AvaOptions Review – How Does This Platform Work?

AvaOptions Review – How Does This Platform Work?

AvaOptions is the name of a custom trading software made by AvaTrade. Alongside the industry-standard MT4 and web trader, AvaTrade’s new platform is a breath of fresh air in the trading community, not enough forex brokerage firms make their own additional software. This is a great opportunity for growth and independence.

Having multiple products for its consumers shows the dedication the firm has for its traders and how actively they are trying to optimize the trading experience for their customers. The AvaOptions platform is very similar to MetaTrader4 which is a very popular trading platform in the trading community.

They share the concept of functionality and several other features like a programming language and a user-friendly interface. However, we would conclude that one needs to have at least some theoretical knowledge about basic trading strategies before using the AvaOptions trading platform as it is specifically designed for experienced users.

Are FX Options Better on AvaOptions?

The pending orders are still blue so they’re cool and waiting to be executed, so you can pick whatever asset you like, like a pound of gold, and you can adjust your periodicity like I said, which we’ll correct, so there’s history, and you can put in studies wherever you like now let’s talk of what we’re really here for, which is choices.

If I press the spot button, I get a menu where I can choose between trading basic calls and puts or trading strategies like call spreads, put spreads, butterflies, and strangles. Buying a strangle is buying a call and a put at different strikes, and you can see how the payoff diagram looks. You’ll profit if the market moves a lot higher, and you’ll profit if the market moves lower, but if the market stays around here, your bought options that end up being worthless.

Click here to Sign Up on AvaOptions

AvaOptions Trading Features

AvaTrade clients can sign up for one of two account categories, depending on the spread offered: a fixed spread account, which is available on both platforms, or a floating spread account, which is only available on the MT4. Both account forms are commission-free and support micro-lot trading.

Check out HotForex if you’re looking for a decent trading site. It has more account forms than any other broker I’ve looked at, all with extremely competitive and exclusive trading conditions tailored to suit the needs and demands of all types of traders.

Sign in from this page Here we go, it’s logging me in, getting all of the parameters it needs, and this is what our screen looks like now. On the left side of the screen, you have various assets, we have major market fx on the top left, equity industry gold and silver, and equity indices, and then all of the other currency pairs down the bottom.

Live FX Options Pricing Widget

This interactive widget displays market data for a variety of European-style vanilla Call and Put options for a number of different currency pairs.

Streaming spot FX rates are displayed on the left column for all views, and standard expiration dates are displayed on the top row, just below the description.

Pricing and Volatility pages are the two types of pages that can be viewed.

Pricing Pages and Volatility Pages are the two styles of pages available in the Option Pricing Widget.

To see a selection of streaming vanilla European style Call and Put option mid-market prices and related info, click either currency pair.

By clicking on the top row of the window, you can choose one of the regular tenors.

At the bottom left of the list, you can choose from a variety of pricing conventions. Term pips are the norm, but Base pips and Base percent are also options.

To see a chart of profit and loss for purchasing an option on 10,000 of the currency pair at the chosen strike and tenor, including the breakeven level, click on any option price.

To see a matrix of Implied Volatilities for all currency pairs and tenors, click “Vols.” Additional pages with Realized volatilities and the Implied to Realized ratio can be selected. To see the Pricing page for any volatility number or currency pair, click on it.

Mobile Version

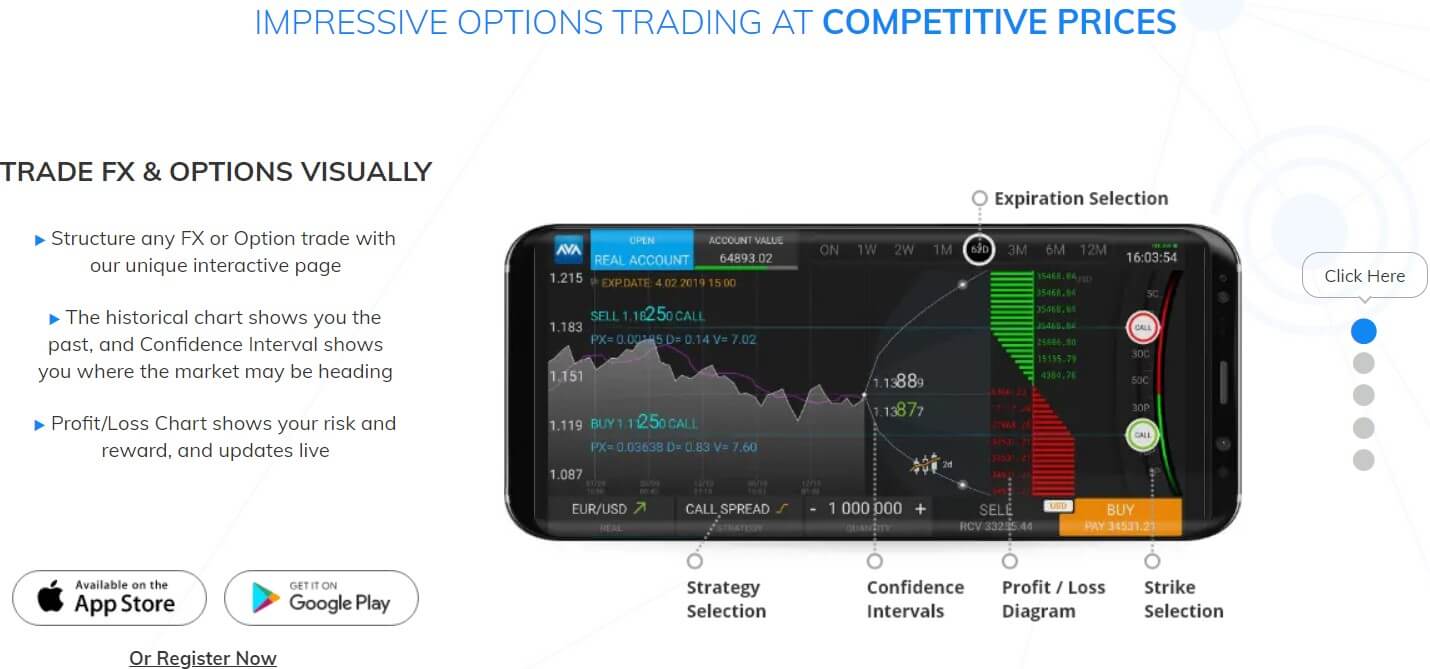

We’d like to give you a brief tour of our trading platform. This is the market watch screen, which looks similar to many other trading platforms. On the left, you’ll see the offer and ask for different properties. On the right, you’ll see the high-low and yesterday’s closed prices. You can also add other currency pairs, such as gold and silver. Adjust the order of the items on this page by clicking Save, and you’ll be taken back to your computer with the new order on the right side. I may scroll left to see one month implied volatilities for the Canadian dollar.

Number of Currency Pairs

55 different currency pairs are available for trade on the platform. On the main panel, you’ll be able to choose from a variety of categories. This is their trading screen, and their trading screen is unique in that you can see the asset we’ve chosen, which by default is the euro/dollar to trade spot, which means you’re trading the asset itself, much like buying or selling a CFD. You can add and look at different types of charts.

Pros & Cons of AvaOptions

No trading software is without its advantages and disadvantages. It is the attitude of the manufacturer towards these topics that can cause a stir of controversy.

Pros

In this section, we will talk about the positive aspects of the platform that we think is worth mentioning. As we know any platform has its pros and cons, we are more than glad to disclose these facts to you.

Interactive pages

The activities and programs of AvaTrade are founded on concrete principles that describe their attitude toward current and future partners and clients.

These principles are Fairness, growth, and development that is sustainable. Priority is provided to clients. This is why the pages of the platform are so immersive and hence very interactive. The visual stimuli on the platform are effective in regards to illustrating marketplace activities.

Charts

The visual stimuli provided by the platform are used to illustrate different financial activities. There are many useful extra features on the platform and the abundance of charts is definitely one of them. An additional feature of it is an autochartist trading signals, for example, and risk management tools that will be available here this week where you can see your net risk by currency pair, currency, and net vega, which is your exposure to implied volatility, among other things, as well as some very nice bar charts and numbers that will help you understand how to hedge or what your net risk is.

Free Widgets

Widgets can be very beneficial for the overall user experience for any type of platform let alone one with such advanced features like The AvaOptions. The financial operations that are processed with this platform are quite complicated therefore the variety of widgets that are accessible on the platform are impeccable and incredibly useful.

13 Option strategies

A variety of attributes is something that we can say about the AvaOptions platform. It’s incredibly diverse. One can strategize in multiple ways, in fact, there are 13 operation strategies including Spot, call, call spread, call ratio put, put spread, put ratio, straddle, straddle, butterfly, condo, risk reversal, and seagull option strategies.

Cons

No platform is without its faults and imperfections. There’s always something that can be worked on and made better by examining and focusing on certain aspects of the platform. In this section, we are glad to shine the light on this topic and discuss the few disadvantages that can be fixed further in the future.

Inactivity Fee

AvaTrade has many services and offers quite a few products to its consumers. The site has an inactivity fee for all of its user’s accounts. The same notion is true for their exclusive platforms which are available on the site including AvaOptions. The said inactivity fee is quite high. After 3 months of inactivity, a $50 quarterly administration cost is charged; after 12 months of inactivity, a $100 annual administration cost is charged.

Few restricted countries

Although AvaTrade is an international brokerage firm, there are quite a few regions that don’t provide services and products to comply with their regulations. This is a firm that believes in its products and services. It’s a legitimate business that follows all the regulatory requirements. Although having few restricted countries is not great in terms of accessibility, it is something that can be worked on by getting more regulations and qualifications.

FAQ on AvaOptions

Is AvaOptions better than MT4?

We would like to think that AvaOptions is a highly advanced software much like MT4. We have found that both of the platforms share common traits and features like interactive interface, great charts, the possibility of rollovers, and hedging. Both of the platforms are available in multiple languages and have distinctive types of users. We would say that the most important distinction is the fact that AvaOption is designed specifically for advanced users while MT4 can be used by both novice and experienced traders.

Is AvaOptions good for beginners?

No, it isn’t great for a complete novice to the industry. We would not recommend traders to start using this platform without doing research and learning about the basics of Forex trading. AvaOptions is specifically designed for experienced traders therefore one needs to have at least some theoretical knowledge before starting to use it for their trading activities.

Can I use AvaOptions outside of AvaTrade?

No, you can’t use it in that particular way. one can not use AvaOptions platform outside the realm of AvaTrade. The mentioned platform is an exclusive product of the AvaTrade brokerage firm therefore one can not use it in synchronous trading with other trading firms.