Trade War in Focus as We Head Into the Weekend

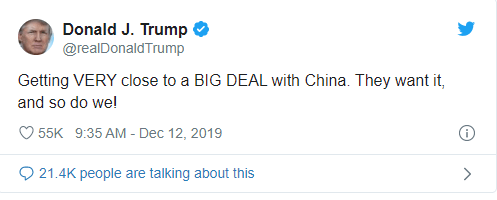

- Donald Trump tweets “very close to trade deal”

- Stock markets rocket higher

- Imposing deadline this Sunday hangs over the head of markets

As we get closer to the weekend, all eyes will be on Pres. Donald Trump in the United States and whether or not he enacts further tariffs in the ongoing trade war against the Chinese. There is a deadline of December 15 to pay attention to, and so far, things haven’t changed markedly. That being said though, there was a Tweet on Thursday from Donald Trump suggesting that a deal between China and the US is “very close.”

Donald Trump tweet

Multiple forces at play

Looking at the overall situation, the trade war is front and center. The Sunday deadline for tariffs is going to be a specter over the market. As Friday rolls in, that will be the only thing people pay attention to, as Wall Street has all but priced in the idea of the delay of tariffs. This leaves the market in a very precarious position. There is nothing in Donald Trump’s past that suggests he won’t be willing to put those tariffs on. In fact, it’s very possible that he has already shown that he’s getting ready to.

As he tweeted on Friday that the Americans and the Chinese are very close to a trade deal, this pushes the market higher. A pattern that has been in effect for the entire trade war has been that Donald Trump would use a higher stock market as a bit of a buffer against the detrimental effects of the trade war. Beyond that, the United States hasn’t begun to feel a major effect due to the trade war.

He has done this more than once, tweeting something to put the market higher, only to turn around and go in the opposite direction. He recognizes that algorithmic traders are willing to jump in and start pushing things higher, giving him a bit of padding to the massive pullback that happens if he does in fact lever more tariffs.

Going forward

Going forward, risk appetite is solely on the shoulders of the trade war. Ultimately, this is a market that will continue to see a lot of volatility, mainly because there are so many different moving pieces when it comes to risk appetite. However, the trade war is without a doubt the biggest piece right now, and as a result, these headlines will continue to cause massive problems.

If the tariffs do get enacted on Sunday, a gap lower in the S&P 500 futures markets and a gap higher in the gold markets will more than likely be the reaction. If he does delay tariffs, you can expect an exact opposite move, as it will be most certainly “risk-on” for traders around the world.