Bitcoin showing signs of going higher?

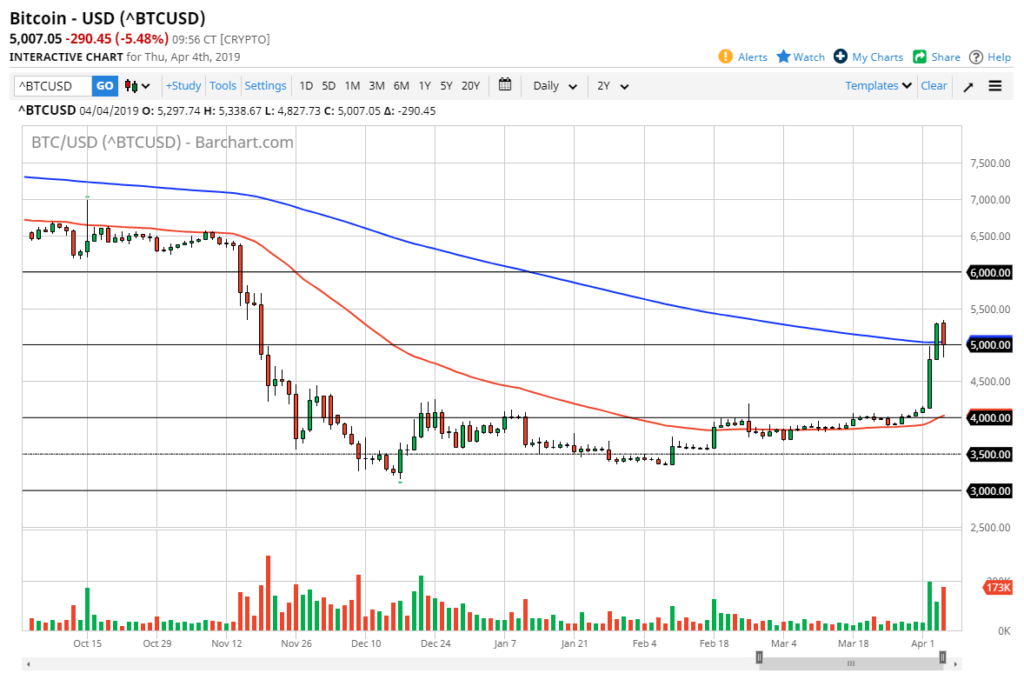

Bitcoin markets broke down a bit during the trading session on Thursday, slicing through the $5000 level. However, we turned around to show signs of life again and it now looks very likely to continue to be a market that will shake a lot of traders out. However, doing a little bit of volume analysis can help.

Volume

When it comes to retail trading, volume suddenly becomes very important. Bitcoin is most certainly a retail driven market as although the larger funds had shown interest in the crypto currency market, the reality is that most of this trading is done by smaller individual trader’s. When you see volume jump like it does, you have to think that there is a bit of life to this move. Over the last couple of sessions we have seen nice volume based upon what had been normal, so it’s obvious that something has changed as far as attitude is concerned.

Moving averages

When I look at the moving averages, the 50 day moving average which is red on the chart is down at the $4000 level. It is starting to turn higher though, and that is a very bullish sign. Ultimately, we had exploded to the upside from there and I think it could be a bit of a dynamic “floor in the market.” Obviously, that’s $1000 lower than we are currently trading, but it is what it is.

The other moving average, the 200 day EMA is sitting just below the recent trading. It sits at roughly $5000, and longer-term traders will of course pay quite a bit of attention to this number as it is considered to be a longer-term trend following moving average. The fact that the $5000 level is right there makes a lot of difference as well, as it is a large, round, psychologically significant figure.

Bitcoin daily

Price action

You should pay quite a bit of attention to the price action that we have seen, as we have had a couple of explosive and high-volume trading days straight up. What’s even more impressive is that the Thursday session broke down below the 200 day EMA only to turn back around as buyers jumped in. This tells me that Bitcoin is getting more of a bid, and therefore I think it’s very likely that the market will trying to continue to go higher. That doesn’t mean that it’s going to happen immediately, but it certainly looks as if we are trying to push towards the upside, with an eye on the $6000 handle.

For a while, we had consolidated sideways between the $3250 level and the $4250 level. That now looks as if it was a bit of a base building exercise, and perhaps an attempt to change the trend. These are often messy affairs, but the reality is that when you see a move like this after an intense stabilization in a market that had melted down the way Bitcoin has, you would have to think it truly means something.