New Zealand Dollar Continues to Recover

- New Zealand dollar recovers for past several days

- Fiat currency has been seeing extreme lows

- Hope in US/China trade talks

The New Zealand dollar has recovered over the last several days against not only the US dollar, but several other currencies as well. This shows that perhaps the Kiwi was oversold, as it had plummeted so drastically. That being said, the reality is that market participants have been extremely bearish on the New Zealand dollar, due to slowing global growth and the US/China trade war.

As the Chinese are coming to the United States for talks on October 10, some traders are starting to believe that perhaps a bit of progress is being made. This should benefit the New Zealand dollar due to exports heading from New Zealand to China, which is a huge part of the New Zealand economy.

Technical bounce

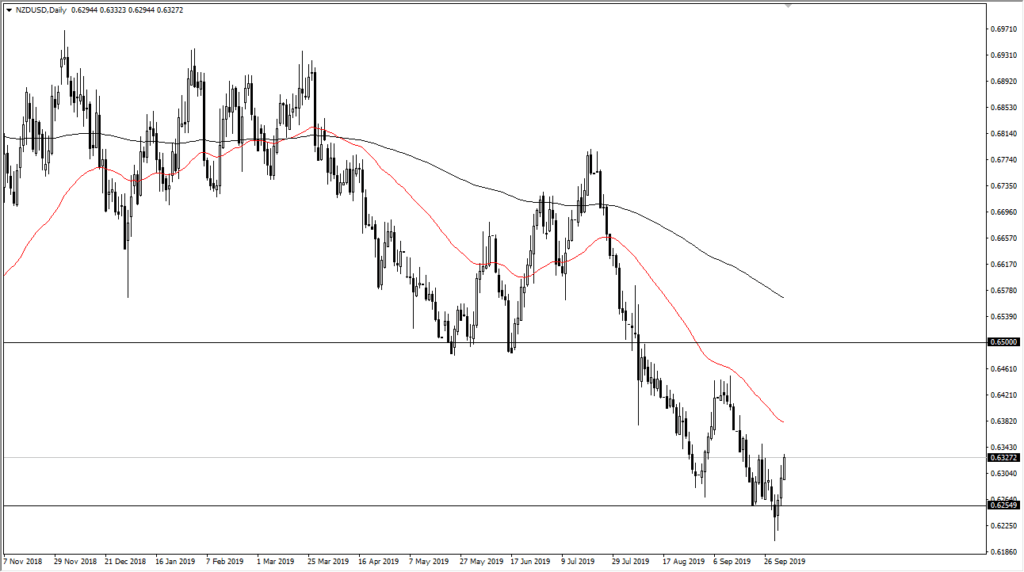

NZD/USD daily chart

The recent activity in this pair does suggest that, at the very least, a technical bounce is on the cards, as the 0.62 level has been a slight barrier for selling pressure. At this point, the market looks very likely to go looking towards the 50-day EMA above, which currently sits just below the 0.64 level. The 50-day EMA has offered technical resistance more than once and is also a well-known trend following mechanism. As such, it should attract a certain amount of volume.

All that being said, the biggest issue is the longer-term trend being so negative. While a bounce might be necessary, it doesn’t necessarily mean that the trend changes, and that won’t be perceived as being likely until the 0.65 level is broken to the upside. By the time the pair gets there, the 200-day EMA should be in the same neighborhood as well.

Two-speed market

The market seems to be running on two separate speeds at the same time. For example, short-term traders are trying to take advantage of these overextended conditions, yet long-term traders will more than likely be content to simply sit on the sidelines and wait for value to show itself in the form of a cheaper US dollar. The US dollar has been one of the favored currencies around the world as of late, so it makes perfect sense that the market is simply correcting itself to find more value.

To the downside, it’s very possible that this pair may reach towards the 0.60 level, and that will be especially true if the talks in Washington aren’t fruitful. Beyond that, signs of further slowing in the global economy could also wreak havoc in this market space. The New Zealand dollar is so highly levered to commodities, which need global growth to strengthen. All things being equal, traders’ time frames should dictate how they look at this pair, but traders will need to keep in mind that there’s a big difference between recovering and changing the trend. So far, this has simply been a recovery.