Euro Runs Into Resistance Against Japanese Yen

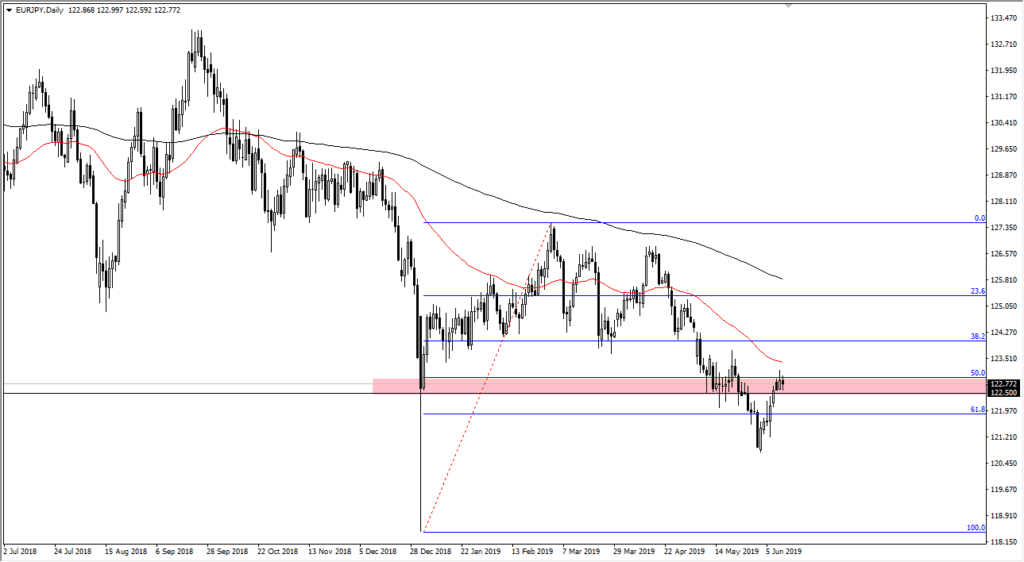

The Euro went back and forth during trading on Wednesday, as we approach a major area on the daily chart. We did form a bit of a shooting star on Tuesday, and the fact that we are staying in this range early on Wednesday suggests that it is going to be difficult to continue to go higher. As you can see from the chart, the area is marked by a pink box this is an area that could well influence the next several candles.

Risk appetite

This is a market that’s prone to being sensitive to what’s going on in risk appetite around the world, as the Euro is considered to be “riskier” than the Japanese yen which is probably the ultimate safety currency. Simply put, if the market continues to rally from here, you should probably see other risk appetite markets such as the S&P 500 and commodities rally as it would show a movement away from safety, and into higher returns. It means that the investing community is willing to put money to work.

However, if we break down below the ¥122.50 level, it’s probably going to continue lower, perhaps down to the recent lows near the ¥120.50 level. This is a market that can move relatively quickly, but keep in mind that beyond risk appetite there are some other influences as well.

EURJPY Analysis June 13th

It’s a cross currency pair

You can’t forget the fact that this is a cross. In other words, as with most cross markets, you need to pay attention to what both currencies are going against the US dollar. If the EUR/USD breaks out above the 1.1350 level, that would show Euro strength. In theory, that is one reason to think that this pair may rally. On the other hand, if you see the USD/JPY break down, that means that you are seeing Japanese yen strength. Remember, the benchmark of how a currency performs is against the US dollar as it is the world’s reserve currency. Cross currency pairs or simply a relative strength play on the currency against the overall market.

If this pair rallies, you will see the EUR/USD pair rally while the USD/JPY pair rallies. Now write both of those pairs down and cross out the USD. You’re left with this pair. You cannot trade within a vacuum.

Technical factors

There are a lot of technical factors when it comes to trading this pair going on right now. We are testing the previous 50% Fibonacci retracement level, which can cause a little bit of noise. Beyond that, we have the 50 day EMA just above and it is, in fact, tilting lower. It is because of this that I am much more comfortable in shorting this market, but obviously, we have to have the right set up. After the 50 day EMA, we also have a gap that is closer to the ¥124.50 area. It is because of this that I anticipate that the market sells off, but if we break above the 50 day EMA one would have to think we will go higher and look towards the previously mentioned gap.