Australian dollar in focus ahead of G 20

The Australian dollar of course will be in focus ahead of the G 20 meeting this weekend, as the biggest headline coming out of that meeting will be whatever happens between the United States and China. After all, they are in the middle of the trade war and this directly influences the rest of the world. The Australian dollar is extraordinarily sensitive to the situation as Australia provides so much of the hard materials that China uses for its economic engine.

Major confluence of resistance

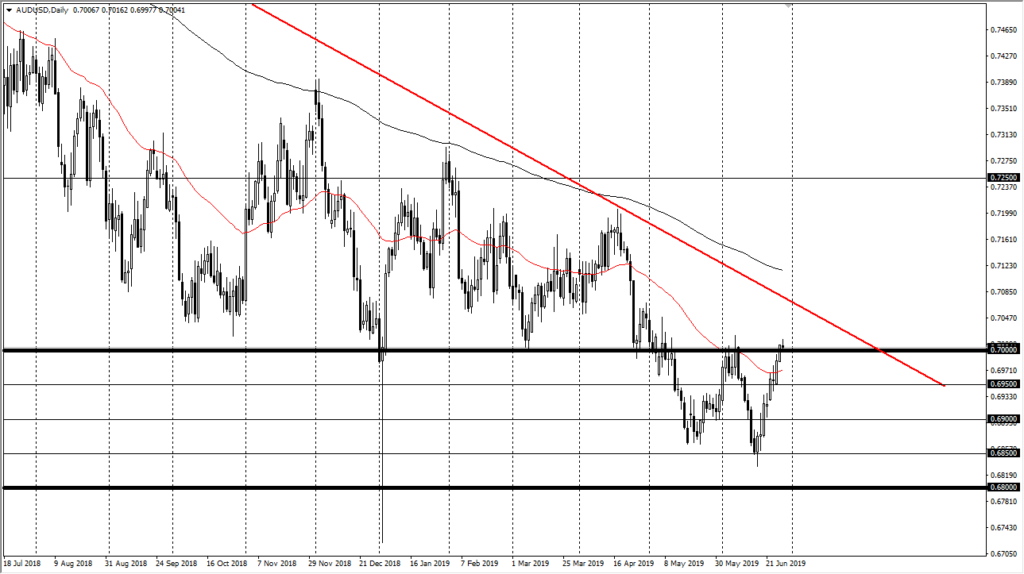

AUD/USD Chart

looking at the chart, you can see that the 0.70 level is an area that has been resistance several times in the past, and we are starting to rollover little bit during trading on Friday. I suspect that there will probably be a lot of people trying to cover any type of risk going into that situation, because it of course will make itself known on Sunday, and there won’t be any way to react to it. That being said, if we break out to the upside that would be a major turn of events.

I would define resistance being shattered on a daily close above the 0.7060 level, an area that has caused a bit of trouble in the past anyway. Ultimately, the charts will continue to look very consolidated, unless of course we get a shock coming out of Osaka.

Federal Reserve

One of the main drivers of the Australian dollar rallying over the last couple of weeks has been the Federal Reserve, which has come out and suggested that they were going to be cutting rates. However, we also know that the RBA is going to be cutting rates in the short term, so I think at this point although the Federal Reserve is going to continue to cut, the reality is that with both central banks looking to do the same thing we look for external factors such as the US/China trade situation.

The main take away

One of the biggest things that stands out on this chart is that we did make a “lower low” recently, so we are still very much in a downtrend although you can also argue that we are in the midst of trying to break out of it. If we can break above the 0.7060 level on a daily close, then it’s very likely that we will go much higher. However, to expect good news out of Japan over the weekend is probably being a bit optimistic, because quite frankly the rhetoric going into the conversation this weekend has been somewhat more of the same, meaning that I’m not expecting much in the way of a change.

If that’s going to be the case, the market is going to continue to be very erratic, and I suspect stay within the range that is marked on the chart. However, all things will make themselves much more clear when the Asian session opens up, because we may or may not get a massive gap. At that point it’s only a matter of following the market.