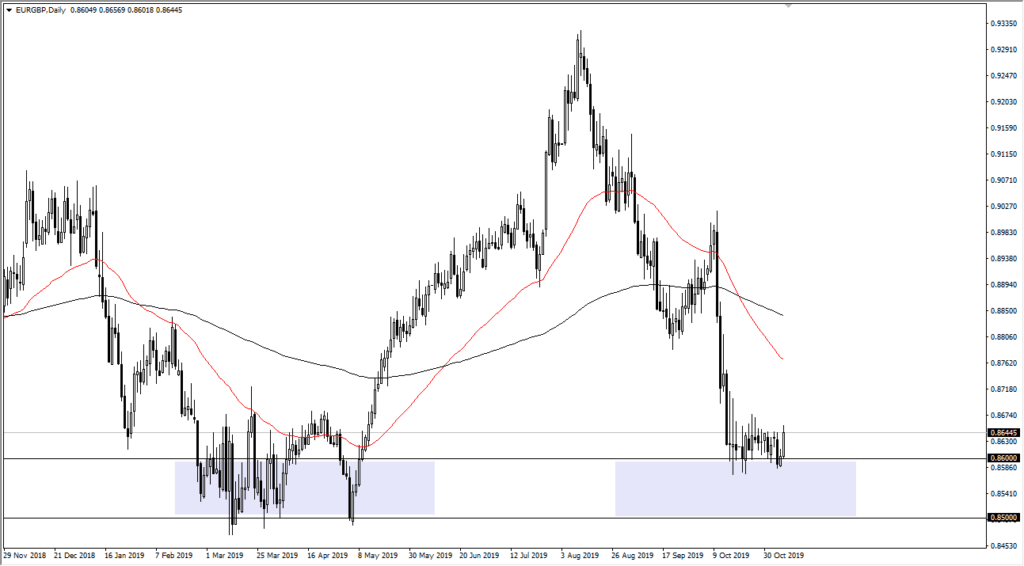

EUR/GBP Sitting at Major Support

- Major support level of 100 pips

- Large, round, psychologically significant figure

- Brexit noise

The EUR/GBP pair has been the center of the universe for the forex world lately, as Brexit has stolen all the headlines. As it features the two economies most directly affected by Brexit, it makes sense that traders will be paying attention to this market.

Because of this, the pair has been rather erratic for the last three years. However, it looks as if the market has found a comfortable place to sit still for a while and digest all of the potential headlines.

Technical analysis

EUR/GBP chart

The market is sitting just above the 0.86 level, which looks very much like a large support level that extends down to at least the psychologically important 0.85 handle. Beyond that, the 0.84 level underneath has also caused a bit of reaction on longer-term weekly time frame charts.

All things being equal, the situation with Brexit should remain relatively quiet until either elections or some type of breakthrough with negotiations come about. That can’t be said of the last three years.

At this point, it looks as if the market is simply willing to sit here and digest what has happened, trying to figure out which direction to go next.

Looking for 0.88 level

Ultimately, this is a market that will make a longer-term decision from this general vicinity, and therefore it’s worth paying attention to. On a bounce from current levels, it is very likely to go looking towards the 0.88 level, as it is an area that has caused significant buying and selling in the past.

If it were to break down, things could get a little bit more difficult. That’s mainly because it would represent a flush into the British pound. This is something that has been sold off relentlessly around the forex world over the last couple of years.

In the short term though, it looks as if the upside is probably a bit more likely than the downside. A short-term trade should be had if the market can clear the highs from last week near the 0.8675 level.

That being said, a move above 0.88 might be asking a bit much, mainly due to the fact that there will be little in the way of headlines to get the pair moving. Adding more fuel to the upside is the fact that the Bank of England had two members vote for a rate cut during the Thursday meeting.

While this doesn’t change monetary policy, it gives traders something to think about, as a couple of the voting members are starting to think about easing monetary policy. This has caused a slight adjustment to expectations, as one would expect. A cautious move higher is the most likely outcome over the next several sessions.