EOS gets hammered on Wednesday

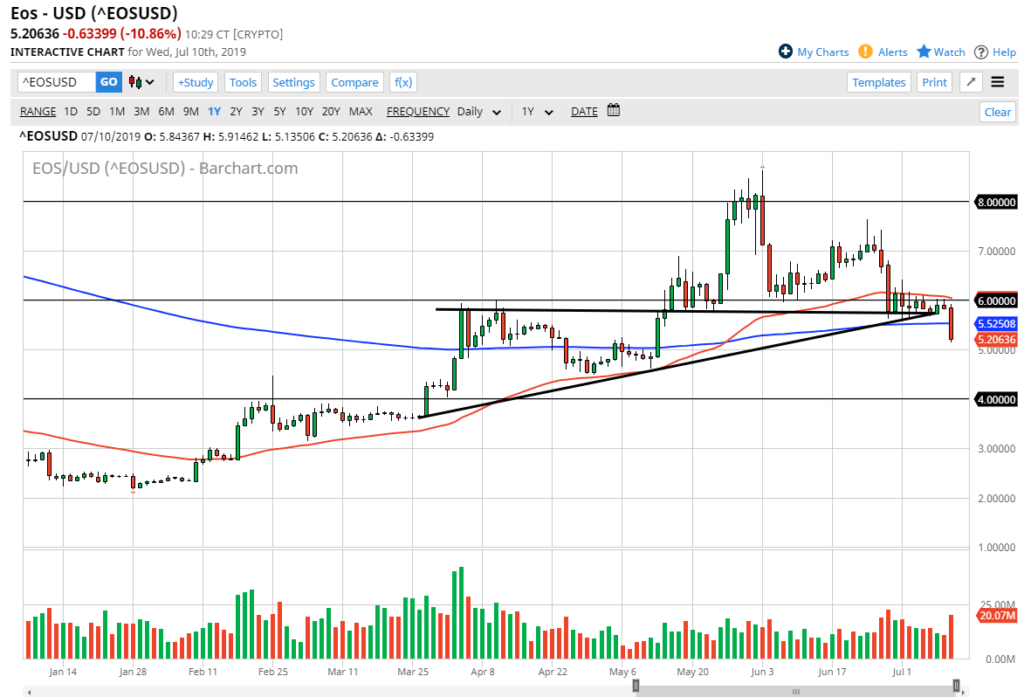

The EOS cryptocurrency got absolutely hammered on Wednesday, slicing through a major uptrend line. By doing so, it looks very negative, and it now appears that the trend is changing, at least in the short term. A major large and round figure has held as resistance after breaking below it, and therefore it’s likely that we will continue to see selling pressure.

Candlestick tells the story

EOS/USD

the candle stick for the session tells the story. It is very long, very red, and looks likely to close at the bottom. That of course shows intense selling, and it should also be noted that the volume was higher than usual. By breaking down the way it has, and slicing through the 200 day EMA, we could see quite a bit of follow-through at this point.

When candlesticks are long and show signs of volume, that of course should be thought of as a bit more important than many of the other ones. The $5 level is just below, and that of course could cause a bit of support. However, the trend line is extraordinarily bullish, and a break down through that is very negative to say the least.

Is the beginning of something bigger?

The question now is whether or not this is the start of something bigger. By breaking the trend line the way it has, EOS could get hammered even further. Ultimately, the Bitcoin market has formed a major shooting star, so that show signs of weakness. Remember, Bitcoin is highly influential when it comes to other crypto currencies, so if it’s starting to get exhausted, these other smaller coins will get absolutely crushed. I believe at this point; you should watch Bitcoin and see what it does next. If it is going to continue to show signs of exhaustion and pull back, EOS has no chance of standing on its own.

The play going forward

The play going forward is that selling EOS should work, at least for the short term. As long as Bitcoin looks exhaustive, the EOS market will more than likely get hammered further. At this point, breaking down below the $5.00 level opens the door to the $4.00 level underneath which I think is massive support. The trend line break of course tells me that the sellers have taken control, so looking at short-term trades is probably the best way to go. Every time this market rallies, at least until Bitcoin turns around, you should be looking to sell and pick up small bits and pieces of profit on the way down to the $4.00 level.

Remember, crypto markets tend to move in the same direction so as long as the major influence of Bitcoin is negative, these other smaller coins have almost no chance. It’s one of the great things about an immature market, it tends to all move in the same direction. Take advantage of that, before the institutional trader start to influence the markets longer-term. I do believe as long as we stay below the $6.00 level, we are very likely to go looking towards the $4.00 level.