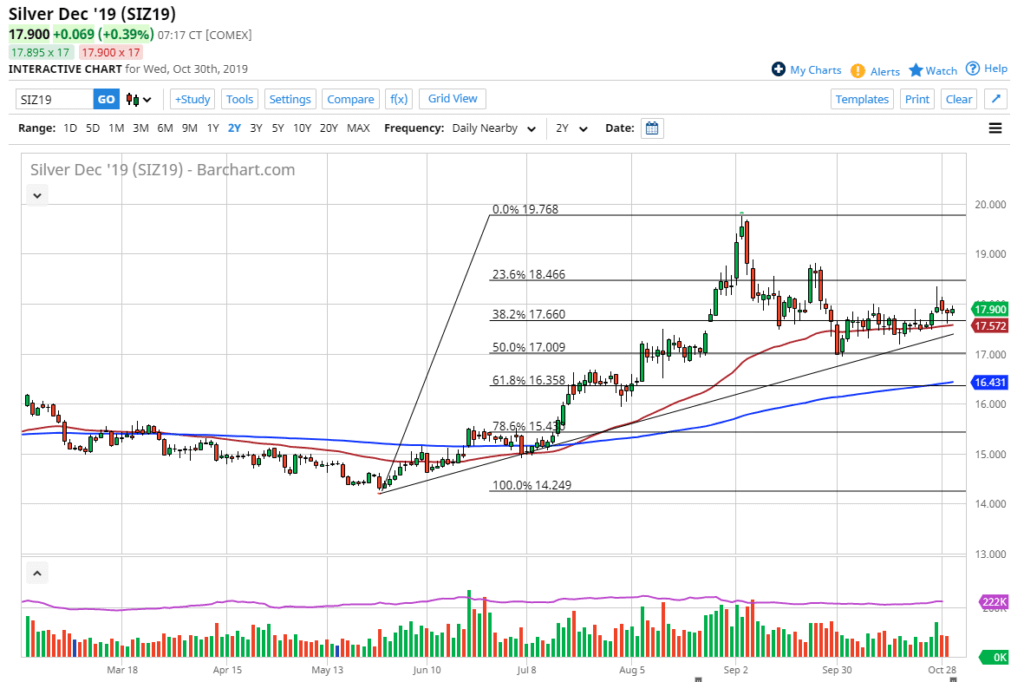

The technical analysis in this market is relatively straightforward at this point, as the 50-day EMA sits just below current trading levels. Beyond that, the hammer that formed during the trading session on Tuesday shows support, and the fact it showed support right at the 50-day EMA is a very strong sign.

There is also an uptrend line just below the 50-day EMA, and as the market gained 15% in August, this pullback over the month of September has been quite reasonable as traders have digested gains. After all, markets cannot go straight up in the air forever, so occasionally you need these pullbacks to build up momentum for the next leg higher. The pullback has been slow and gentle, so this suggests there is still plenty of demand for silver over the longer term.

The trade going forward

Without knowing the exact words of the statement, one thing that seems to be relatively well known is that the Federal Reserve is going to cut interest rates by at least 25 basis points, and could continue to be very dovish overall. If that’s going to be the case, then the market is very likely to eventually turn back to the upside, and the Federal Reserve could be the catalyst.

Remember, the market has shown itself to be one that offers value every time it dips, and this latest grind higher seems to offer more stabilization. With that in mind, it makes sense that silver continues to reach towards the highs, with a bit of psychological resistance at the $18.00 level, structural resistance of the $18.75 level, and psychological resistance again at the $19.00 level. Ultimately, though, the market should be able to break through all that to reach towards the highs.

Buying on the dips will continue to be the best way to trade this market because silver does tend to be very choppy and volatile. It is not only a precious metal trade, but it also has a large industrial component to demand. Longer-term, demand for silver far outweighs supply coming out of the ground, giving it a bit of a floor regardless.