British Pound Likely to Break Below 1.20

- No end in sight for British weakness

- Rumors of snap election

- Technical level being retested

- No good news for Sterling

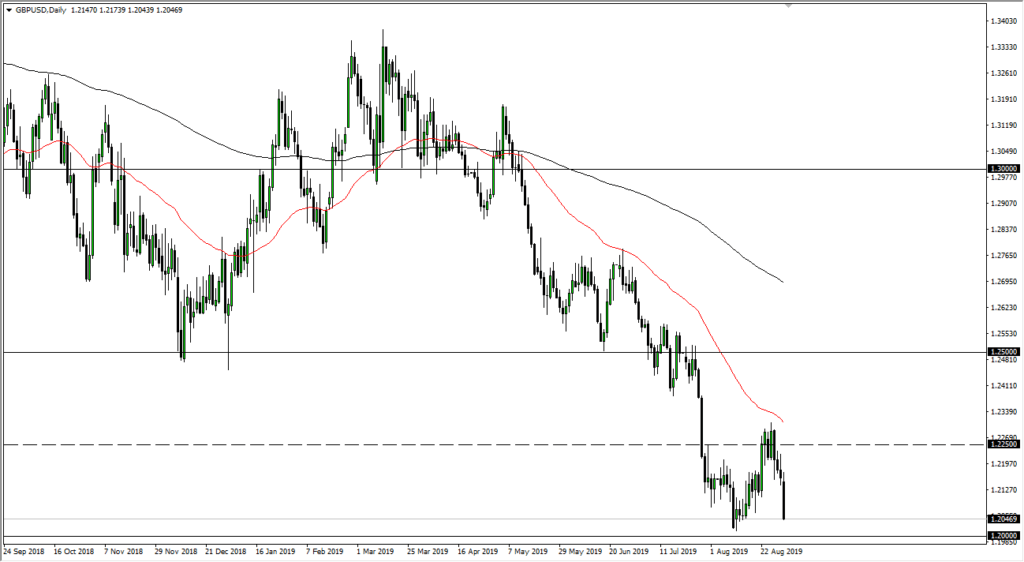

Looking at the British pound, it is clear that it continues to struggle on Monday trading. At this point, it looks as if the markets will test the 1.20 GBP level, an area that caused a significant bounce previously. At this level, we have seen a significant bounce and there should be a reasonable amount of support just waiting to happen. It is because of this that a break down below there could really open up the “floodgates” when it comes to the downward pressure.

Continued Brexit drama

The Brexit drama never seems to end. At this point in time, it is highly likely that the British pound will continue to suffer at the hands of politicians that cannot seem to get it together. There are now rumors in Westminster that Tories are looking to perhaps oust Boris Johnson in the hope of saving some type of deal with the European Union. At the same time, he is talking about a potential snap election if that happens.

In other words, we have more drama and fewer facts when it comes to the British pound. Traders despise uncertainty, and will therefore run away from the currency.

Technical levels

GBP/USD Daily Chart

The technical level you should be paying attention to is the 1.20 level. If we can get an hourly close below that level, it’s very possible that we will unwind down to some historical support levels in the pair at the 1.18 handle and that of the 1.15 level. It is likely to reach the 1.15 level given enough time, although it will obviously be very noisy between here and there. There will still be leading headlines out there that can have an impact, so at this point it is probably best to look at short-term rallies as opportunities to sell again.

To the upside, if we were to break above the 1.2250 level again, it could show a bottoming pattern that longer-term traders may pay attention to. At this point, however, it seems unlikely, unless there is some type of major change in the way that the British are dealing with themselves and with the European Union. A massive “flush lower” may eventually occur, and that could be the bottom. We have simply not seen that capitulation sell-off that a lot of longer-term traders wait for.

The trade going forward

The trade going forward is to simply sell this market every time it rallies about 50 pips or so. It’s not recommended to put huge positions on, but it will get more aggressive below the 1.20 level, as it would be a major support breach. It is a psychologically important figure as well. Ultimately, this is a market that seems destined to break down. But in the meantime, it will still rattle the nerves of both buyers and sellers.