Trade Second & Fourth Waves Successfully

The Forex market, despite being the most liquid financial market in the world, actually spends more time in consolidation rather than in trending. Few traders understand this, and especially swing traders or investors (traders who take a longer horizon into consideration for the take profit to come) often lose their patience. As a consequence, the inevitable happens: Trades are closed too early, and by the time a trade is closed, the market will almost always have started moving. And just like that, an opportunity has been missed purely because of lack of patience. According to Elliott, market moves should be classified as impulsive or corrective, and, using this classification for the previous example, it means that an impulsive wave implies that the market is trending, while a corrective wave means that the market is ranging. Because there are more ranges than trends, it is vital to know how to trade corrective waves, and what the implications of such corrections are. In an impulsive wave, or in a five-wave structure, of the five waves that form the whole impulsive wave, the second and the fourth ones are corrective.

Steps to be Taken when Trading Corrective Waves in an Impulsive Move

Between the second and the fourth wave, a trader should always favour trading the second wave rather than the fourth one. This is because the fourth wave is followed by a fifth one that is usually shorter than the first wave, which means that the market will not travel much more beyond the end of the third wave. Having said that, the implications are that the overall impulsive wave will end pretty soon anyway, and it is therefore risky to trade the fourth wave. However, this can be done, and conditions for this are listed below in the section dedicated to trading this wave.

Trading the Second Wave – Things to Consider

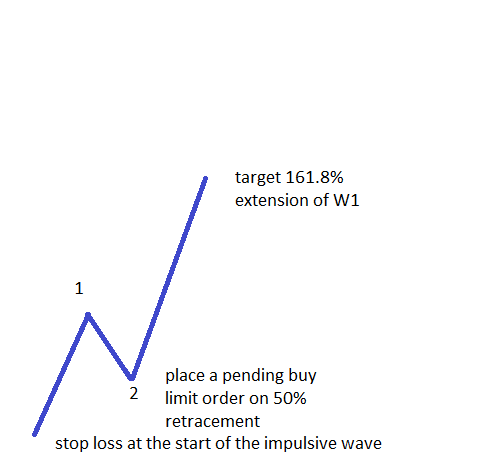

A second wave can end either in the territory of the first one, or beyond it. In the first instance, the typical retracement level would be between 50% and 61.8%, but not much more than that. If the price indeed retraces beyond the 61.8% level, look for that move to be only the a-wave portion of the second wave. In any case, a move into 50%–61.8% retracement into the territory of the first wave should be traded. If the first wave is bullish, then a long trade can be traded. If it is bearish, a short trade should be opened. The stop loss for this trade should be the starting point of the first wave.

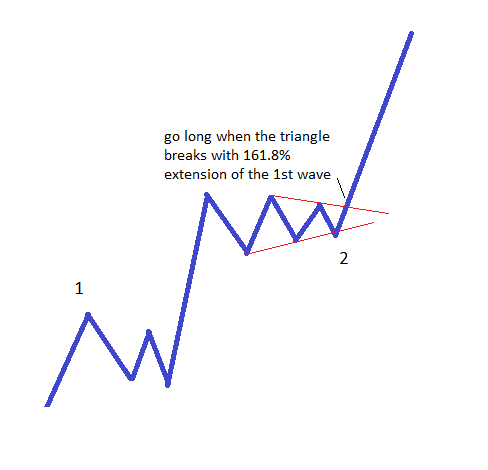

What is to be done if the price does not retrace more than 50% into the territory of the first wave? When this happens, the second wave is most likely forming a running correction. This is even better, as such a correction is followed by an explosion for the third wave, and it is almost certain that the whole impulsive wave will have a third-wave extension. In order to trade such a possibility, one needs to wait for the price to come back beyond the end of the first wave. This move will typically be a violent one, and unprepared traders will think that the third wave has started. This is totally wrong! The thing to do is to look for a consolidation area forming after that move; typically look for a triangle. By the time the triangle is broken, a new trade can be opened with a stop loss at the end of the first wave, and targeting 161.8% of the first wave, placed at the end of the triangle mentioned earlier.

Trading the Fourth Wave – Things to Consider

The fourth wave offers more possibilities for trading when compared with the second wave, simply because at that moment in time we have enough clues about the overall impulsive wave that is forming. While the fourth wave is not that rewarding, as traders are only targeting the fifth wave that is yet to form, it can be traded if the overall move is forming on a longer timeframe, such as daily or longer.

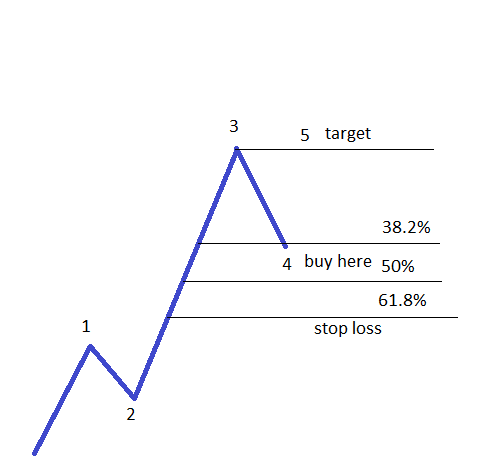

If the second wave was a complex correction, chances are that the fourth one is going to be a simple correction. Therefore, look for either a zigzag, a flat or a triangle to form. Of these three patterns, a triangle is least likely, so a flat or a zigzag are the patterns to trade. A fourth wave should not retrace more than 38.2% when compared with the length of the third wave if the third wave is the extended wave. One can therefore place a pending order to trade this retracement. More about how to use such a pending order can be found in the article dedicated to trading with pending orders in that section of our Forex Trading Academy project. A typical stop loss for such a trade would be the 50%–61.8% retracement level of the third wave.

If the market retraces into that area, chances are that the move you traded is actually a corrective wave and not an impulsive one. As for the take profit, the safest place to set it is at the end of the third wave. Indeed such a move is mandatory, as the market occasionally forms a so-called fifth-wave failure. However, it can be placed a bit higher as well; or even better, you can set an open target with a trailing stop. In this way, even if the market retraces, the stop will be hit, the profit will be booked, and the fourth wave will have been traded. The a–b–c move most likely started earlier. The second and fourth waves should differ in the time taken for both corrections to form, and sometimes, at least when it comes to the Elliott Waves theory, the time element is even more important than price. If the impulsive wave is forming on a longer timeframe, make sure you understand that price needs time to consolidate, and this means that it is better to use pending orders. Both the second and fourth waves can be really violent, and as a trader, you’ll be challenged to close the trades. The psychological factor plays an important role in the overall profitability of a trading account, as it is unlikely that a trade will move in your favour from the start. It is only normal for a position to show a loss; this is part of the overall trading process. What is not normal is to not understand where you are with the overall count, and to trade randomly. Elliott Waves allows a trader to avoid that, thus allowing for profits to be made.

Other educational materials

- Types of Expanding Triangles

- Trading with X Waves

- The Concept of a Running Correction

- Placing Pending Orders When Trading with Elliott

- Overlapping Between Corrective Waves

- The All-Important B Wave Retracement

Recommended further readings

- “The asymmetric path of economic long waves.” Coccia, Mario. Technological Forecasting and Social Change 77, no. 5 (2010): 730-738.

- “The globalization of trade in retail services.” Wrigley, Neil, and Michelle Lowe. Organisation for Economic Co-operation and Development (2010).