Australian dollar grinding higher against Kiwi dollar

The Australian dollar tends to move in a choppy manner against its cousin the Kiwi dollar. This is because the two economies are so heavily intertwined, and they both of course are commodity currencies, which all tend to move either higher or lower based upon risk appetite. Because of this, the AUD/NZD pair tends to be more of a longer-term situation.

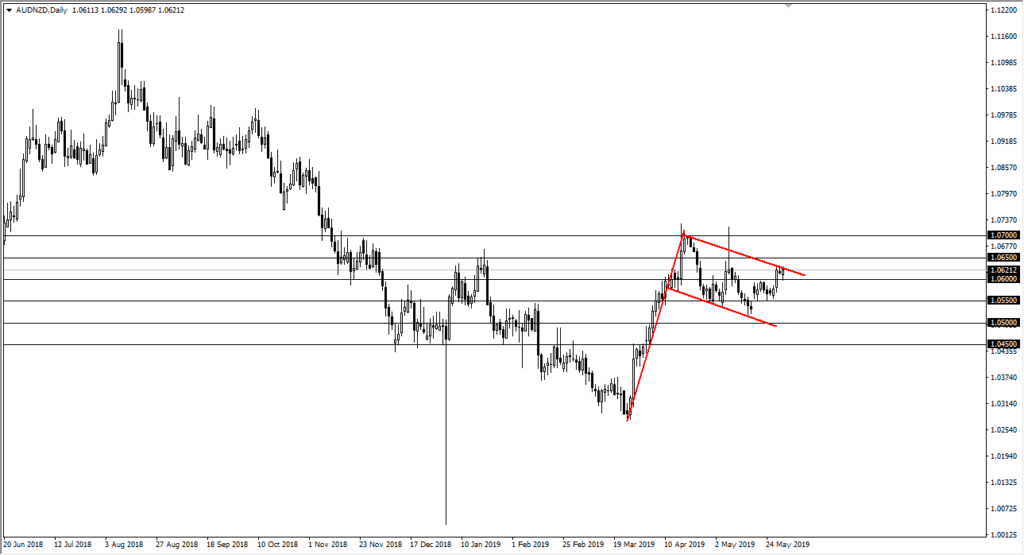

Bullish flag? Potential “W pattern?”

AUD/NZD

When I look at this chart, you can see that I have a bullish flag marked. This is because out of the two economies, the Australian economy is probably “safer”, and therefore it makes sense that the Aussie would continue to grind higher in the economic conditions that we find the markets dealing with right now. After all, the US/China trade war continues to cause major issues, and of course works against the Australians but it also works against risk appetite in general. With that in mind, one would have to think that a smaller economy like New Zealand would be hit especially hard.

As you can see on the chart, the bullish flag is quite substantial, and could lead to roughly 6 handles higher, giving me a target of about 1.12. This isn’t a currency pair that tends to move very quickly, so this becomes a longer-term trade. If you look at the flag, you can also make out a bit of a W pattern, so that could also be the next signal, perhaps sending this market to 1.0850 above. Either way, this looks like a bullish market and therefore it’s probably only a matter of time before we break higher. While I do recognize that the 1.07 level has been massive resistance, and that there is a little bit of a candlestick wick outside of the flag, no matter how you slice this chart it looks bullish.

Gold

Remember that the Australian dollar also is affected by the price of gold, and as gold has seen the lot of bullish pressure of the last several sessions. That makes sense that it would continue to drag the Aussie dollar right along with it. As long as gold seems reasonably strong, it makes sense that the Australian dollar will outperform the Kiwi dollar which is much more agriculturally based.

The main take away

While the rest the world is paying attention to the Euro or the British pound, this is a pair that is going to be much more stable. Even when we surged higher to form the pole of the flag, you can see how steady the market had moved. We now look set to go higher again, even though we have been grinding somewhat lower over the last couple of weeks. This is a classic flag from what I see, and even if you don’t believe in that, the “W pattern” signifies higher pricing as well.

Looking at the chart you can see that every 50 pips there is a certain amount of support and resistance that knocks the market around. With that in mind, watch those levels but certainly you should be looking to buy dips going forward.