Suddenly silver looks vulnerable

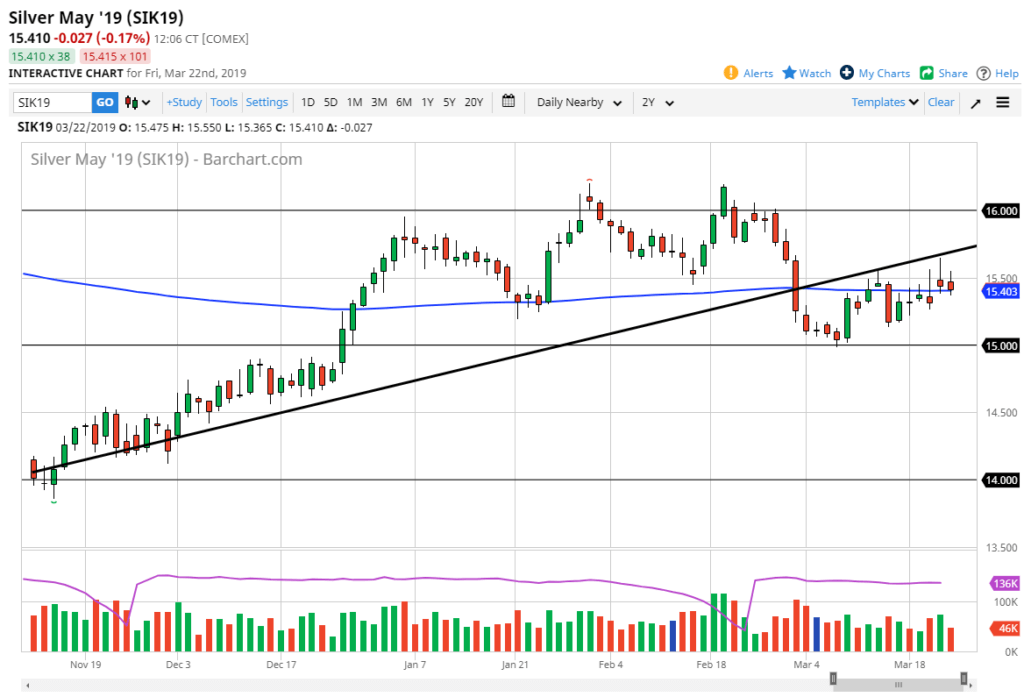

During the Friday session, the silver market initially broke above the $15.50 level but sold off yet again. We are hanging about the 200 day EMA which of course attracts a lot of attention but at the outset, it seems as if the week has had one prevailing theme: above $15.50 there is a ton of selling pressure.

Previous trend line

During the last couple of days, silver has tested the bottom of the previous uptrend line that had been so prominent in this market. We have formed three candles in a row that look very much like shooting stars, and now the Friday candle could very well close the same way. At this point, once or twice could be a coincidence, but once you get this many resistive looking candles underneath the previous uptrend line, one would have to think that the market is telling you something.

US dollar

The US dollar always has an effect on precious metals, and silver is especially sensitive to it. With the bond market getting a strong bid over the last couple of days, there has been a significant amount of US dollar strength. As bonds go, that should flow more money towards the greenback, putting more bearish pressure on silver. In fact, one thing to pay attention in the silver market is that the silver market looks much more sensitive and ready to drop than the gold market. It is simply underperforming gold, so therefore if the US dollar strengthens, you will be looking to sell silver, not gold. On the other side, if the US dollar falls apart, then you’re looking to buy gold, not silver.

Various levels

There are various levels that we will be paying attention to, with the most obvious one being the $15.50 level. At this point, it’s likely that we will continue to respect that area as support and resistance, but right now it looks very much like resistance. Another important area is going to be the $15 level underneath, which has offered a lot of support and makes a nice target at this point. However, one would have to think that there will be a lot of volatility around the 200 day EMA, but that’s something that we have seen over the last couple of days anyway. With that in mind, you should be very cautious about your position size, recognizing that silver is going to be extraordinarily sensitive to global demand as well, which could be questioned a bit at this point, as global PMI numbers have dropped hard.

The main take away

The main take away is that the Silver markets look vulnerable and could sell off rather drastically. If they do, we could go as low as $15 rather quickly, and a break down below there would be a very negative turn of events. Ultimately, if we break to the upside and clear the previous uptrend line, then the market should then go to the $16 level. By breaking the back of the shooting star from the Thursday session and the uptrend line, that probably has the market looking to not only reach that $16 level, but it could be the beginning of significant momentum to the upside.