British pound finds support against Yen

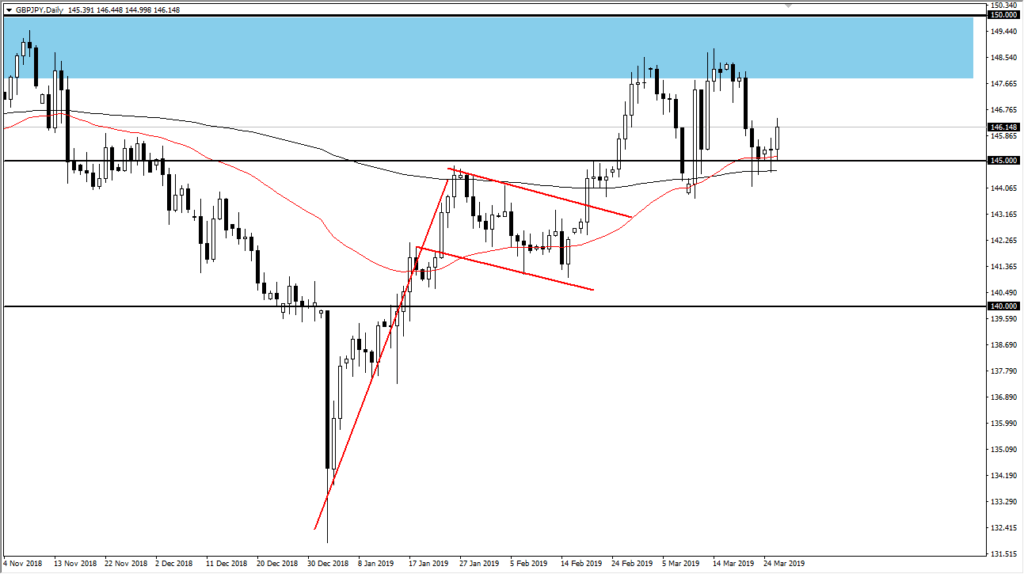

The British pound initially pulled back a bit during trading on Tuesday but found support at the vital ¥145 level. This is an area that of course will attract a lot of attention as it is a large, round, psychologically significant number.

Technical factors

Looking at the chart, there are a lot of reasons to think that this area is going to be very crucial. For example, I’ve already mentioned the ¥145 level, which of course attracts a lot of attention due to the fact that it is such a large, round, psychologically significant figure. However, there is also the 50 day EMA, pictured in red on my chart, that sits right at the ¥145 level.

Beyond that we also have the 200 day EMA that sits underneath the hammer that formed during the trading session on Monday. This shows that we are more than likely going to continue to find buyers at these lower levels, but not only that we have plenty of structural action there as well. It appears that we will probably go looking towards the highs from a handful of sessions ago, near the ¥148.50 level.

After all of that, you can scan lower and see that there is a major bullish flag that has broken to the upside. That of course is a very bullish sign, and in fact shows significant moves to the upside very possible. The “pole” of the flag measures for a move to the ¥155 level, which of course is quite a distance from here.

GBP/JPY daily

One way bet?

Looking at the chart, you can make an argument for a “one way bet”, that has recently kicked off. Remember that this market is very highly sensitive to risk appetite overall so you will have to pay attention to other markets also. The stock market is a good proxy for risk appetite, so if it goes higher it’s likely that this pair will as well as the Japanese yen is considered to be one of the ultimate “safety currencies.” Beyond that, the British pound of course has a lot moving it as well.

And then there is the Brexit

The Brexit of course will continue to be a major issue, as we have headlines coming out back and forth across several days. There are a lot of machines trading this market based upon reading headlines, so keep in mind that it’s very likely that we will continue to see massive volatility. It’s with that that we find ourselves needing to take smaller positions. However, that doesn’t mean that the market doesn’t “lean” in one direction, in this case higher.

The next hurdle

The next hurdle is just above at the ¥150 level, an area that will of course attract a lot of attention as it is a large come around, psychologically significant figure. I think at this point it’s very likely that we will continue down pullbacks in order to build up enough momentum to finally break to the upside. After all, it is a very important level, but eventually it will give way based upon all of the upward pressure that we have seen. Pullbacks are thought of as buying opportunities, with the massive support extending down to the ¥144 level. Once we break the ¥150 level, it opens the door to that previously mentioned ¥155 level.