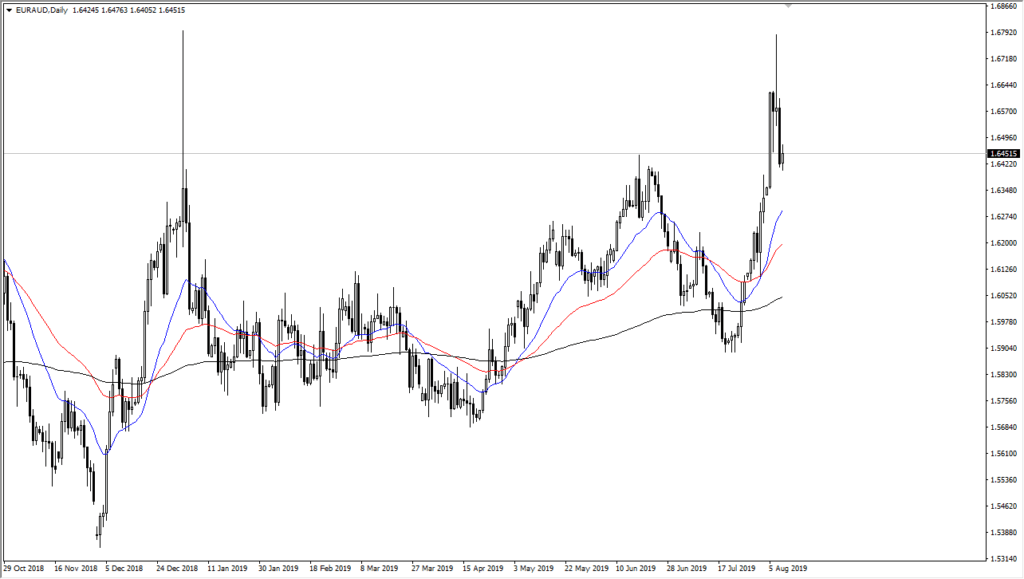

Euro overextended against Australian dollar

The Euro has recently been very strong against the Australian dollar and considering that the Australian economy is having a lot of trouble, mainly due to the US/China trade situation. With that, we have seen the Australian dollar get hammered against several currencies around the world. Obviously, the Euro has been no different against the Aussie, so it’s not a huge surprise to consider that we were reaching the 1.68 level during the week. Ultimately, this pullback has been rather strong, and while you are looking at the daily chart, you should also keep in mind that the weekly chart has formed a major shooting star. The shooting star of course is a negative candle stick, and we did form one on the daily chart as well, so this has a couple of reasons that are lining up to show the exhaustion.

That being said, we are still in and uptrend

EUR/AUD

Please keep in mind that although we are showing signs of exhaustion, and could very well continue to drop from here, the reality is that we are in and uptrend for many good reasons. Because of this, I think that the Australian dollar will eventually soften against currencies around the world but as we head into the weekend it does make sense of there may have been a bit of profit taking and what has been a very parabolic move over the last couple of weeks.

Looking at this chart, there are plenty of reasons underneath to think that we could bounce. The 1.62 level underneath is an area that was previous resistance and has been shown as being supportive in the middle of the uptrend that we have seen. We also have the 50 day EMA in that area, which of course will attract a lot of longer-term technical traders. We also see the 200 day EMA showing signs of support, and it looks as if we are starting to turn to the upside. Ultimately, this pullback should be good for the overall uptrend, and somewhere closer to the 1.62 level it could make for a value opportunity as it would be roughly 50% pullback from the latest surge higher.

The trade going forward

The trade going forward is to simply wait for signs of support after a pullback to pick up a bit of value. After all, the Euro isn’t exactly the strongest currency out there, but it isn’t the Australian dollar. Keep in mind that the Aussie is being hurt due to the US/China trade situation, and the Euro is a way to get away from that situation. Beyond that, there have been several interest rate cuts in Asia this week, which of course will have an effect on Australia, considering that it supplies most of Asia with its hard commodities. The fact that New Zealand, India, and Thailand cut rates rather aggressively and out of the blues suggests that the situation in Asia is getting worse. If that’s going to be the case, it’s very difficult to imagine that the Aussie will strengthen for a longer-term move in this environment.