Crude oil markets continue to rally

Looking at the WTI Crude Oil markets, we continue to show strength as we reach towards the $63 level. This is a market that is highly sensitive to the economic conditions in the United States, and with the jobs number coming out on Friday, it suggests that things are going quite well. Beyond that, we have several other fundamental factors that can come into play.

OPEC production cuts

The members of OPEC don’t get back together until June, so having said that it’s almost impossible to imagine a scenario where production cuts get overturned between now and then. Even though Donald Trump has been jawboning OPEC lately, the reality is that it’s only a matter of noise at this point. That being said, the reality is that it would take some type of extraordinarily odd move for OPEC to suddenly increase production. However, if somebody like Saudi Arabia were to do that on their own, it would change everything.

As long as there are production cuts out there, people look to the future for the crude oil supply, and as that is the case, it’s very likely that the tightening supply is going to continue to weigh upon the minds of traders.

The technical set up

WTI Crude Oil

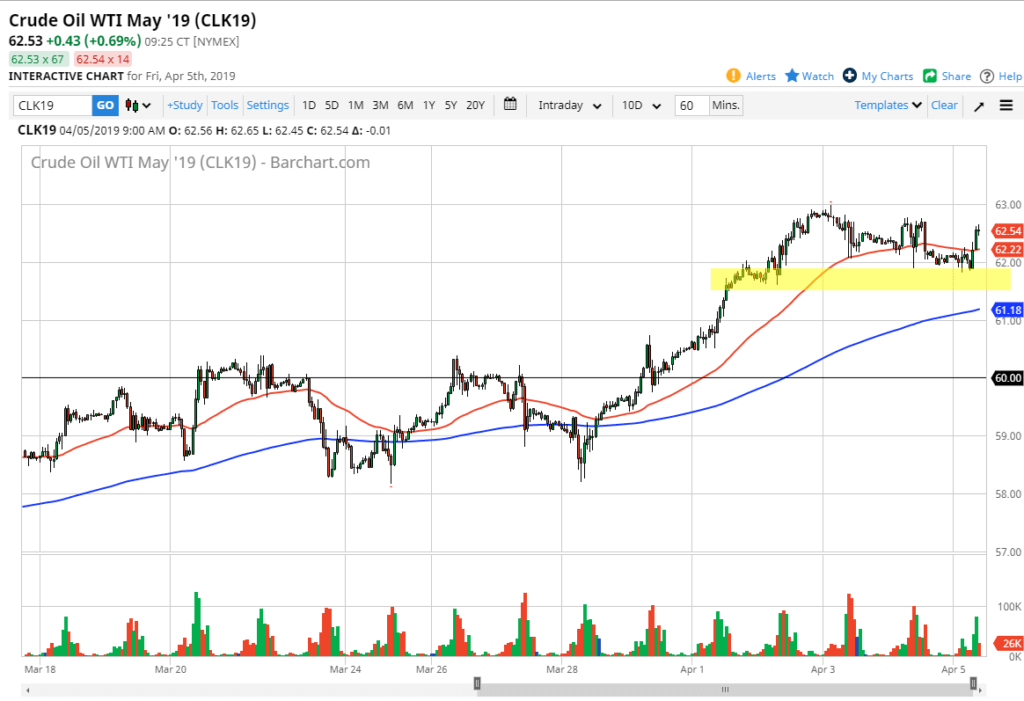

Looking at the chart, there are a couple technical factors that we should be paying attention to. The initial one of course is that the 50 day EMA is right in the middle of trading, which of course is an opportunity to trade right along with the algorithmic traders out there that pay so much attention to it.

Beyond that, there is a lot of support at the $62 level that we have seen during trading on Friday, and that should continue to be the case although breaking down below it isn’t necessarily an impossibility. There are other support levels underneath, down at the $61 level and of course the psychologically important $60 level which was so much resistance in the past and should now be supported. Beyond that, if we were to break above the $63 level that opens up the door to the $65 level above, which of course is a large, round, psychologically significant figure, and what the longer-term charts do suggest.

US dollar

You should pay attention to the US dollar, because if it starts to soften, that could “turbocharge” the crude oil market. The US dollar is overextended, so it would not be surprising at all to see something happen along those lines. A strengthening US dollar could be negative for crude oil, as we are at such an important level. At that point, traders may start to worry about the effect.

All things being equal though, we are currently trading around the 1.12 level against the Euro, one of the biggest proxies for US dollar strength or weakness. This is an area that has held quite nicely so we may be seeing the currency markets cooperate with the crude oil markets now.

In the end

In the end, I like buying crude oil on dips as it has shown so much proclivity to rally. There are multiple support levels underneath that should continue to keep the market somewhat afloat, and of course bullion. Shorting isn’t much of a thought at this point it just comes down to whether or not we will get value that we can take advantage of.