US Dollar Trying to Bottom Against Japanese Yen

- US dollar gapped higher to kick off week

- Sitting just above 50-day EMA

- USD/JPY above ¥108

The US dollar has gapped higher to kick off the week, reaching well above the ¥108 level. This is a currency pair that’s worth paying attention to at this point in time because it represents risk appetite. The Japanese yen offers safety overall.

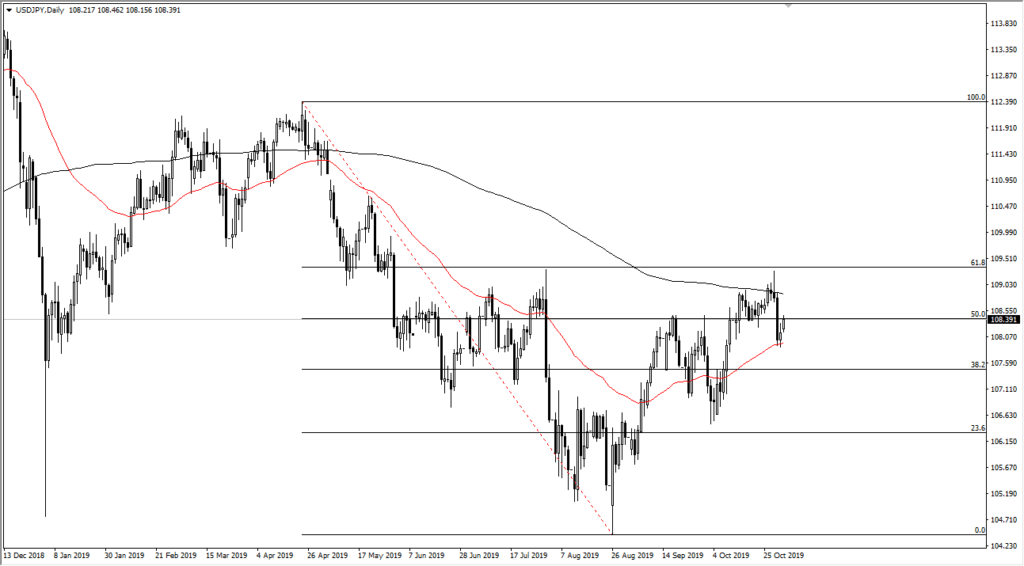

It’s also worth keeping an eye on because it looks as if the market is trying to break higher. Beyond that, when you look at the longer-term chart, you could make an argument for something akin to an “inverted head and shoulders”.

If the market breaks above there, then it becomes more of a longer-term buy-and-hold type of signal. Ultimately, this pair will move right along with risk appetite globally. As a result, the S&P 500 is sometimes used as a secondary indicator as well.

Correlations

USD/JPY chart

There are significant correlations to observe in reference to the S&P 500, which is trying everything it can to break out even higher. This is a market that should react right along with it, but there is also a lot of overhead that you need to pay attention to.

The breaking of the shooting star that was formed during Thursday of last week would not only clear short-term resistance; it would also break above the 61.8% Fibonacci retracement level, bringing more buyers in. At that point, the sloppy “inverted head and shoulders” would have kicked off, opening up the possibility of much higher prices.

The trade going forward

The trade going forward is to look for short-term pullbacks to take advantage of value. It appears that there is more of a global “risk-on” trade out there, and that should continue to push towards the ¥110 level above and perhaps even higher. This market seems to be building up inertia, and therefore once the markets are released, it could be a rather rapid move.

Alternatively, if the market was to break down below the ¥107 level, things could change rather drastically. If that were to happen, it would probably coincide with some type of major breakdown in risk appetite around the world, not just in this market. Keep in mind that this pair is highly sensitive to the US-China trade situation and, of course, global growth overall.

If that’s going to be the case, we could get erratic trading, but the market still seems to favor the upside in general. Watching for global correlations will be the clue and the way to trade going forward. Ultimately, it should be looked at as a market that is somewhat historically cheap, so that could also add more fuel to the fire.