Crude oil finding buyers

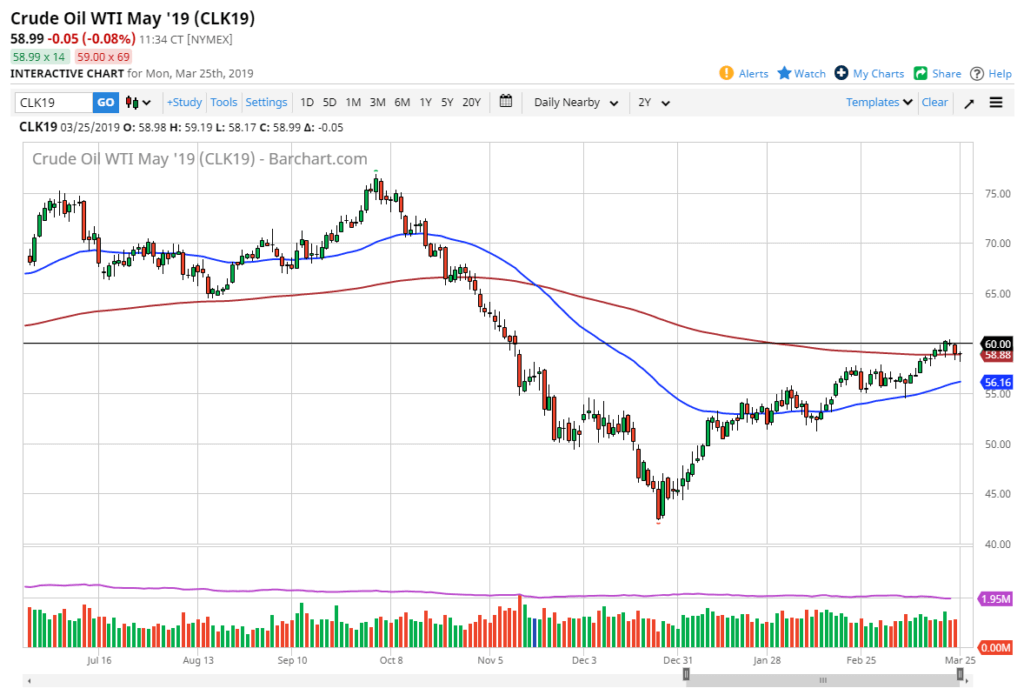

The West Texas Intermediate crude market initially fell to kick off the session on Monday but found enough buyers underneath the significant 200 day EMA to turn around and show signs of life again. By doing so, informing what looks like a hammer, it suggests that there are plenty of buyers underneath willing to pick this market up and perhaps break above the $60 handle.

At the $60 handle, we had previously seen a gap which of course attracts a lot of attention. It has recently been filled, and now it looks as if being able to break above the $60 level would confirm that we have not only filled the gap, but we are looking to go much higher. If that continues to be the case, then it’s very likely that we will see an opportunity for a larger move.

Oil chart

Potential targets

Looking at the charts, you can see that the market has respected the 200 day EMA again, which of course is a very bullish sign. If we can break higher, this will fire off several longer-term technical trades as well, perhaps sending this market much higher. At that point, it’s very likely that we will go looking towards the $65 level, perhaps even higher than that. Ultimately, this is a market that does see a lot of volatility but remember that there are a lot of different things going on at the same time.

Production cuts

Crude oil markets will continue to have a bit of a bullish bias to them, as OPEC has recently pushed back a meeting until June, and that being the case it’s likely that the production cuts will continue to push a little bit of bullish pressure in this market. Overall, the production cuts will continue to be a bit of an issue, but on the other side we have some other headwinds. For example, we are starting to see signs of a global slowdown and that would drive this market lower under normal circumstances, as it would suggest that industrial demand will drop.

Chinese stimulus of course can be a major influence as well, so we will have to see whether or not the man picks up in China. If it does, that by itself should drive crude oil markets higher. However, if it doesn’t work, that will be another reason to worry. Currently, it does look as if we have more buyers interested in this market than sellers and that is the most important thing. However, you need to pay attention to all of these moving pieces as a will most certainly have an effect on what happens overall.

The main take away

At this point it seems as if the buyers are willing to step in and pick up crude oil markets when they do it. That doesn’t mean that it will last forever, but at this point you have to assume that the market will continue to do what it has been doing simply until it doesn’t. A break to the upside seems easier than a break to the downside, but obviously we could get negative headwinds. If we break above $61, that should send fresh money into the market.