Australian dollar continues to grind higher

The Australian dollar rallied again during trading on Wednesday, as we continue to grind to the upside. At this point in time it looks as if the Aussie is trying to continue a trend change overall, as we have been basing for some time. Ultimately, this is a market that will probably go higher but we have a lot of things to think about in the meantime that will make this a somewhat difficult to trade to hang onto.

Technical set up

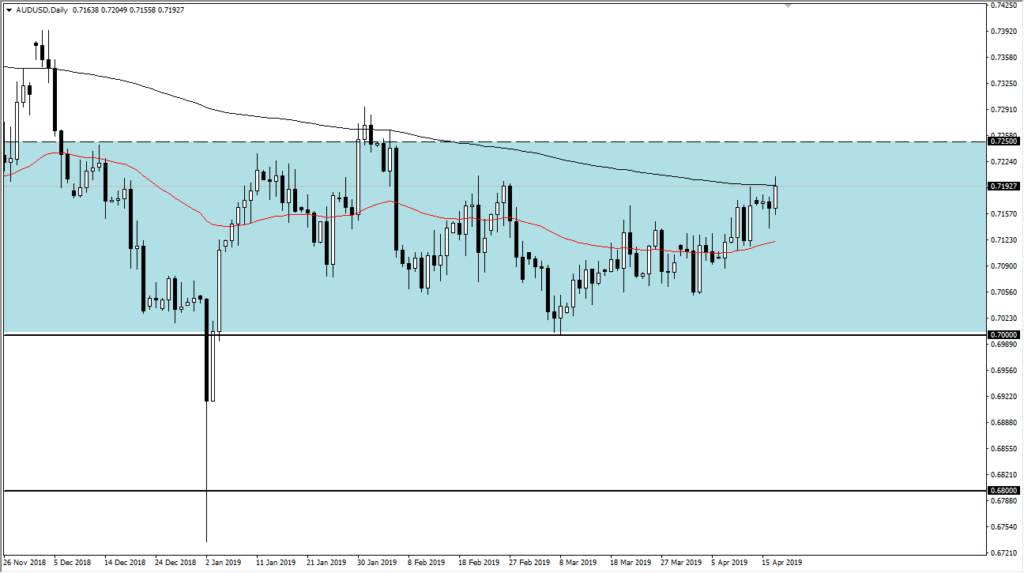

The technical set up has been relatively simple to identify, as we have a massive support level at the 0.70 level that shows itself as high as the monthly timeframe. Ultimately, the market looks very likely to continue to find buyers underneath, and I do believe that there will be a lot of value hunters out there. However, we are pressing up against the 200 day EMA which will of course attract a lot of longer-term traders. If that’s going to be the case, then I would anticipate that we will have a certain amount of difficulty going forward so therefore you will need to be very patient.

Below we have the 50 day EMA pictured in red, which is offering support as of late. It’s also turning higher which of course is a very bullish sign and therefore I suspect that a lot of traders are starting to take notice. To the upside, the 0.7250 level will be massive resistance, as it has been more than once. A break above there could open the door to the 0.75 level though, which is even more important on longer-term charts. At that point, it’s very likely that a break out above there would signaled the longer-term trend change for everyone, and it would be very likely to bring in a fresh flood of new orders.

Beyond all of that, it looks like we are forming a bit of a “rounded bottom”, which takes a long time to shake out, so patients will be the keyword to pay attention to when it comes to the Aussie dollar overall. Gold falling certainly won’t help, but this will all be about a completely different set of circumstances in the market.

AUD/USD chart

Fundamental set up

Obviously, you need to pay attention to the fundamental set up for a market, and right now the most important thing is that the United States and China continue to have issues. If they ever solve that situation as far as trade is concerned, it’s very likely that the Australian dollar will rally significantly as it is a proxy for the Chinese economy, and of course the Australians provide so much of the raw materials for the Chinese economic engine.

On the other side of the equation we have the Federal Reserve looking very dovish, and more than likely that won’t change. While the RBA has been a bit soft as well, the reality is that the Federal Reserve will move this much further.

Going forward

Going forward it looks like it’s going to be more of the same: finding value at short-term dips and signs of support should be a nice buying opportunity, and selling the Australian dollar is going to be very difficult for anything more than just a small scalp.