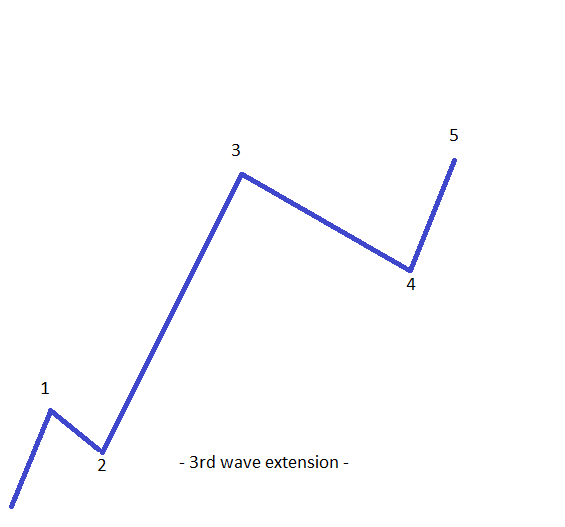

Trading 3rd Wave Extension

A third-wave extension impulsive wave is by far the most likely one to be found when counting waves with the Elliott Waves theory. Elliott found that after a consolidation of the second wave, the third wave is extended more than 161.8% compared with the length of the first wave. This extension is a relative one, in the sense that the above distance is the minimum one for the price to travel. Often the price moves well beyond that level, to 261.8% and even 461.8%, depending on the power of the move. A third-wave extension makes it difficult to trade the third wave, but one can prepare for it during the second-wave consolidation. As was the case in the previous article on the Forex Trading Academy, let’s list here the minimum conditions for a five-wave structure to be considered an impulsive wave:

- In a five-wave structure, the first, third and fifth waves are impulsive waves on their own.

- The second and the fourth waves are corrective

- At least one wave is extended

- The third wave cannot be the shortest one when compared with the first and the fifth.

On top of these things, a third-wave extension impulsive move should consider other price- and time-related factors. This is the only way to correctly interpret and trade such an impulsive wave.

| Broker | Bonus | More |

|---|

Things to Consider in a Third-Wave Extension

In such a pattern, the third wave is the longest one, hence it should stand out from the crowd when it comes to its length and the velocity of the move. It is far and away the wave you don’t want to miss trading, as the other ones are either shorter impulsive waves (the first and fifth waves) or consolidation areas (the second and fourth waves).

Preparing for the Third Wave

While there is nothing wrong with the above thinking, the whole idea is not correct from an Elliott point of view. I mean, it is correct, but it is rarely that the Forex market will behave like that. Maybe other markets will, but not the Forex one. Forex is accepted as being extremely volatile, and therefore spikes are the name of the game. Such a move beyond the 61.8% level should be only the first corrective phase of the second wave, namely the a-wave. In other words, it is wrong to assume that the third wave will start from that point, and it means the second wave is not completed. A normal place for the second wave to end will be between 38.2% and 50%, or usually it will be a running correction. (For more details about how running corrections work, please refer to the articles dedicated to that subject.) So, if we are to take an educated guess about the end of the second wave, that would be around 38.2%–50% retracement into the territory of the first wave. This is the place from which the third wave should be projected.

Alternation Between the First and the Fifth wave

The principle of alternation, as described by Elliott, refers to the two corrective waves in an impulsive wave. However, those are not the only waves to alternate, as alternation is interpreted based on the non-extended waves as well. Having said that, it means that in a third-wave extension impulsive move, the two non-extended waves play an important role in a trading plan that involves such an impulsive wave. A well-designed trading plan should look like the following:

- In a bullish impulsive move, buy the 38.2% retracement level into the territory of the first wave. The stop loss should be at the start of the first wave, and the take profit at the 161.8% extension of the first wave, projected from the 38.2% retracement. This is because we don’t know at this very moment the actual end of the second wave.

- By the time price moves beyond the highs of the first wave, chances are that the second wave is completed and we’re well into the third wave. At this moment, we can find out exactly where the second wave ended, and adjust the take profit for the previous trade.

- Measure the time taken for the second wave, as well as the distance the price has travelled (the distance between the highest and the lowest point in the second wave). The fourth wave should alternate when compared to these two values.

- After the take profit, if reached, it is time to prepare for trading the bullish impulsive wave on the short side, as the five-wave structure is about to be completed. This is where the alternation between the non-extended waves comes into place. The thing to do is to look at both the price and the time taken for the first wave, and use a Fibonacci ratio to find out both price and time levels for the fifth wave.

Exactly as was the case with the first-wave extension in the previous article, we’ve shown a trading plan for a bullish impulsive wave, a plan that involves both a long and a short trade. It means that we traded the impulsive move to the upside, and by the time the extended wave completed, we traded in the other direction. The last article dedicated to the Elliott Waves theory will deal with the fifth-wave extension impulsive move. While third- and first-wave extensions are common, the fifth wave one is rare, even on the Forex market. However, we must know how to interpret it when it forms.

Other educational materials

- Forex Trading When Central Bankers Hold Speeches

- Risk-off vs. Risk-on Trading

- Trading with the Cloud – Use Ichimoku Cloud to Spot Reversals

- Forex Market Terminology

- Profit from Forex Trading Using Different Trading Styles

- How to Trade Double Extended Impulsive Waves

Recommended further readings

- “Real Time Experimental Study and Analysis of Elliott Wave Theory in Signal Strength Prediction.” Vishvaksenan, K. S., R. Kalaiarasan, R. Kalidoss, and R. Karthipan. Proceedings of the National Academy of Sciences, India Section A: Physical Sciences: 1-13.