USD/CAD pulls back after a strong Canadian jobs number

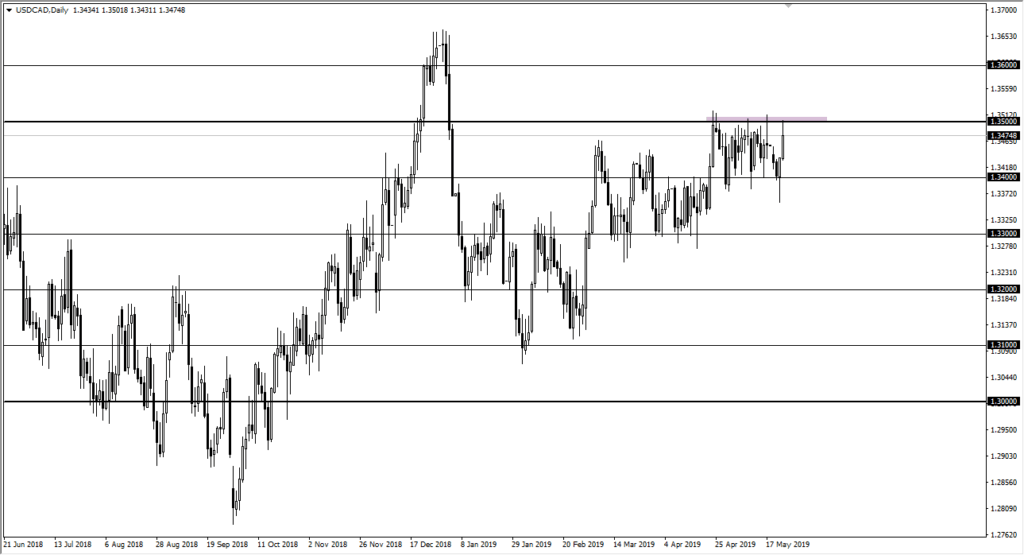

The US dollar fell rather hard against the Canadian dollar during trading on Friday as the Canadians added 105,000 jobs last month, which is the largest number ever recorded. That obviously is bullish for the Canadian dollar, and as a result we saw the 1.35 level offer resistance yet again against the US dollar. That being the case, the market is reaching towards lower support levels.

Multiple levels

USD/CAD Chart

There are multiple levels of support underneath, so even though the US dollar has fallen a bit against the Canadian dollar, quite frankly even with a stronger Canadian jobs number there are a lot of things out there to worry about. From a technical analysis standpoint, you can see that the 1.34 level looks to be offering support, just as the 1.33 level is, followed by the 1.32 level, and so on. This is a very structurally driven market, which makes sense considering that the two economies are so highly intertwined.

Keep in mind that when things go bad, the Canadians tend to take it on the chin because the economy is so much smaller than the American one. The Canadian dollar is a bit of a proxy for the oil markets and does look as if they are going to be a bit difficult to deal with as well. Beyond that, this pair may not be the best way to play crude oil anymore, as the Americans actually produce more crude oil than Canada.

US/China trade relations

One of the biggest problems facing the Canadian dollar is that the US/China trade relations continue to give us a lot of trouble. That being the case, there will be concern about commodity currencies, which of course Canada is one. There is also a drive into the US dollar, because people will be buying treasuries if they are concerned about protecting trading capital. One of the first ways they do that is the buy the bonds in America which of course demand US dollars. If we get US dollar strength, you can expect it to show appeared just as it would anywhere else. I suspect that if the trade relations continue to sour, this pair will continue to grind higher given enough time.

However though, keep in mind that this pair does tend to chop around a bit so I wouldn’t expect explosive moves anytime soon. This pair tends to grind and I think that’s what we are looking at here, a grind due to the trade relations.

The trade going forward

It’s very likely that this market will grind a bit higher and try to reach towards the 1.35 level again. In fact, the Friday session has already seen a bit of a bounce from the 1.34 level. The US dollar will probably strengthen as we worry about what happens over the weekend, with the Chinese likely to retaliate for tariffs being levied upon them. With that in mind, the greenback will definitely get a bit of a bid unless something changes over the weekend to give people hope of a good resolution.