British pound continues to sit at low levels against Japanese yen

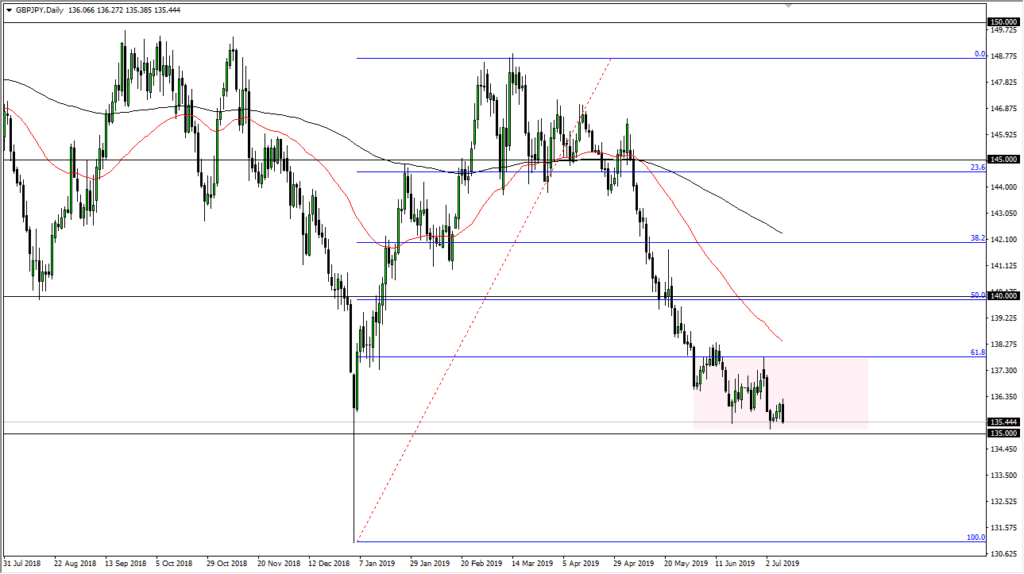

The British pound continues to selloff against the Japanese yen, perhaps in a bit of a “risk off” move, but at this point the most important thing to pay attention to is that we are in fact in a downtrend but pressing the round figure of ¥135. If this level gives way, that could send this market much lower.

Major support level

The British pound has fallen quite a bit during the day on Monday, breaking the back of the hammer like candle from the Monday session. This of course is a negative sign but quite frankly the ¥135 level is the real prize for the bears. If we were to break down the support level, the market could fall towards the 100% Fibonacci retracement level, somewhere closer to the ¥131.50 level underneath. That would be a complete wipeout of the entire rally.

GBP/JPY chart

Risk appetite and the Brexit

The biggest thing that drives this pair most of the time is risk appetite, meaning whether or not people are looking to find higher interest rates, or if they are looking for something to the effect of safety. The Japanese yen is considered to be one of the safest currencies out there, so obviously if we do get some type of major selloff when it comes to risk appetite, the Japanese yen will probably be bought, driving this pair off. On the other hand, people may be looking to pick up “cheap pounds” at these levels, thereby putting in a bit of a bottom in this area, or at least a momentary bottom. If we do get a bounce, then the market could go to the ¥138 level above.

Beyond all of that though we have problems with the Brexit, which up to this point has been “as clear as mud.” One feels that it’s only a matter of time before some type of headline crosses the wires that causes concern, so this is why I think rallies at this point are more than likely going to be sold off, so although we could get the move towards the ¥138 level, the reality is that a lot of traders will be looking for signs of exhaustion in which to sell into.

The play going forward

The play going forward is one of two scenarios: a break down below the ¥135 level on a daily close would be a signal to start selling again, and perhaps aiming down to the ¥131.50 level. Alternately, if we do get some type of bounce at this point, I would more than likely step away from the market and wait until the 50 day EMA which is in red on the chart catches up with the ¥138 level. If that happens, then it’s very likely any signs of exhaustion will bring in fresh selling and could be a nice entry. Even if we are trying to build some type of base in this general vicinity, it will take quite a bit of time to turn things around.