| Overall | Commissions & Fees | Licensing & Safety | Platforms & Tools | |

|---|---|---|---|---|

| Points | 97 | 97 | 93 | 95 |

Overview – Fees and commissions – Safety – Opening an account – Account types – Trading Platforms – Markets and products – Research tools – Education and training – Customer support – Our verdict

Online trading became so convenient that anyone can start trading from their home or even bed. All you need is an internet connection and a broker – however, choosing the right broker might not be easy, as not all of them are trustworthy.

The financial trading market is oversupplied with financial brokers, since a considerable portion of them are fraud, you need to check all about the broker before you get started.

Capital.com broker has recently joined this industry and became an important player very quickly. In this guide, we will be looking at Capital.com review, and we will check all the offers that are found on their website, to know how reliable their services are.

The Capital.com offers a wide range of services while being regulated by several regulatory bodies. They give users a chance to trade using several trading platforms such as MetaTrader4, TradingView, and Webtrader.

There are five financial markets where traders can buy and sell assets. The markets are Forex, stocks, commodities, indices, and cryptocurrencies (all on CFDs). The maximum leverage and the spread are variable and they change according to the security a trader is choosing.

The broker accepts a lot of withdrawing and depositing methods. At the same time, it charges zero commission when a trader wants to cash out to send funds to their trading account.

- Licensed by FCA, CySEC, ASIC, and NBRB

- Variety of payment methods

- Zero commission on deposits and withdrawals

- Low minimum deposit requirement

- Useful educational section

- Huge variety of tradable assets

- Web Platform&Mobile App

- Lack of bonuses

- Lack of different trading accounts types

overall scores

In this review, you can find all the information you need to decide whether is the right broker for you. Our expert team has thoroughly explored the broker, using a tested methodology and scoring system. This process places importance on the things we know matter most to traders. Below you can see how scored in each of our high-priority categories.

Fees & commissions

Capital.com broker takes zero commission on depositing and withdrawals. However, the broker basically makes its money through the spread, which is variable between the different products offered in each market. Let’s check what other forms of payment exist with this broker.

Overnight charges

Capital com financial broker calculates the overnight rollover fees based on the entire value of the trade position, and not only on the leverage value provided.

The interest fees are different from one asset to another, and a trader can see these calculations in their trading platform in the lower navigation panel, where the swap charges are automatically calculated and shown.

Deposits

A trader can deposit their funds to their trading account using a credit/debit card, online banking, e-wallets, and wire transfer. It can take 24 hours to 5 business days for your funds to arrive. Usually, using bank cards and e-wallet is a faster option to deposit your money.

Wire transfer is considered one of the safest ways to get your money delivered. In this transfer, you do not give your personal information to the broker, which keeps your personal information safe, but it takes the longest which can go up to 5 business days.

Withdrawals

Similar to deposits, there are several ways for traders to cash out their money. Keep in mind that some of these methods can be specific to the region where the trader resides.

Capital broker withdrawal options are bank transfers, credit/debit cards, PayPal, Sofort, Net Banking, Virtual Accounts, and Ovo.

A trader can receive their money according to the method used. The processing time can take from 48 hours to 3 business days. Getting your money using e-wallets is considered the fastest.

Is capital.com reliable?

After checking the license of this broker, we found that Capital.com is regulated by four regulatory authorities, FCA, CySEC, ASIC, NBRB. These four authorities are well known and they impose financial regulations in the UK, Europe, Belarus and Australia.

Being licensed by any of these regulators makes a trader confident about the quality and the intention of the broker. The broker behaves under a strict guideline, and any attempt of malpractice will be faced with hefty fines and can revoke the broker’s business license.

Capital.com also mentions the registrations number of each license the broker follows. This registration number can be checked on the proper license website – we have made research and can confidently say that the license status is active and valid according to the information provided on the broker’s website.

What makes us believe that Capital.com can be trusted is that the broker operates in the regions that are heavily regulated. This means that the broker does not have anything to hide, and it abides by the law.

How to start trading with Capital.com?

The registration process is quite easy with this broker. You need to find and click on the button in gold, on the top-right corner, insert your email address, and create a password.

You will receive a verification link on your email before you continue registration, once you have verified your account through the link, you will continue inserting your personal information such as your name, phone number, country of residence, and address.

After that, you will encounter a few questions that will help the broker know more about your level of experience, and about your expectations from trading. Lastly, you will need to submit further documents such as proof of identity and proof of address. Within 48 hours your application will be processed, and once approved, you can start depositing and trading.

How to open an account (step-by-step)

- Click on the “Trade Now” button in the top-right corner.

- Enter your email address and create a new password.

- Verify your account from the verification link received in your email.

- Insert your personal information such as name, telephone number, address.

- Complete the survey about your trading experience and expectations.

- Submit identity and address verification documents to get verified and to start trading.

Trading with Capital broker

Capital.com serves different regions and trading accounts types differ accordingly. For instance, the broker offers CFD trading for every region, while direct market access is offered for markets that operate under the NBRB.

The broker operates on four websites, each website represents a different region from the broker’s coverage area. Depending on the location of the trader, they might see different options that are specific to their region.

CFD trading

This trading account type is very popular in most brokerage companies. CFD trading means trading on the speculation of price changes, without the physical ownership of an asset. This trading account is available for all users of Capital.com.

Trading with CFDs gives the investor bigger trading options, since direct market access requires more time and procedures, CFD trading comes like a perfect alternative that enables the trader to enter any financial market.

Minimum deposit

The minimum deposit required to start trading is 20 USD/EUR/GPB, depending on the region, traders can start depositing with 1500 RUB or 100 PLN by card.

Note that the broker does not charge any deposit commission fees, the method you choose to fund your account will decide how soon will the funds appear in your trading account.

Trading platform

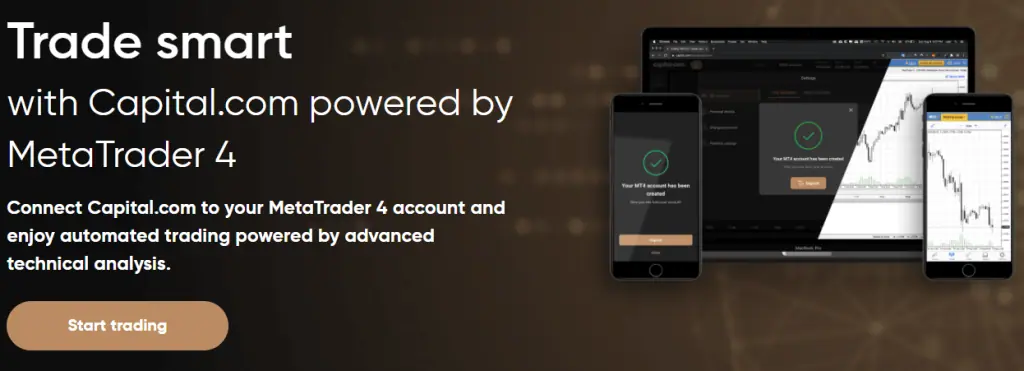

There are multiple ways for traders to execute market orders. MetaTrader4, TradeView, and Webtrader are available on the website.

The MetaTrader4 is the most popular trading platform, and to be offered with the broker can indicate that capital financial broker is legit, because MetaTrader only collaborates with reputable brokerage companies.

TradeView is another trading platform that is used by many traders, it is relatively new and gained some popularity among investors.

The Webtrader is also another great option, which enables the traders to directly log in to manage their investment without installing any software, they can directly go to the Webtrader from the website.

Having that many options with capital Forex broker trading platforms MT4, TradingView, and Webtrader can attract as many investors as possible, with their different preferences to use any trading software.

Tradable assets

Capital.com financial broker covers every financial market, of course, according to what is allowed under the different licenses. For example, the FCA regulations do not allow cryptocurrency trading, therefore the broker cannot offer it to UK traders.

Aside from that, every other market is available, with a lot of instruments in the Forex, stock, indices, commodities, and cryptocurrency markets (all on CFDs). The features offered in each market such as the maximum leverage and the spread are variable and we will demonstrate them down below.

Cryptocurrency

Since Capital.com is licensed by the FCA, it cannot offer cryptocurrency trading for the UK market, that’s why on the UK website version, a trader cannot see this option under the tab “markets”

Capital broker enables cryptocurrency trading for clients outside the UK market. There are 376 cryptocurrencies that can be traded, with a variable spread.

The maximum leverage that traders can use depends on the regulations, as the following.

1:2 – ASIC & CySEC

Forex

There are 138 currency pairs that can be traded (on CFDs), with very tight spreads – for example, 0.00006 pips on trading EUR/USD.

The leverage is changing here as well according to the legislation that regulates the market.

Under the FCA, ASIC, and CySEC it is 1:30 for major currencies, and 1:20 for non-major currencies.

Stocks

Capital.com enables their clients CFD trading and direct access to the stock exchange market.

There are more than 5900 stocks that can be traded with this broker, which gives the trader a big option to choose from, with tight spreads that are variable according to the stock.

The maximum leverage is 1:5 according to the FCA, ASIC, and CySEC.

Indices

There are 22 indices offered by Capital.com and they span across different regions, US indices, German indices, France indices, and many more.

The maximum leverage a trader may use according to the FCA, CySEC, and ASIC it is 1:20 for major indices, and 1:10 for non-major indices.

Commodities

There are 23 commodities that can be traded on CFDs with Capital.com. They include precious metals as gold and silver, as well as other commodities like sugar, coffee beans, oil, and gas.

The spread changes between the commodities. For example, it is 0.02 of the US crude oil, and 0.04 on brent oil. The maximum leverage according to the FCA, ASIC, and CySEC goes as the following:

1:20 for gold

1:10 for commodities other than gold.

Research tools

The broker offers a news page that keeps the trader aware of market news. It includes reporting the latest news that can affect different markets, periodical reports that affect the traders’ investments, and weekly markets reviews.

Another tab talks about market analysis, it provides the trader with tools to understand how specific news affects the trader’s decision, and what outcome can be expected from any event.

Education

What really makes Capital.com stands out from other brokers is the education section. The Capital.com offers different options for users to get educated about everything regarding the trading.

The education section starts with definitions of basic terminologies, explaining the trading instruments and options available. The broker also explains what are the different trading strategies that are used and how to implement each of them.

The video content is also very useful, there are webinars and video lessons that talk about market trends and how to analyze their movements. Besides, there is also the YouTube channel of the broker where videos of different topics are posted.

Customer service

The support team of Capital.com is really helpful. The live chat feature is very useful and one can get quick responses to whatever questions they have. At first, an AI Bot will be available in the chat, and if it fails to address your question, you will be connected with a support agent.

Other ways to communicate with this broker are contacting them on the support email address, or the support phone number that is indicated on the website. Also, you may communicate with them using different platforms such as WhatsApp, Telegram, Messenger, and Viber.

It is very important for a trader to have sufficient support help from a specific company. This plays a major role in choosing the broker because the trader is putting their funds with this broker so reliability and trust are key factors.

Final verdict

After checking all the services and offers that we discussed in this Capital.com review, we conclude that Capital.com is legit, you can rely on this broker to handle your money with expertise and professionalism.

Capital.com charges zero commission on deposits and withdrawals, which is very true, there are no hidden fees, the wide span of payment methods makes every traders’ life much easier.

What’s next

TAKE ACTION

Open an account on the broker website.

See what benefits one offers over the other.

Trading financial markets has never been easier.