Are stock markets starting to get toppy?

With the way the US stock markets have been behaving lately, you would think that perhaps there was nothing to worry about in the world, because quite frankly stocks can only go higher it seems. However, Friday was an interesting trading session because it’s possible that we are starting to see the market show signs of exhaustion.

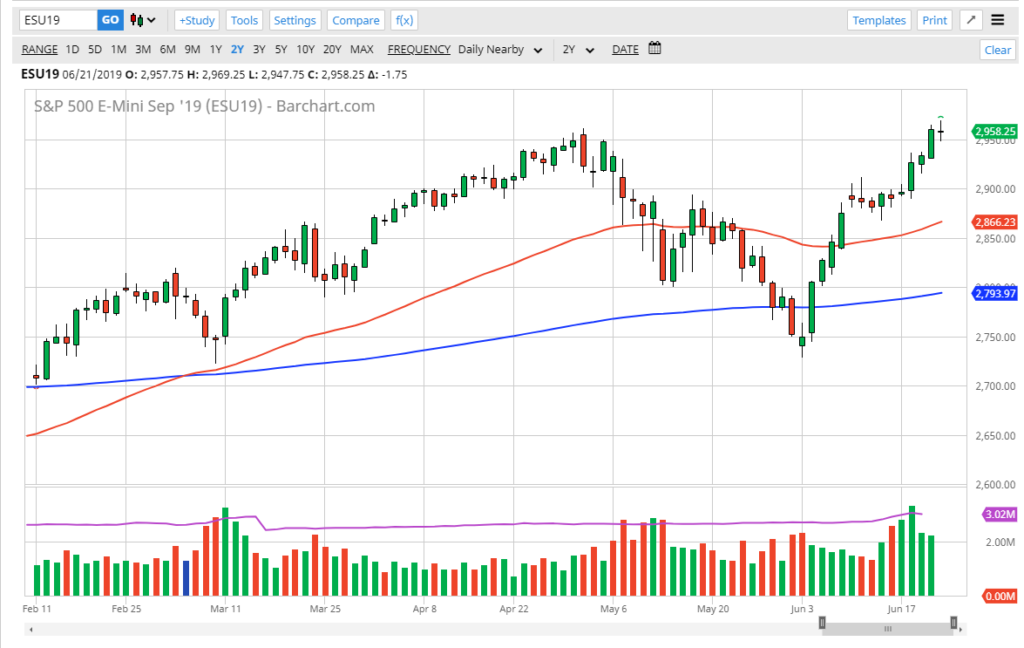

All-time highs

The market is at all-time highs, which of course is bullish. However, the action on Friday was less than desirable. With that being the case, if we break down below the bottom of the candle stick it could send in a fresh new group of selling pressure, perhaps sending the market down to the 2900 level. That’s a level that should be massive support, and quite frankly the market has gotten a bit ahead of itself. Yes, the Federal Reserve is willing to step in and bail Wall Street out at the first hint of trouble, but that doesn’t mean that the underlying economy merits this type of strength. The 50 day EMA is below the 2900 level, so it’s very likely that we will see buyers sooner or later on a drug. That being said, the drop could be rather drastic and extreme, so be aware of that.

S&P 500 E Mini

US dollar

The US dollar continues to be softened by the Federal Reserve, and bonds sold off drastically. That being the case, it does favor higher stocks over the longer-term but again, we could get a bit of retrenchment which makes quite a bit of sense. If we were to break down below the 2880 area, I think at that point you have to start to question whether the 50 day EMA will hold. If it doesn’t, then we could really start to fall apart.

Gold breaks out and other concerns

Something that is a bit counterintuitive is the fact that gold is breaking out, which tends to mean that we are looking for safety, which you won’t find in the stock market. Another thing that is a bit difficult to be excited about is the fact that utilities and healthcare stocks are among the leaders. Those don’t exactly install confidence in a vibrant and growing economy.

The play going forward

At this point, the play going forward is to simply look for value and take advantage of it when it occurs. As long as we have weak monetary policy in the United States, it’s very likely that traders will continue to pick up assets in general. However, we are in a very difficult environment as we worry about Iran, China, and God knows what else at this point. If you are involved in this marketplace, the one thing that you need to do is keep your position size small and get out at the first signs of trouble. That doesn’t mean that you should be short of the market, just simply that you should be skeptical of it at these high levels. That being said, the momentum longer-term is certainly on the upside.