Euro continues to flirt with falling apart

The Euro continues to flirt with major weakness, and perhaps a major break down after that. Ultimately, the Euro is being hammered by the fact that Germany is now considering the idea of stimulus. This of course would be a major turn of events and change in attitude of the “locomotive of the European Union”, which obviously most traders look at as the main reason to trade the Euro overall.

Interest rate differential

To get an idea of just how warped the economic situation is for traders to deal with, one simply has to look at the interest rate differential. For years, the US dollar was a major funding currency as the interest rates in the United States were extraordinarily low. Beyond that, we now have negative interest rates in the European Union, and that of course will have money flowing out of that area. I think at this point it’s obvious that the Euro is in serious trouble, especially considering that the ECB is looking to buy even more bonds.

Without the ability to play a higher interest rate differential for the Europeans, the Euro will continue to struggle longer term. Granted, the Federal Reserve is very likely to cut interest rates as well, but we are much further away from negative interest rates in the United States at this point, so there is still an advantage to owning US Treasuries over Bunds.

Technical analysis

EUR/USD

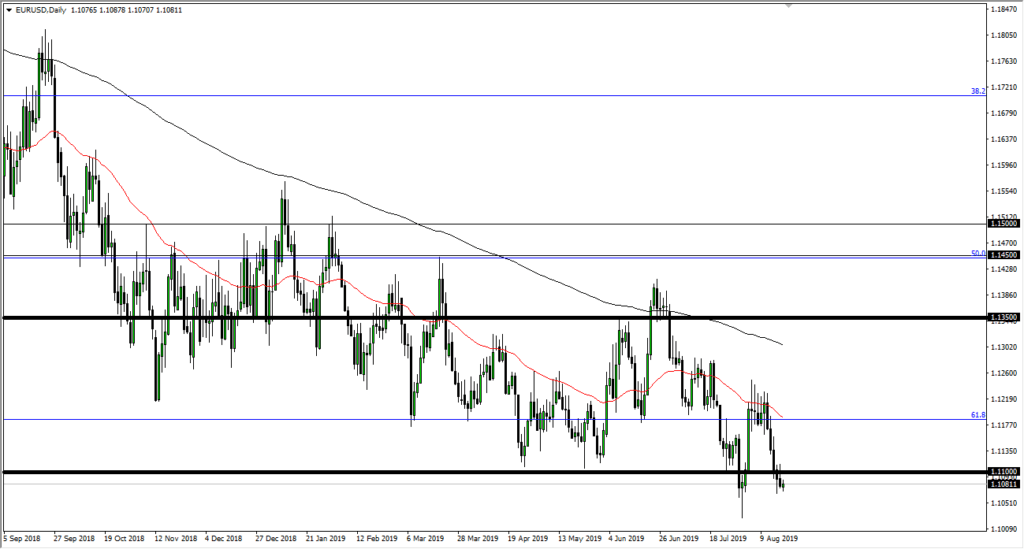

The technical analysis of course is very poor for this currency pair. We are currently below the 1.11 handle, which was an area that offers a lot of support. However, it’s not until we clear the 1.10 level underneath that the “all clear” is signal to short heavily. In the meantime, it looks as if the 50 day EMA which is pictured in red on the chart is going to offer quite a bit of resistance.

The 61.8% Fibonacci retracement level has been broken, retested, and now we are continue to go lower. At this point, the market is likely to continue to go towards the 100% Fibonacci retracement longer term, which means we could be falling as low as 1.05 EUR. There is nothing on this chart that looks bullish, but obviously we are getting at extreme lows so a short-term bounce could come, but I’ll be taken advantage of that.

The trade going forward

The trade going forward is quite simple: all be a seller of the Euro going forward. Yes, I recognize that we could rally a bit from here but I believe that the 50 day EMA will continue to offer a lot of resistance, and quite frankly every time we rally I look at it as the US dollar going “on sale.” Longer term, I fully anticipate that we will probably continue the downward momentum and eventually the Germans will acquiesce and start stimulating the economy, and that of course leads to an even weaker currency. The Euro also has to worry about the Brexit, so there’s nothing good coming out of that side of the world.