Trump pushes back tariff date against China

Just before the futures market opened Monday morning in Asia, President Donald Trump tweeted that he was pushing back the impending tariff increase against the Chinese that was slated for March 1. In reaction, we have seen a bit of a “risk on” attitude around the world, and this is particularly interesting considering that we are at major technical levels.

S&P 500

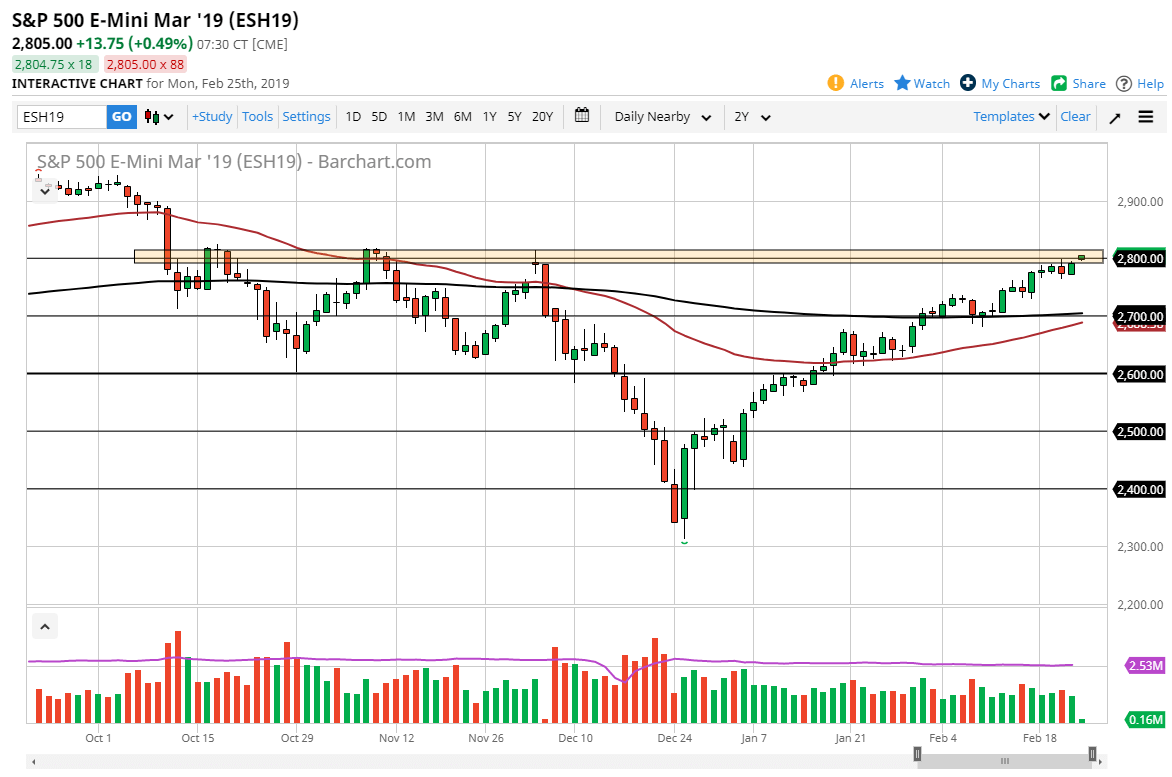

The S&P 500 is an excellent proxy for risk, as it does tend to be very volatile when headlines across the wires. The 2800 level has been extraordinarily important more than once, as we have formed triple top previously. Now that we find ourselves at this area, it will be interesting and very telling as to what happens next. As we scan the charts going into the U.S. Open, we are right on the precipice of a major break out.

Simply put, if the fact that it looks like there will eventually be a US/China trade deal does not push stock markets above the 2820 handle, this would be a very telling sign. We are at major technical resistance obviously and have seen a lack of volume on the way higher. That of course has a lot of people concerned about going long of the stock markets in general, but there are a couple of technical signals that look somewhat positive.

The bullish case

The 50 day EMA is getting ready to cross above the 200 day EMA at roughly 2700, a level that of course would be very important. This is a market that has completely recovered from a major selloff and now it looks as if the longer-term signal is starting to form itself as well. Remember, stock markets have no reflection on the underlying economy, that is something that has gone the way of the dodo. It doesn’t matter that economic numbers are getting worse, what matters is that the US/Chinese trade war seems to be calming down, and the Federal Reserve seems to be willing to throw liquidity into the market as needed.

There is the old adage “you can’t fight the Fed”, and that seems to be how most traders are playing the market. At this point, you can expect President Trump to pivot to Europe in Japan, so the whole idea of trade wars will reenter the picture, but it will be with different combatants. The US/China trade war is by far the biggest fight on the card, so obviously while there will be reactions to a US/Europe auto tariff situation, it will more than likely be specific to individual names, not necessarily the entire market.

Where do we go from here?

If the buyers do in fact take out the resistance, the next obvious barrier is going to be the 2900 level, an area where we had seen significant selling previously. Longer-term, we could be talking about a move towards the 3000 handle, but that is probably a story for spring time, possibly even summer. Expect very choppy and difficult trading conditions over the next several sessions, but also you should keep an eye on how the next impulsive candle is formed, it could give you the directionality of where we go. While things do look bullish, if we get a long red candle, we are probably going to revisit the 2700 level.