Swiss franc flexes its muscles during Thursday session

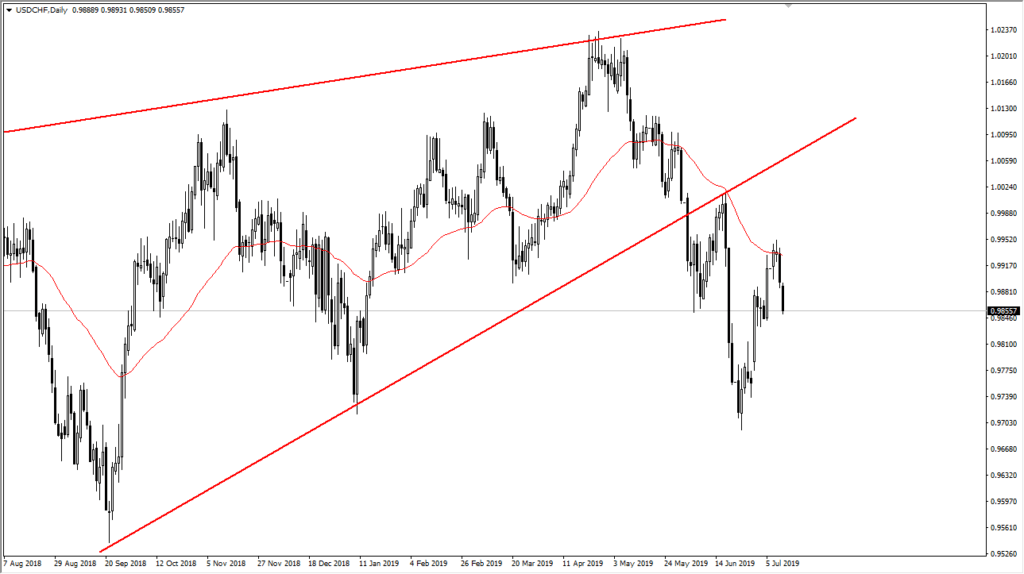

The Swiss franc continues to show signs of strength, as it has hit the $0.9850 level during early north American trading on Thursday. We have recently tried to recapture a significant selloff but have failed and ended up making a “lower high” just above, which of course suggests that we are going to continue to see negative pressure in this market.

50 day EMA

USD/CHF chart

The 50 day EMA has held as significant resistance just in the last couple of days and has been rather reliable when it comes to this trading pair. The market had recently broken down through a significant uptrend line, and you can even make an argument for a “rising wedge” on the longer-term time frames. At this point, it looks as if we have broken down, trying to rally to turn things around and recapture all of those losses, only to fail. At this point, the Swiss franc continues to flex its muscles.

Potential targets and drivers

the Swiss franc continues to show its strength due to a lot of concerns around the world, and of course we have the potential “double whammy” of interest rate cuts coming out of the United States. While the Swiss franc has an extraordinarily low interest rate attached to it, if the Americans are going to cut their rate, then we need to readjust pricing for the greenback. However, with so many global concerns involving trade and the economy, it makes sense that money may be flowing into Switzerland to find a bit of safety. Furthermore, the European Union continues to deteriorate financially, and that can drive money across the border from Germany, Austria, and many other EU countries into the Swiss economy.

Based upon the rising wedge, we could be seeing a move down to the $0.95 level over the longer-term. Keep in mind that this pair doesn’t necessarily have quick movement but tends to grind a bit more than anything else. This does set up for a nice longer-term short in this market, but you must be patient as we will get the occasional rally. It appears that the 50 day exponential moving average is going to continue to be important, so obviously you may wish to pay attention to that moving average.

To the upside, the parity level looks to be massive resistance, so if we were to turn around and go all the way to that level, it’s very likely that we would struggle to break above it. The Swiss franc will of course continue to strengthen due to not only the Federal Reserve but also to the idea of geopolitical concerns which we have plenty of. Ultimately, the Swiss franc is enjoying a bit of a renaissance again, as it had been so unwanted for so long. With the Americans cutting rates, the Swiss franc may become a little bit more “safe” than it had been as the greenback was being used as the safety currency of the moment for so long.