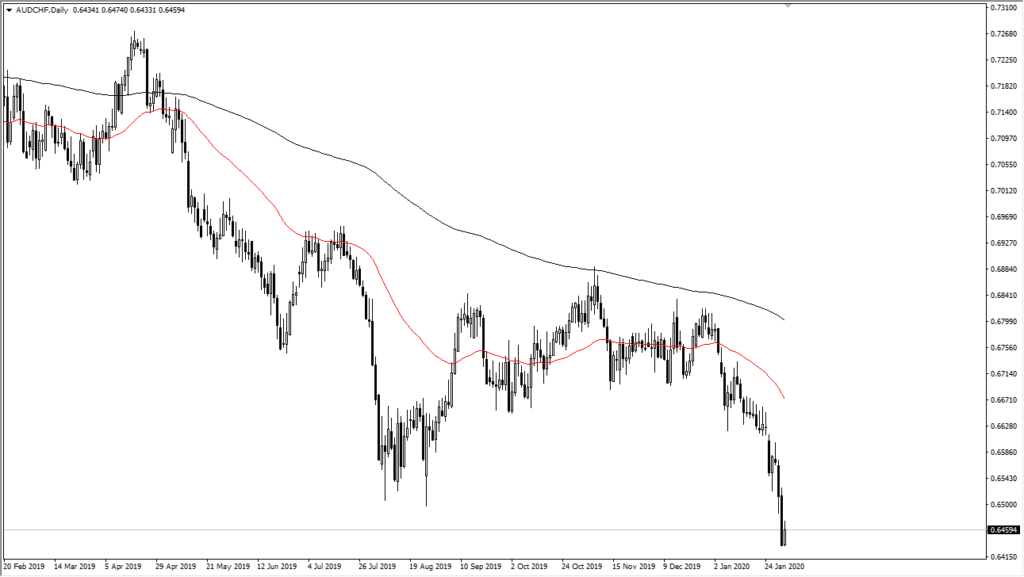

Aussie Dollar Recovers Slightly Against the Franc

- Longer-term downtrend intact

- Coronavirus impacts the AUD

- AUD/CHF market just below major handle

- Pair favors Switzerland as far from outbreak source

The Australian dollar has bounced during the trading session on Monday to kick off the week. This could well come from the currency becoming slightly oversold.

There is still plenty of fear when it comes to Asia. Such fears affect the Australian markets because the country’s economy is highly sensitive to everything Asia related. After all, most of the exports coming out of Australia go directly into China. Concerns relating to the coronavirus outbreak are clearly working against the Australian economy.

Technical analysis looking dark

AUD/CHF yearly chart

The technical analysis for this pair has been very dark for quite some time. The coronavirus in China has seen a lot of the factories close due to concerns about the outbreak. If this continues to worsen, demand for raw materials coming out of Australia will fall, and monetary flow will be affected.

The 50-day EMA is turning lower, and sharply so. The market has recently broken down below the 0.65 handle, which will be thought of as a large, round, psychologically significant number. The fact that the market has sliced through that level suggests there is further to go to the downside.

One of the reasons that this pair is so fascinating is that the Swiss franc is a safety currency, while the Australian dollar is so highly tied to a region that has major concerns over the coronavirus. It makes a considerable amount of sense that this pair favors Switzerland, being far away from the source of the outbreak.

Time to step in and sell rallies

The play going forward is to step in and sell rallies as they occur. The first major resistance area will be the psychologically important 0.65 handle, as the market does tend to be attracted to these big figures.

Beyond that, there is a gap near the 0.66 level that should show resistance, as well as the 50-day EMA. To the downside, the market will more than likely be attracted to the 0.6250 level and then the 0.60 level, as it is a target on longer-term charts.

As fear enters the market, it’s very likely that this pair will continue to grind lower. The question now is whether or not fear will abate.

The coronavirus epidemic still has far to go. The downtrend should continue, and anyone stepping in to buy this pair right now is probably going to struggle to make profits.