Gold at Major Support Level

- Gold markets testing significant support

- The precious metal has sold off drastically

- Federal Reserve tomorrow

Gold markets have sold off again during the trading session early on Tuesday, as traders question whether or not the “risk-off” position is the trade that should be taken.

With the Federal Reserve coming out with a statement tomorrow, it is possible that they will disappoint the market. That will probably crush gold, as a lot of people are starting to bake in the idea of major quantitative easing.

Technical analysis

Gold monthly chart

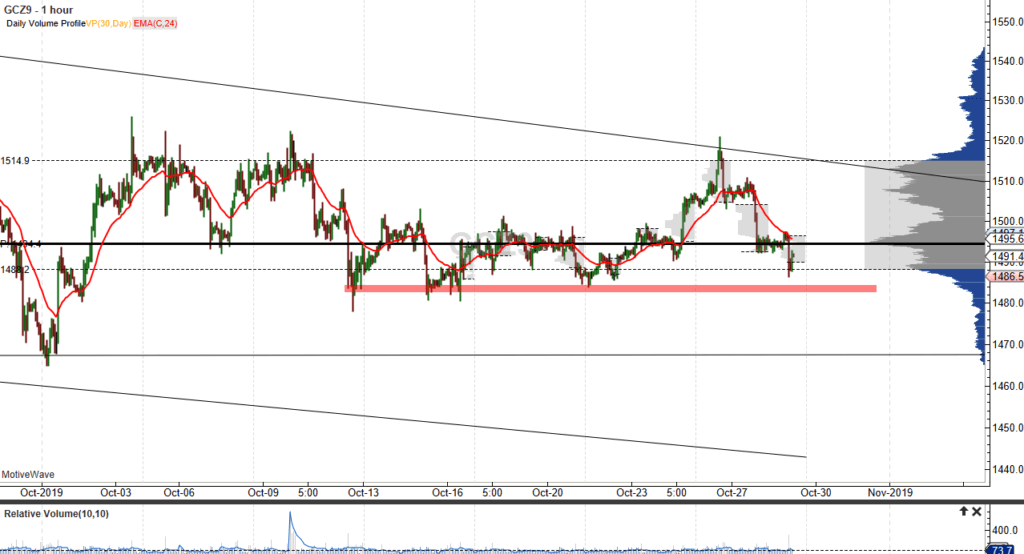

The technical analysis for the gold market is rather interesting at this point, considering that the market is sitting near the $1485 level – an area that has offered quite a bit of support in the past. Beyond that, it is at the bottom of the “value area” of the 30-day volume profile. In other words, we are close to the bottom of “normalcy” over the last month.

It’s very likely that the next 24 hours will be very quiet until the Federal Reserve makes its announcement at 2pm Eastern Standard Time on Wednesday. When that announcement comes out, traders will be paying attention to not only the interest-rate decision, but also the accompanying statement. If it sounds hawkish, that could be the one thing that breaks this market down below the support just underneath and unwinds gold down to the $1470 level.

The alternate scenario could be that the Federal Reserve sounds very dovish. The market would then break above the $1500 level, which could open the door to a move for another $10 or so to the upside. At this point, it is a bit of a 50-50 trade, meaning things could get very dangerous for those who simply jump in with both feet.

It should also be noted that on the daily chart there is a bit of a bullish flag, but it is running out of time. If we can break out to the upside, it could send this market looking towards the $1800 level. That would make a bit of sense considering there is so much in the way of technical analysis, geopolitical concern, and loosening of central bank policy around the world, whatever the Federal Reserve does.

The trade going forward

The trade going forward in this market is probably best done an hour after the decision is made. This is because the lack of liquidity could throw the gold market around like a ragdoll heading into that announcement.

However, if the market does break above the $1500 level between now and then, it’s very likely that you could go ahead and pick up that $10 worth of move. Traders will be trying to “front-run” the announcement, as they do occasionally. Otherwise, sitting on your hands until seeing what the reaction is for a good hour after the announcement is the prudent thing to do.