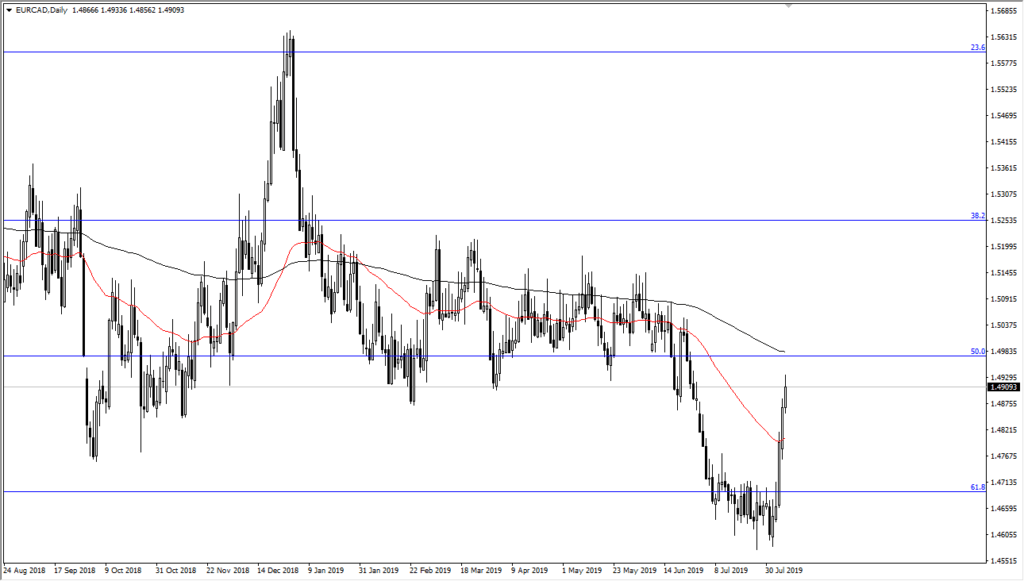

Euro approaching resistance against Canadian dollar

The Euro has been ripping to the upside against the Canadian dollar over the last several days, reaching towards the previous consolidation area. This has been an extraordinarily bullish sign, and although it has been impressive, the reality is that the market can’t go in one direction forever.

With that being said, there are several technical factors above that are going to press upon the viability of the move to the upside. This isn’t so much a reflection of the sudden Canadian dollar strength, but more than likely the market trying to approach a level that it has been comfortable with for some time.

Technical factors

There are quite a few technical factors in this general vicinity, so, therefore, it’s likely that we will get a bit of a pullback. The first thing that I see of course is the black 200 day EMA just above, which always attracts a certain amount of attention when a pair approaches it. Beyond that, it is close to the 1.50 level, which also has a significant function as it is a large, round, psychologically important figure.

At this point, you should notice that in the past we had seen the lot of consolidation in this region, so it does make sense that the market would slow down in this general vicinity anyway. Beyond that, we are starting to see the market pulled back just a little bit from this spike to the upside, and therefore it looks as if we could run into a bit of exhaustion anyway. Because of this, it’s very likely that we will continue to go a bit lower, simply because we are running into far too much potential selling pressure.

EUR/CAD Chart

Crude oil and central banks

The Canadian dollar is highly sensitive to crude oil prices, and we have seen the crude oil market get hammered during the last 24 hours again. This works against the Canadian dollar, so this is part of the reason why we have seen such a large spike to the upside. Beyond that, we have seen the Asian central banks shock the world with interest rate cuts.

The Royal Bank of New Zealand, Thailand, and Indian central banks all cut interest rates overnight. This, of course, has caused a lot of concerns when it comes to global growth, which of course is to suggest that there will be less demand for crude oil. This should make sense going forward, and if we are going to see global growth slow down, it makes sense that commodity currencies, especially ones related to crude oil, should continue to struggle.

Going forward

it’s very likely that we continue to see the Canadian dollar suffer, but it also makes sense that we get a bit of a pullback as we are overdone. The next couple of days will see a serious test of the 1.50 level, but that’s an area where you would expect to see a significant pullback, perhaps 200 pips. What’s the signal? If crude oil starts to bounce from the $51 level in the WTI contract.