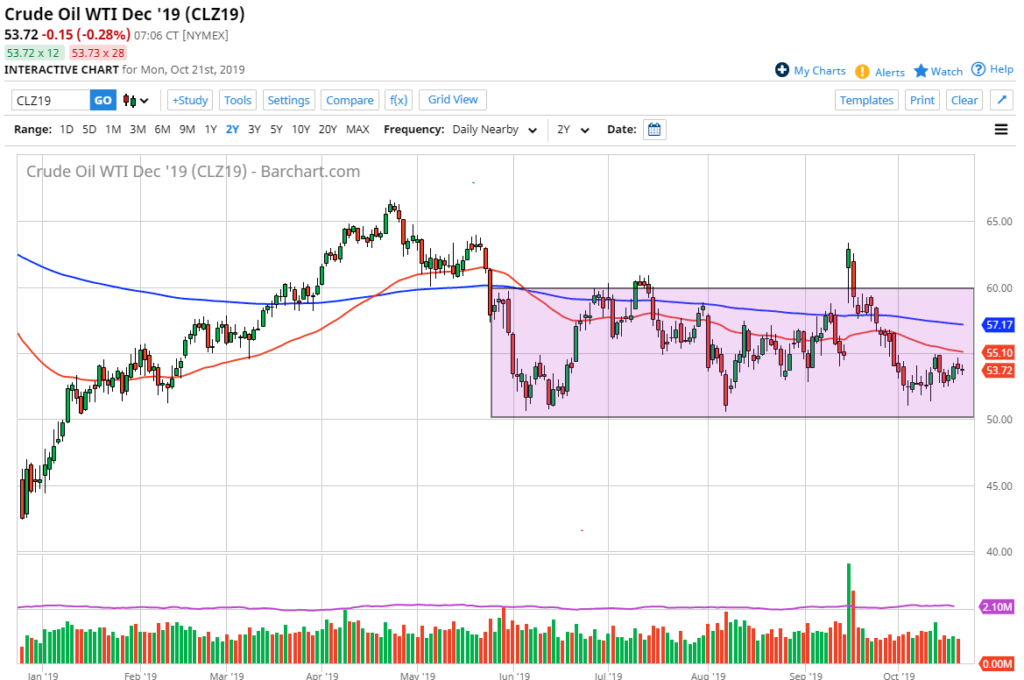

Crude Oil Continues to Build Base

- WTI continues consolidation

- $50 extraordinarily important

- Moving averages just above

The crude oil markets continue to be relatively choppy during the week, as the $50 level underneath keeps offering quite a bit of psychological and structural support. Ultimately, this is a market that should continue to see a lot of interest just below because the $50 level is historically important. This, of course, will attract a lot of headlines. There are a lot of fundamental factors out there as well that are pushing and pulling the crude oil markets back and forth.

There is still a significant amount of tension in the Middle East, and with the Iranian refinery catching fire at the weekend, there is the suspicion that perhaps the Saudi Arabian government has retaliated.

Technical analysis

The technical analysis continues to be somewhat consolidated, mainly because the 50-day EMA is sitting just above the $55 level – which, of course, has its own importance to lend to the market. Pullbacks at this point should continue to find plenty of support underneath. It should be pointed out that the shorter-term charts have shown a significant amount of buying pressure at the $51 level that extends down to the $50 level.

Looking at the chart, there has been a significant amount of resistance at the $60 level. Historically, oil markets do tend to move in $10 increments. With that being the case, it makes sense that perhaps traders will continue to look at this range to go back and forth, and there are also concerns about demand. When it comes to energy, global growth has been under serious pressure.

Crude Oil technical analysis

Range-bound systems

Range-bound systems will possibly continue to be employed in this market, with its borders being well defined. That doesn’t mean it won’t be noisy and choppy along the way. Looking at dips, though, there should be buying opportunities. There should also be selling opportunities above. With that said, the 50-day EMA being broken to the upside allows for the longer-term consolidation area to become more the norm. The $60 level should cause significant resistance, as it has in the past, based on “market memory”.

This should continue to be an active market. Intraday trading is probably best as well, with an eye on the larger level. Ultimately, there is something of a limit as to how high the oil markets can go due to the economic slowdowns around the world. However, with the tension underneath the surface in the Middle East, there is also always going to be the possibility of a sudden shot higher. Caution and small position sizing should lead the way.