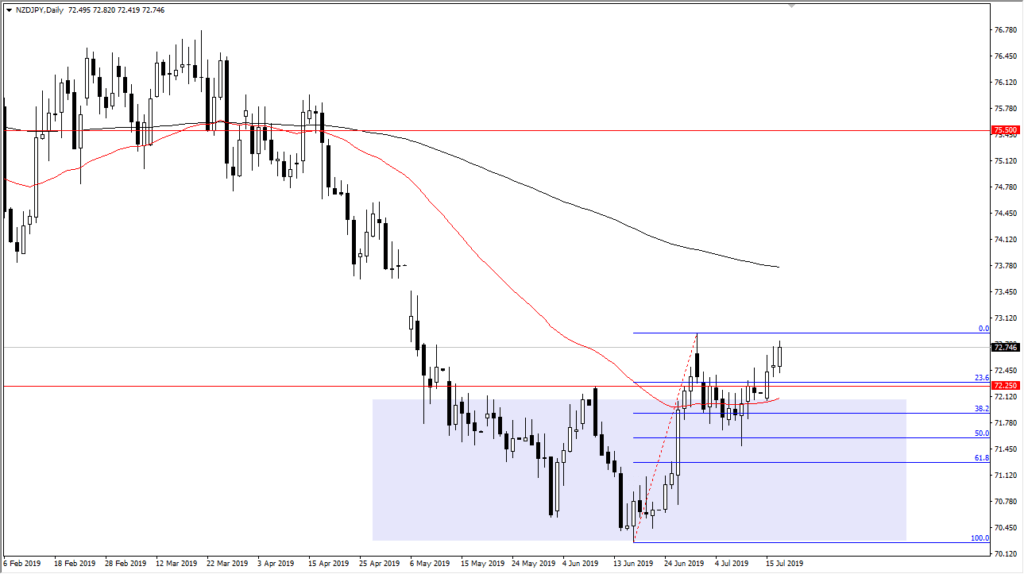

New Zealand dollar continues to push higher against Yen

The New Zealand dollar has rallied again during the trading session on Wednesday, as we are approaching the top of the most recent surge higher. This looks like a bottoming pattern, and the fact that we did trade above the top of the shooting star from the previous session bodes well for the buyers. The New Zealand dollar of course is more of a “risk on” currency, as the Japanese yen is a “safety currency”, but overall we need to pay attention to several technical factors.

Bottoming pattern

NZD/JPY

The New Zealand dollar has bounced from the ¥70.50 level couple of times, and now we have extended above the ¥0.7225 level. This is an area that has been important a couple of times, and now that we have broken above there it’s very likely that we are going to try to take out the ¥73 level. This is the most recent high, and therefore if we can break above that level it’s likely that we could go to the 200 day EMA. Just below, we have the 50 day EMA pictured in red and it is starting to offer dynamic support. Beyond that it is starting to curl to the upside.

All things being equal, we need to pay attention to the US/China trade relations, because they affect the Japanese yen. The market has seen quite a bit of volatility as of late due to these headlines, but the most recent string of comments have been a little bit more conciliatory, so therefore it’s possible that we continue to reach to the upside. Overall, it looks as if we are trying to break out but obviously there will be a lot of different issues to throw the markets around. I think at this point it’s very likely that short-term pullbacks should continue to be buying opportunities.

Widen your stop loss orders

The market dictates with the sudden changes in attitude that you probably need to widen your stop loss orders. When you do this, obviously you will need to cut your position size, because preservation of your trading capital is going to be paramount in this condition. Having said that, once we get the move in our direction we need to allow the market drastically, and therefore we need to allow the market to “breathe”, meaning that the real money is going to be made in the longer-term move. Once we break out to the upside, we could go as high as the ¥75.50 level.