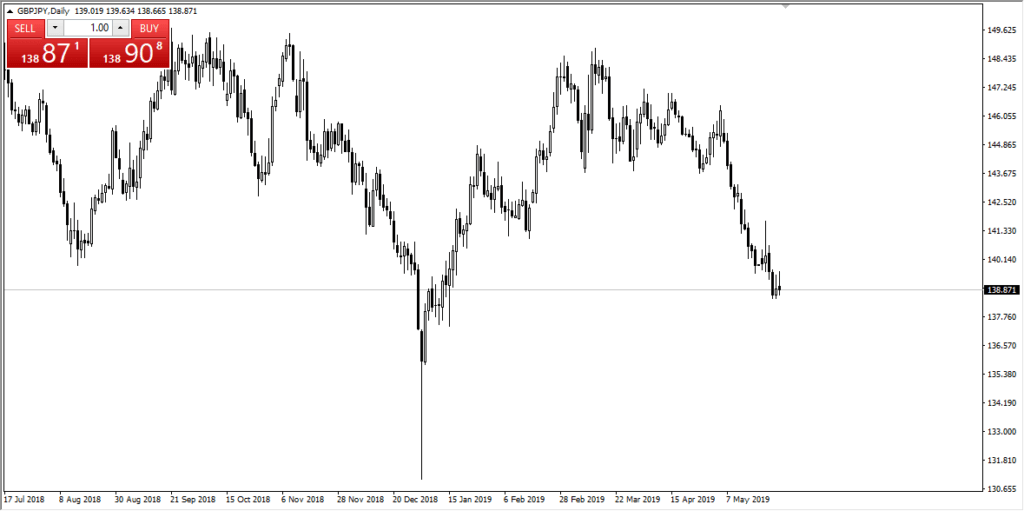

British pound finding support against Japanese yen after massive selloff

The British pound fell hard during the early part of the trading session on Thursday but reached a crucial support level and it does in fact look like the buyers are starting to come back into play. Because of this, it’s very interesting to see how this plays out. As we head into the US/China trade talks, there is going to be a lot of concern and fear out there, which of course will have massive influence on what happens with this pair as it is so wrist sensitive.

The support level

The support level that I’m talking about of course is the ¥142.50 level. This is an area that has been important more than once, and of course the scene of a previous gap. We fill that gap during the trading session on Thursday, but then turned around to show signs of life later in the day. The question now is whether or not we can hold this area but certainly it looks very likely as a candidate for buyers to come in and at least try to cause a significant bounce. Needless to say, I think that the entire world is watching this area as it is so important.

Another support level

Another thing that could come into play as the support level below at the 140 young level. If we break down below the ¥142 level, then it is very likely we will go and visit that area. Ultimately, this is a market that I think will continue to be very volatile, and of course sensitive to the headlines out there when it comes to the trade war negotiations and all things risk related. The opportunity for financial loss is going to be great in this environment, so by all means you should keep your position size extraordinarily low. Longer-term, I believe that the market will eventually find buyers mainly because the British pound is historically cheap.

GBP/JPY

Let’s not forget the Brexit

The Brexit of course continues to be a major problem with the British pound and all things related to it. As long as that’s going to be the case, it’s very likely that we continue to see volatility there as well. However, we have calm down a bit when it comes to that situation as there has been a delay in the Brexit. However, one can only assume that it’s only a matter of time before we get some headline that throws the markets into a tizzy again.

Be cautious with this pair, but we are starting to see the first vestiges of buyers coming back into the market. Overall, we are going to need to see some type of Brexit-based catalyst as far as good news is concerned in order to break above the ¥145 level, but it does look like longer-term traders are starting to accumulate the British pound, at least tentatively in this area. I would necessarily be a seller at this point, but I would be a buyer either at the ¥142.50 level or perhaps even the ¥140 level.