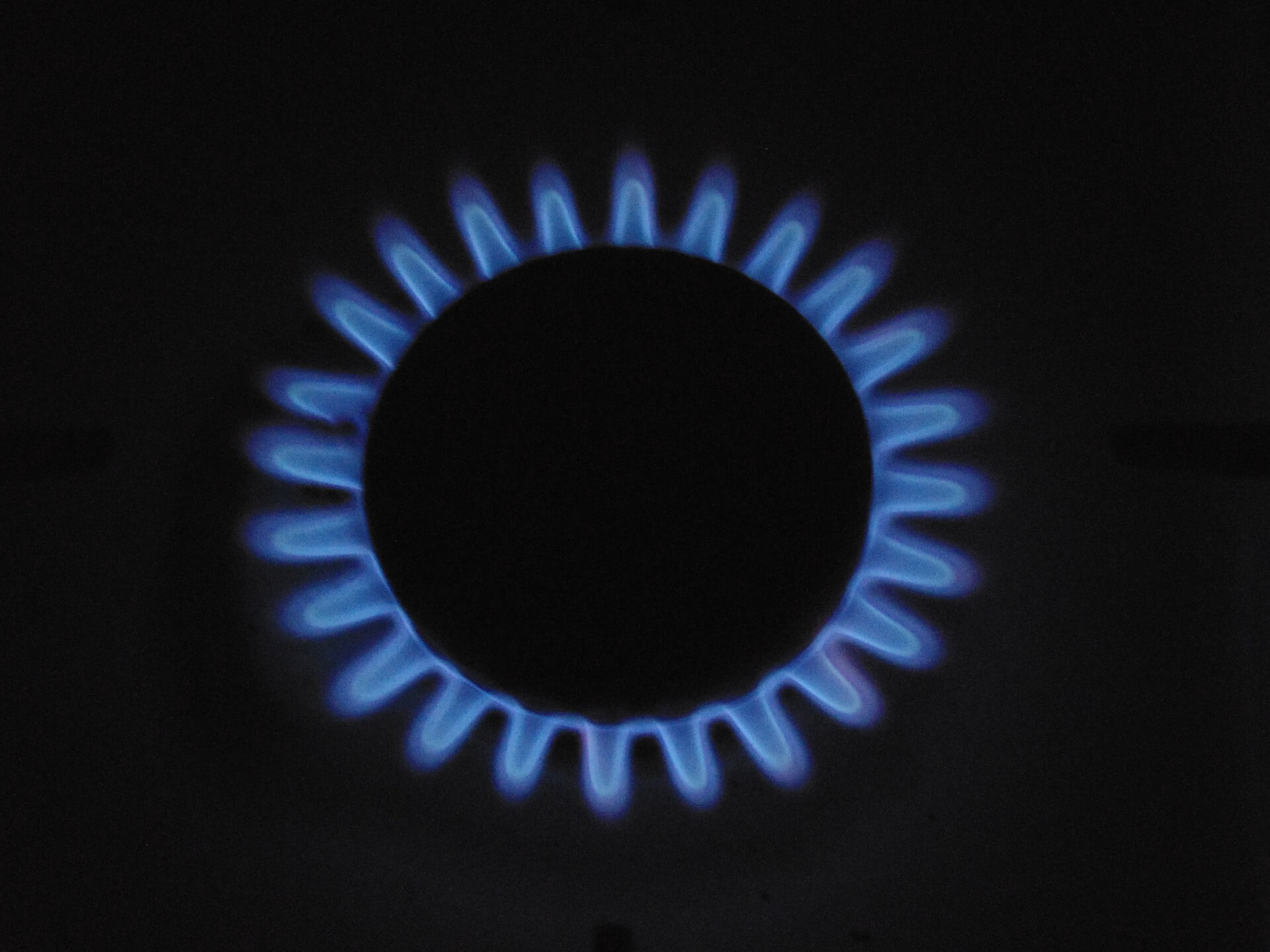

Oil and Natural Gas Moving in Different Directions

- Natural gas at extreme lows

- Oil to gas ratio at 30 to one

When it comes to the energy markets, the United States is without a doubt one of the most important regions. Both crude oil and natural gas are major drivers of the economy, and the differences in those markets can be seen in a rather dramatic fashion when it comes to the oil to gas price ratio.

It’s the highest it’s been in six years, which is a measurement of the cost of WTI Crude Oil versus Natural Gas.

The oil to gas ratio

The oil to gas ratio, which is the level at which one trades over another, has recently reached 30 to one. Most pundits believe this will extend even further, as natural gas markets are under the boot of oversupply.

The Americans drilled 17% more natural gas during 2019 then they did in 2018, in a market that has already been oversupplied. Furthermore, the winter in the United States so far has been very mild, knocking demand back even further. Most analysts believe that prices for natural gas will fall again in 2020, as the demand simply cannot overcome the supply.

Most US drillers have abandoned the idea of looking for natural gas, except those who specialize in the commodity. Exxon Mobil Corporation, Diamondback Energy Inc., and Pioneer Natural Resources Company have all started to shift to seeking more valuable crude oil and natural gas liquids, which run on slightly different fundamentals. That being said, the markets can still be flooded with natural gas supply if companies choose to switch back to supply it.

The average over the last five years has been closer to a reading of 19 to one. But over the last year or so, we have seen natural gas markets drop dramatically, while the crude oil markets have been grinding higher.

Natural gas is much more insulated from these issues, so that is part of the problem that we have seen with the ratio. Furthermore, there’s been an increase in short positions as record production has allowed utility companies to store plenty of natural gas for the winter in the United States.

In other words, it would take something rather remarkable to push the supply down enough to drive prices higher. It will be interesting to see what production actually does in 2020, as it is currently expected to rise about 3%.

Going forward in the energy markets

There is an argument to be made for a so-called “pairs trade”, but that’s probably for some time in the future. This is when you buy one of the assets and short the other.

Crude oil has taken a couple of punches to the face in the last 24 hours, but it still remains somewhat range-bound. That means it’s likely that the WTI Crude Oil market will continue to hang in the same range it’s been in.

Natural gas is a different animal because it is so oversupplied. 2020 is very likely to be a continuation of that negativity, plus we are just a couple of months away from seeing warm temperatures again.

Natural gas will probably continue to have a miserable trend for the next year while crude oil remains range-bound.